France’s AMF Issues Warning Against BITGET for Unauthorized Digital Asset Services

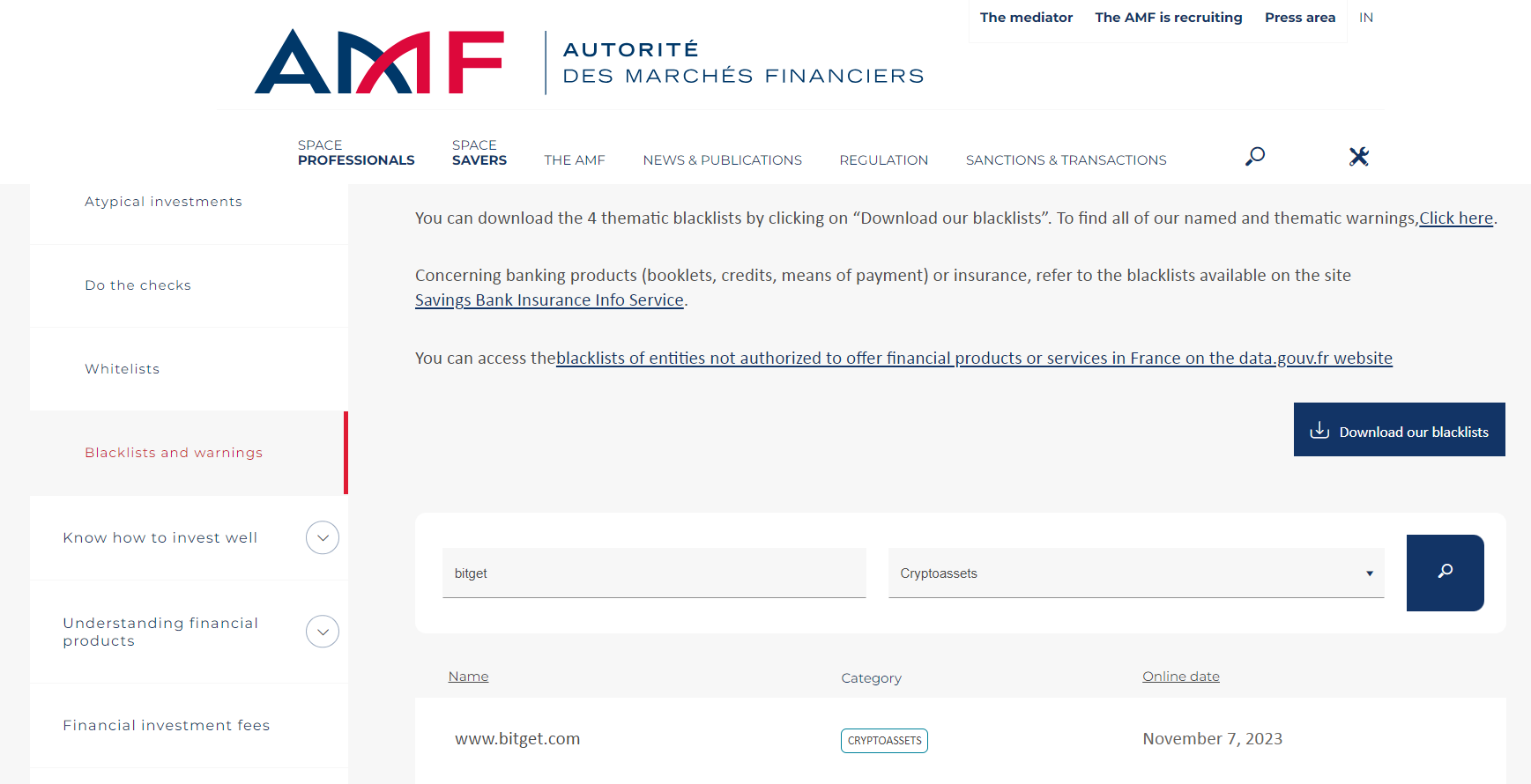

The French Financial Markets Authority, the Autorité des Marchés Financiers (AMF), warned against BITGET, citing unauthorized digital asset services.

The AMF regularly updates its black lists of new websites and entities “proposing typical investments to investors in France without being authorized.”

French Financial Regulator To Blacklist BITGET for Unauthorized Crypto Services

[Mise en garde] L’AMF rappelle au public que la plateforme de #trading de #cryptoactifs BITGET est inscrite sur liste noire : elle n’est pas autorisée à fournir des services sur actifs numériques en France.

Pour en savoir plus➡️https://t.co/5WM4EcmBKw#Crypto #Protection #Epargne pic.twitter.com/sJah2ve1YN— AMF (@AMF_actu) April 2, 2024

On April 2, AMF issued a circular on the supervision and issuance of virtual assets in the country, with BITGET on the list of those that offer crypto investments through unauthorized entities.

According to the regulator, Bitget has been offering investment products without being authorized to provide such services. To protect investors from potentially fraudulent investments, AMF and the French Prudential Supervision and Resolution Authority (ACPR) added Bitget to the updated list of unauthorized investment providers to be blacklisted.

The monetary and financial code requires mandatory registration as a digital asset service provider (PSAN) for specific activities related to digital assets, such as custody services, buying or selling digital assets, and operating digital asset trading platforms. This registration ensures compliance with regulations aimed at preventing money laundering and terrorism financing, as well as ensuring the integrity and competency of management and shareholders, thereby protecting the interests of investors.

Bitget, however, has yet to obtain the necessary registration as a PSAN and has been offering digital asset services in France without authorization. As a result, the platform has been included on the AMF blacklist since November 7, 2023, due to non-compliance with French regulations.

The AMF, empowered by the monetary and financial code, reserves the right to take legal action to block Bitget’s website and other similar platforms operating illegally in France. The regulatory body also stressed the importance of being cautious, noting that BITGET lacks authorization to provide its services related to digital assets within France. Consequently, the AMF is prepared to take legal measures to block access to the platform’s website.

The authority strongly recommended that investors follow the list of authorized investment providers using the online register of financial service providers and the list of authorized providers in the financial investment advisor or crowdfunding categories.

French Financial Regulator Expands Blacklist to Include Unauthorized Sites Offering Various Investments

Since the establishment of the blacklist in 2017, which initially targeted websites illegally offering diamonds for investment, the AMF has expanded the list to include over 400 unauthorized internet addresses across various categories, such as livestock, wines, or champagne.

Since January 1, 2024, the AMF has added three names to its list of unauthorized sites offering atypical investments in “gold.” The complete list of unauthorized sites offering investments in various goods is available on the AMF website and the Assurance Banque Épargne Info Service (ABEIS) website.

The AMF emphasizes that while the list is regularly updated, it may not be exhaustive as new unauthorized actors emerge. Furthermore, registration decisions issued by the AMF can be reviewed on its website.

In a separate update from last month, the AMF urged investment service providers to consider the specific nature of temporary ownership dismemberment when marketing units in real estate investment companies (SCPIs). Protecting investors remains the AMF’s primary strategic objective.

During short inspections at four distributor institutions, the AMF found insufficient attention to the unique features of temporary ownership dismemberment in providing investment services involving SCPI units. The AMF emphasized the importance of complying with regulations and highlighted good and poor practices observed during its inspections.