Is Injective Going Down? INJ Price Drops 4% as New Mining Coin Secures $8.1 Million

Injective Protocol holders are in panic as INJ price drops -4%, explore this INJ price analysis to discover whether Injective is going down.

The INJ price tumble comes as markets brace for an anticipated token unlock, which will see the final tranche of 3.66m tokens (valued at $132m).

🚨 Final Cliff Unlocks Alert 🚨

Mark your calendars for January 21, 2024$INJ will be fully unlocked (100%)

Get ready for the massive cliff unlocks.

🪙 3.66 m tokens

💰 132.4 m dollars

🌀 4.35% of cir. supplyAllocations:

– Advisors: $12.04 m

– Team: $120.37 m$INJ was… pic.twitter.com/EYCyv4hsuC— Token Unlocks (@Token_Unlocks) January 7, 2024

This huge token unlock will bring the total supply to 100m tokens fully distributed, however, with a potential influx of a significant quantity of supply, markets are risking-off in anticipation.

INJ Price Analysis: As Crypto Markets Risk-Off Injective Protocol Ahead of Token Unlock – Is Injective Going Down?

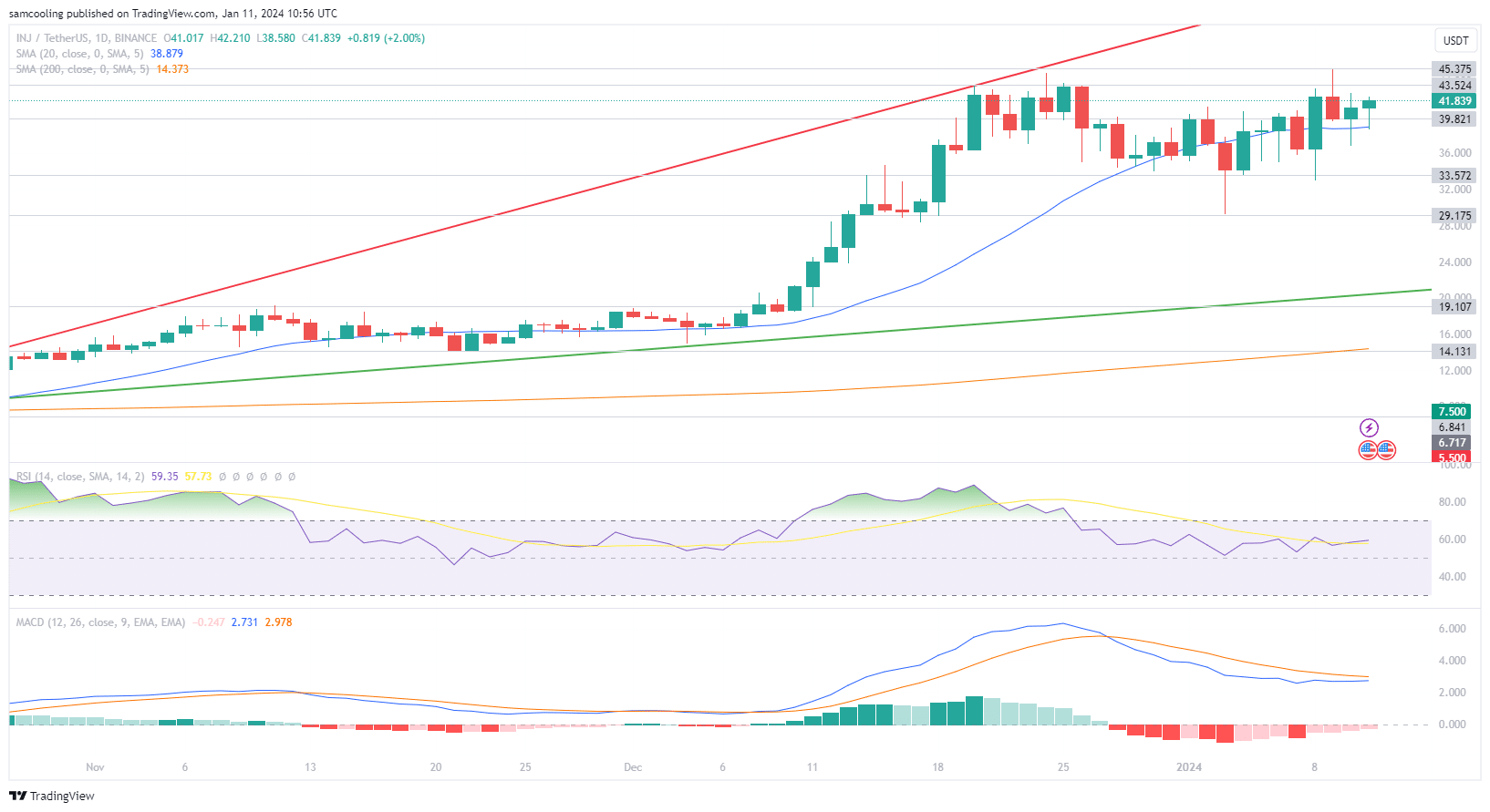

As INJ price fights to stay afloat, Injective Protocol is currently trading at a market price of $41.75 (representing a 24-hour change of +1.8%).

This comes after a -4% drop saw INJ price drop down to test lower support at the 20DMA (which is currently sat at $38.91), however, a strong bounce has since seen INJ regain bullish form.

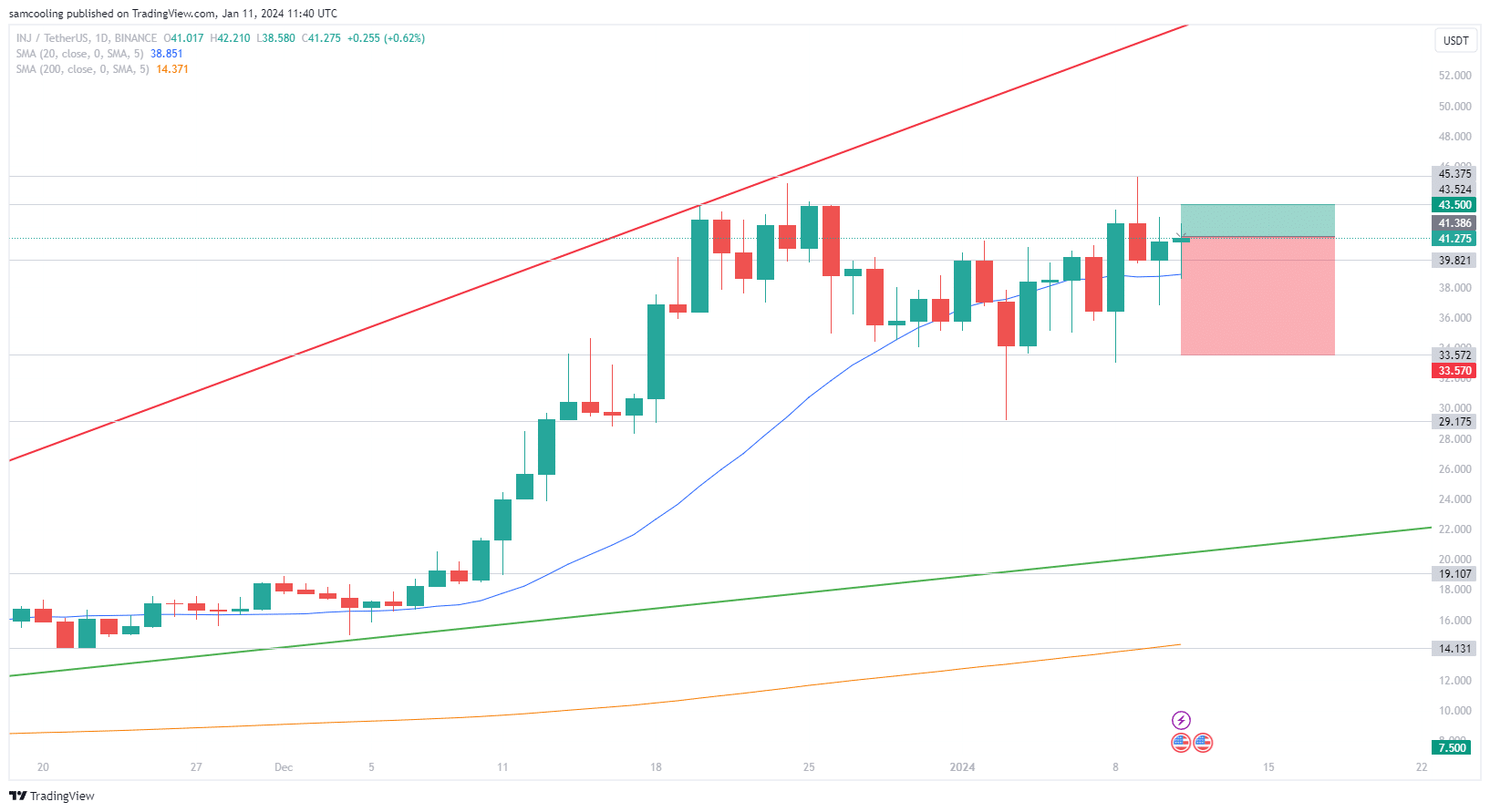

Ascendance on the 20DMA is now forcing convergence for INJ price against a tough patch of overhead resistance at $43.50 – in a move that could trigger a decisive direction on the short-time frame.

Meanwhile, the ascendant 200DMA remains below the trading channel at $14.43.

In a positive sign, the recovery move has failed to overheat the RSI, although this leading indicator is still showcasing bearish overbought divergence at 58.75.

This is matched with the MACD, which is also displaying minor bearish divergence at -0.271 in a sign of struggling momentum.

Overall, INJ price analysis reveals weakness and vulnerability in the chart here, with fleeting momentum and overbought price structure leading into an impending token unlock.

Injective Protocol is left facing an upside target at $43.50 (a potential +5.11%).

While downside risk could see INJ price plummet down to $33.57 (a possible -18.89%).

Consequently, INJ price is weighted with a risk: reward structure of 0.27 – a terrible entry characterised by significant risk on the short-time frame.

But while INJ offers little growth opportunity on the short-time frame, a viral Bitcoin cloud mining project could soon post considerable returns – check out BTCMTX.

INJ Price Analysis Alternative? New Bitcoin Cloud Mining Project BTCMTX Smashes $8.22M Raised

Dive into the innovative world of Bitcoin Minetrix and its pioneering stake-to-mine system – as the skyrocketing presale smashes +$8,223,936 raised.

Offering an enticing 86% Staking APY, Bitcoin Minetrix provides a platform where users can buy, stake, and then watch as the rewards start accumulating.

Advantages of #BitcoinMinetrix:

Convenient accessibility.

Efficient cost structure. 💵

Abundant space and peaceful environment.

No concerns about resale value. 🔁 pic.twitter.com/slptHOIHNk

— Bitcoinminetrix (@bitcoinminetrix) January 11, 2024

The true essence of passive income in the crypto world has never been this accessible.

With the Bitcoin Minetrix approach, gone are the days of heavy initial capital and navigating complex mining contracts.

$8.5M In The Crosshairs: Bitcoin Minetrix Surges Past $8M – Poised to Outperform INJ Price

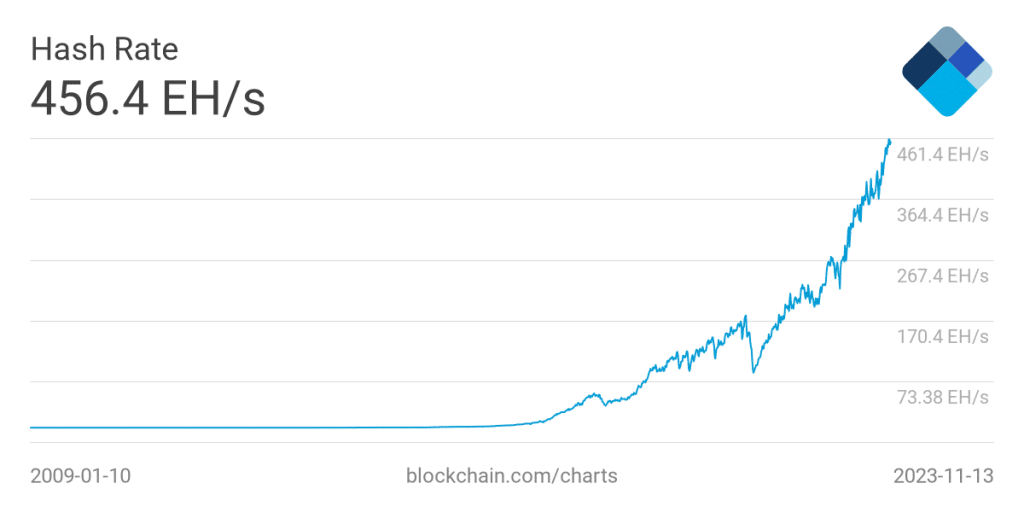

Since the 2021 Bull Run, Bitcoin mining has defied expectations by undertaking something of a renaissance in network growth.

Bitcoin’s Hash Rate (a measure of the total amount of computational power directed at mining Bitcoin blocks) has surged to an incredible all-time high of 525 Exahashes per second (EH/S).

This dramatic growth has been fuelled by a substantial increase in the scale of Marathon Digital and Riot Platforms’ mining operations.

The world’s largest Bitcoin miner – Marathon – reported that for Q3 2023 it had an average hash rate of 14.2 EH/s (a 500% growth YoY), around 4% of the overall network hash (mining around 1153 BTC per month, or, $42.2M USD).

Meanwhile Riot Platforms reported a new record hash rate of 10.9 EH/s (mining around 368 BTC per month, or, $13.3M USD), with Riot’s operations expected to grow to 20.2 EH/s by summer 2024.

But while the all-time high in Bitcoin network hash rate is healthy for Bitcoin network security, and clearly profitable for growing mining operations, it has also begun to lose sight of the original promise of Satoshi Nakamoto’s decentralization.

Bitcoin mining in 2023 is the most centralized it has ever been in its short 15-year history.

Why Has Bitcoin Mining Become So Centralized?

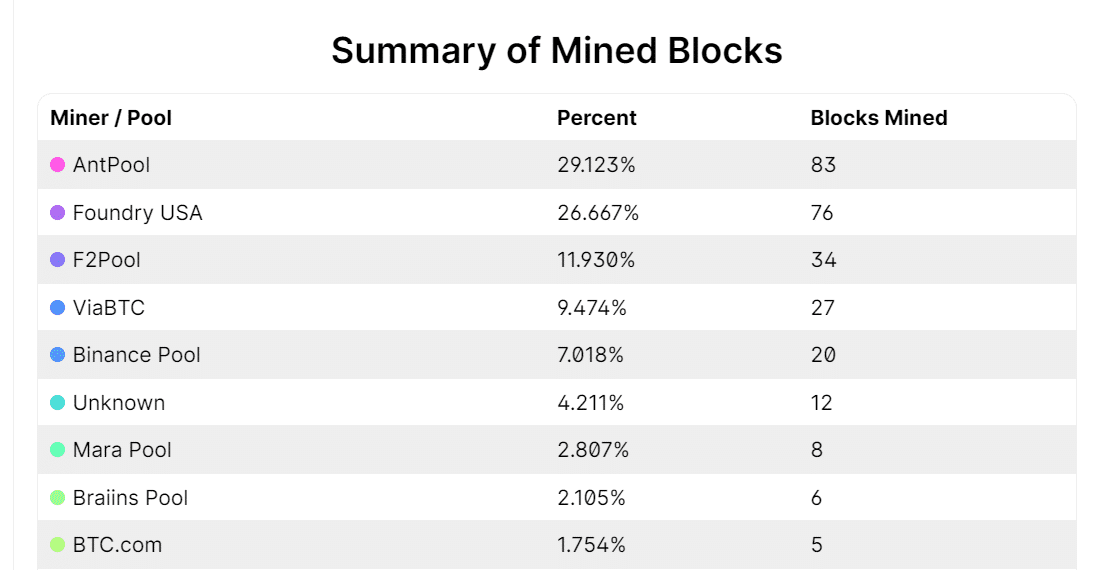

A closer look at the summary of mined blocks over the past 48-hours reveals that a shocking 55.79% of all Bitcoin block rewards go to just two Bitcoin mining pools.

AntPool took the largest share at 83 blocks mined (29.123%), while second largest mining pool Foundry USA mined 76 blocks (26.667%).

This dwarfs the number of blocks mined by even third-place F2Pool (34 blocks mined, around 11.93%), highlighting the growing challenge of increased mining centralization.

This heightened network activity, and increased centralization of mining power has become clearly reflected in the consequent all-time high in the difficulty rate for mining Bitcoin.

Currently standing at 70,440,798,833,881 – it has never been harder for individual participants to engage in profitable Bitcoin mining.

This challenge of heightened network difficulty, fuelled by increased competition and centralization of mining power, has created the need for new solutions for the retail investor to participate in Bitcoin mining – both for network decentralization and preserving Bitcoin as a profitable activity for the individual.

Enter Bitcoin Minetrix, which was launched to deliver secure and transparent Bitcoin mining rewards for the retail investor through an innovative, decentralized Bitcoin cloud mining approach.

Key Highlights of the BTCMTX Advantage Over Injective Protocol Imminent Retracement:

- Distinctive Edge in the Market: In an industry filled with numerous cloud mining platforms, Bitcoin Minetrix carves a niche for itself. As the first-ever tokenized Bitcoin cloud mining initiative, it offers an automated system that’s geared for cloud-based Bitcoin mining, setting a new standard for the industry.

- Safety First with Ethereum Blockchain: Bitcoin Minetrix operates on the tried and trusted Ethereum blockchain. This ensures top-notch security and reliability, allowing users to sidestep the risks associated with external mining pools, and offering a safeguard against potential fraudulent cloud mining services.

- Championing True Decentralization: At its core, Bitcoin Minetrix upholds the ethos of decentralization. In an age where centralization often introduces vulnerabilities, Bitcoin Minetrix breaks the mold, redistributing mining profits from big corporations to individual retail investors through its novel Stake-to-Mine system.

- Tapping into the Bitcoin Halving Opportunity: Perfectly poised to make the most of the upcoming Bitcoin halving, Bitcoin Minetrix provides investors with a golden opportunity. The impending halving might seem daunting for miners due to reduced block rewards, but historically, such events have driven up Bitcoin’s value. Bitcoin Minetrix provides a platform for investors to tap into this potential surge, sans the associated capital risks.

- The BTCMTX Presale Opportunity: The ongoing BTCMTX presale has already garnered significant interest, with over $8m raised towards its $8.5M goal. At a competitive price of just $0.0127 per token, early investors have a unique chance to be at the forefront of this stake-to-mine evolution.

The Bottom Line: Don’t Miss BTCMTX

In sum, Bitcoin Minetrix is set to redefine the Bitcoin landscape. With its innovative methodologies, stringent security measures, and the vast potential of its stake-to-mine mechanism, it beckons as a lucrative opportunity for early-bird investors.

Secure your position in this transformative journey by joining the BTCMTX presale today.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.