EU Watchdog Warns 90% of Crypto Trading Funneled Through Few Exchanges

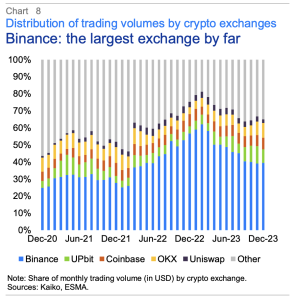

The European Union’s (EU) securities regulator warned about the high concentration of trading activity on a limited number of crypto exchanges. Notably, Binance, a single platform, controls roughly half of the entire market, it said Wednesday.

Analysis from the European Securities and Markets Authority revealed that a mere 10 exchanges handle about 90% of all cryptocurrency trades. Further, the report identified significant variations in market liquidity, with a tendency for larger exchanges to exhibit higher levels of liquidity.

“While this might be advantageous from an efficiency standpoint (due to economies of scale), it raises considerable concerns regarding the implications of a failure or malfunction at a major asset or exchange for the wider crypto ecosystem,” the ESMA said.

MiCA Regulation Yet to Boost Euro Adoption in Crypto

An examination of the fiat currencies employed within the crypto market revealed a strong dependence on USD and the South Korean won. Meanwhile, the Euro plays a comparatively insignificant role, accounting for about 10% of transactions.

Additionally, it observed that Markets in Crypto Assets (MiCA) regulation has not, to date, resulted in any observable increase in the use of the Euro within the cryptocurrency market.

Notwithstanding the current lack of impact, the ESMA expects that MiCA could emerge as a potential catalyst for growth upon its implementation in 2024. This anticipated effect stems from MiCA’s focus on strengthening investor protection within the market.

ESMA Disputes Crypto’s Safe-Haven Status

Further, the ESMA challenged the notion of crypto assets acting as a safe haven during periods of broader market distress. Its report identified a degree of co-movement between crypto assets and equities, while also highlighting the absence of a consistent relationship with gold, a traditionally recognized safe-haven asset.

Licensed Exchanges, Unclear Locations

The regulator also highlighted that the inherent opacity of crypto transactions makes it challenging to pinpoint their origin. Yet, a significant portion of crypto exchanges are found to be situated in jurisdictions characterized as tax havens.

According to the ESMA, roughly 55% of transactions are conducted on crypto exchanges licensed under the EU’s VASP framework. However, a substantial proportion of these transactions likely occur outside the European Union.

Bitcoin, Ether, and Tether Dominate Crypto Market

Separately, it found that an increase in the number of actively traded crypto assets since 2020 has not mitigated the significant concentration within the market. As of Dec. 2023, a mere three cryptocurrencies – Bitcoin (BTC), Ether (ETH), and the stablecoin Tether (USDT) – comprise a substantial 74% of the total market capitalization and 55% of the annual trading volume.