Dogecoin Pulls Back as These Indicators Signal Conditions Overbought – But Here’s Why the DOGE Outlook Remains Strong

After surging more than 10% on Tuesday, its biggest one-day gains since early April, Dogecoin (DOGE) has succumbed to profit-taking on Wednesday and was last trading around 3.5% lower.

Dogecoin hit its highest level since April on Tuesday around $0.084 as traders bid the meme coin up on hopes it will be integrated as a payment tool into Elon Musk’s X platform, which the precocious billionaire just rebranded from Twitter.

But DOGE has since pulled back to just under $0.08 after a few short-term technical indicators began to flash that conditions had become overbought.

Firstly, DOGE’s 14-Day Relative Strength Index (RSI) jumped above 70 on Tuesday, signifying the market had entered overbought territory.

The last time Dogecoin’s RSI went above 70 back in April, this was the trigger for significant profit-taking and a quick market reversal.

Meanwhile, Dogecoin’s latest jump saw it break to the north of its 20-Day Bollinger Bands – i.e. meaning that the price had jumped two standard deviations above its 20-Day Moving Average, which is only expected to occur 5% or less of the time.

Traders often interpret a Bollinger Band breakout as a sign the market has gone too far.

In wake of the signal from these two indicators, it shouldn’t be too surprising to see that DOGE is suffering amid elevated profit taking.

Here’s Why the Dogecoin (DOGE) Outlook Remains Strong

Despite Wednesday’s downside, the Dogecoin outlook remains strong.

From a fundamental standpoint, hype surrounding Twitter’s rebranding to X may continue to act as a tailwind, given many expect Musk to integrate Dogecoin into a future payments platform, which should bolster demand for the coin.

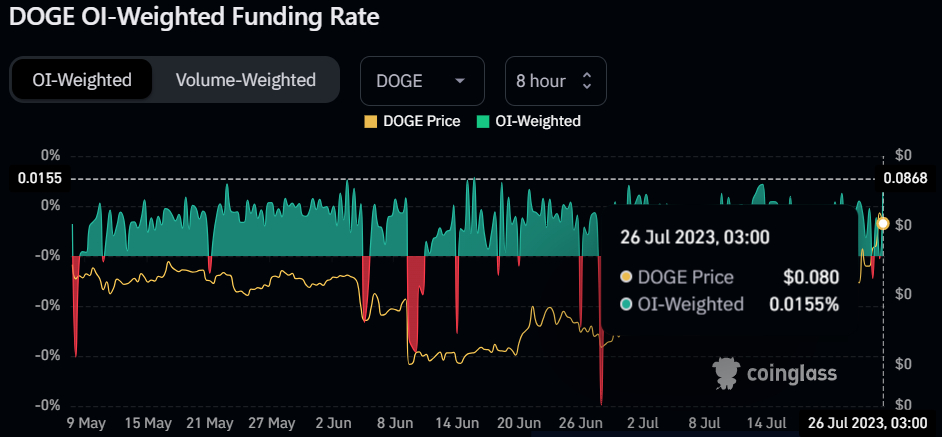

Indeed, traders appear to be buying the intra-day dip aggressively, with Dogecoin futures margin funding rates having just jumped to their highest level in around 10 days, as per CoinGlass.com.

Dogecoin is also looking strong from a technical standpoint.

Dogecoin’s surge this week has seen the cryptocurrency break to the north of two key resistance levels.

These include 1) a downtrend from the 2021 record highs and 2) the 200-Day Moving Average.

While a break above the 200DMA is always a good sign of a positive shift in near-term price momentum, the more important breakout is the move above the downtrend from the 2021 record highs.

This sends a signal that Dogecoin’s more than 2-year bear market may finally be coming to an end.

The most obvious bullish target is now a retest of 2023’s highs in the $0.10 area, which could mark quick gains in the region of 20% for investors who get in now.

But why stop at 20%.

If Dogecoin is going to find itself as an important part of a future X payments system, then a retest of last October’s highs in the $0.16 area is a decent possibility, which would mark gains of nearly 100% from current levels.

Alternative Coin to Consider – BTC20 (BTC20)

Billed as “Bitcoin on Ethereum’ and as an opportunity for members of the cryptocurrency community to purchase bitcoin at its 2011 price of $1, a new token called BTC20 has been garnering a lot of hype.

The tokenomics are designed to mimic bitcoin – a 21 million BTC20 token supply cap, with tokens to be released to BTC20 stakers (rather than miners) according to the exact same issuance schedule as bitcoin.

Some are claiming BTC20 is even better than bitcoin, given it runs on an ecofriendly, low energy consuming Proof-of-Stake Ethereum blockchain, rather than on an energy-guzzling Proof-of-Work chain like bitcoin.

As per the project’s whitepaper, BTC20 is looking to raise a minimum of $3 million, though this could rise to $6 million, via the sale of BTC20 tokens for $1 each.

With the project having already raised over $2.6 million in just a few days, traders need to move quickly to secure their spot.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.