Is Curve DAO Token Going to Zero? CRV Price Drops 20% and New Meme Coin Surpasses $300,000 in Funding

CurveDAO (CRV) is continuing to tumble to rock-bottom prices more than a month after a dramatic exploit sent shockwaves through the Curve Finance ecosystem – with spectators predicting Curve DAO token going to zero, will CRV sink or swim?

Catastrophe struck the leading DeFi ecosystem on July 30, when more than $61m was stolen from Curve Finance pools running using the Vyper programming language – sending shockwaves through DeFi markets.

In the aftermath of the incident, CRV plunged -20%, and with the ecosystem still reeling in what has been labeled a ‘DeFi stress test’ – market confidence has been fraying in this once promising project.

Yet, amid the gloom and doom, there are signs of an ecosystem in recovery mode.

The recent CurveDAO proposal #394 to whitelist DeFi protocol PrismaFi saw huge DAO engagement, with the second-highest voter turnout in the history of CurveDAO.

This showcases the resilience of an ecosystem in recouperation, but as CRV continues to grind-down in price, will it be enough to trigger a reversal on the charts?

CRV Price Analysis: Is Curve DAO Token Going to Zero?

Amid the recovery effort, CurveDAO token is currently trading at a rock-bottom market price of $0.47 (a 24-hour change of -0.86%).

This comes in the midst of a tumultuous August, which has seen CRV so far bleed-out -19.5% since August 1 as market confidence continues to ebb-away from Curve.

Now mounting a last-ditch consolidation attempt at the rock-bottom $0.45 support level – everything is to play for as CRV risks a complete breakdown.

The seismic drop on July 30 saw CRV fall away from a ceiling of resistance around the now descendant 20DMA, and this moving average will act to supress upside potential on the short-time frame.

While the 200DMA remains steadfast at $0.84, high above ongoing price action and the upper trendline.

As for CRV’s indicators, the RSI provides reasons to be optimistic, cooling-off substantially amid the downside moves to a significant oversold signal at 23 – this suggests price could push up soon.

And the MACD, showcases only minor bearish divergence at -0.0045, suggesting the momentum behind this cascading move might not be as significant as it appears on the chart.

Indeed, with the RSI at 23 – the downside potential from here seems limited, and looking back to historic price action from November-December 2022, in the aftermath of the FTX crash CRV bounced from the very same level ($0.45) to mount a +160% recovery rally in January 2023.

This suggests that CRV holders could anticipate a bounce here, but it will be limited by resistance from the 20DMA.

Therefore, CRV faces an upside target marking a clean break above the 20DMA at $0.60 (a possible +27.4% move).

However, downside risk is limited by strong support at $0.45 (reducing risk to a -4.4% move).

This leaves CRV with an extremely alluring risk: reward of 6.25 – a very strong entry for an exceptional long position.

But while intrepid traders might battle significant risk, smart money often play it safer, prefering to hedge their bets on high-growth meme coins – and one emerging project worthy of attention this week is Sonik coin.

Introducing Sonik Coin as it Approaches $400,000 Raised in Moon-Shot Presale

Sonik Coin ($SONIK), which is not only making waves in crypto markets, but also racing – with the audacious goal of being the fastest token to hit the $100 million market cap.

And given the current trajectory, this aspiration may soon be a reality – as this rockstar presale has surged to a jaw-dropping +$350,000 raised in less than a week.

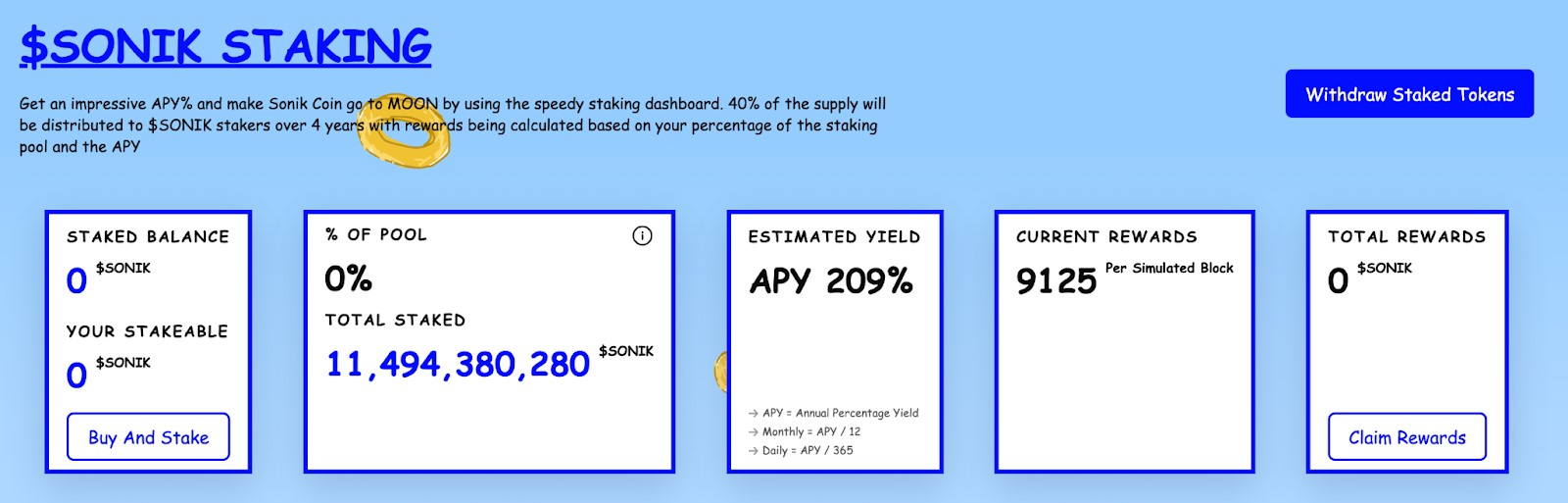

But what has got markets so excited about the unlikely Sonik coin? The answer is in the APY – let’s dig down into this further.

Sonik Presale ‘Gotta Go Fast’ as Project Accelerates Towards Top-Tier APY

An intriguing 50% of the mammoth 300 billion $SONIK supply has been allocated for early investors, making it a limited-time golden opportunity.

With each token priced at a meager $0.000014, enthusiasts have the perfect entry point, especially before its much-anticipated debut on Uniswap post-presale.

This decentralized exchange is a powerhouse, and $SONIK’s presence there will undoubtedly amplify its visibility manifold.

But Sonik Coin is more than just another meme coin, the staking APY of an astounding 209% speaks volumes about its potential returns.

Staking not only adds an avenue for passive income, but its inclusion also showcases the team’s commitment to longevity and stability.

The idea? By staking, holders are encouraged to hold onto their tokens for more extended periods, thus mitigating volatile price swings and cementing a firm foundation for steady growth.

PepeCoin has Proved Sonik’s High-Growth Potential in Meme Coin Vertical

Now, let’s talk about $PEPE, Pepecoin’s astronomic growth—delivering jaw-dropping returns of over 10,000% to early backers— has set a precedent.

Given $SONIK’s innovative staking model and the infectious enthusiasm around its branding (a nod to the ever-popular Sonic the Hedgehog), it’s poised for a similar, if not more impressive, trajectory.

The transparent, community-centric vision of the Sonik Coin’s founders, paired with its tantalizing staking rewards and the buzz it has already generated, sets it apart in a sea of meme coins.

Check out the Sonik Telegram and Twitter here.

If history and market patterns tell us anything, the early bird catches the worm. Or in this case, rides the supersonic wave.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.