Chainlink Bears Found a Weak Link As Rally and Interest Wane

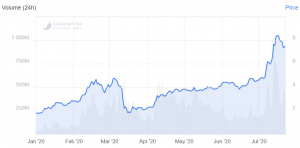

After seeing an exponential price rally that took its price from USD 1.4 after crypto’s Black Thursday in March, to almost USD 9 in mid-July, chainlink (LINK) now finally appears to be taking a breather, with fading Google search interest putting a damper on sentiment.

At the time of writing, (09:47 UTC), LINK, ranked 9th by market capitalization, traded at a price of USD 7.22, down 3.6% over the past 24 hours and around 10% percent in a week. However, the fall still represents little more than a minor correction given the rise of more than 500% since its Black Thursday low.

LINK price chart:

Meanwhile, according to Google Trends, search interest for the term ‘chainlink’ is now almost back at the level from July 11, after seeing a peak in interest on July 13.

Further putting some pressure on LINK’s price may be a controversial report, published last week, which called Chainlink “a fraud,” and said the team behind the token uses “classic pump and dump techniques” to lure in token investors.

However, some still believe the correction seen in LINK over the past few days is only a short-term pullback in what will eventually become a larger parabolic trend.

Usually described as a decentralized oracle service that provides real-world data to various on-chain applications, Chainlink has seen strong interest from retail investors over the past few months as the project has landed a number of partnerships. Among them is the decentralized token swap protocol Kyber Network (KNC), and the low-volatility money protocol known as Meter, which have both recently said they will integrate Chainlink’s oracle service into their respective protocols.