BTC Bears Eye Break Below $60,000 as ETF Flows Slow, Macro Headwinds Grow – Here’s Where the Bitcoin Price is Headed Next

Bitcoin (BTC) bears are eyeing a break below the key psychological $60,000 level, with ETF flows having slowed this week and macro headwinds continuing to pile up. Some are even predicting that the Bitcoin price could be headed towards $50,000 next.

The Bitcoin price briefly dipped as low as $ 59,800 on Wednesday. However, the world’s largest cryptocurrency by market capitalization has since recovered to the $60,400s, down around 5% on the day.

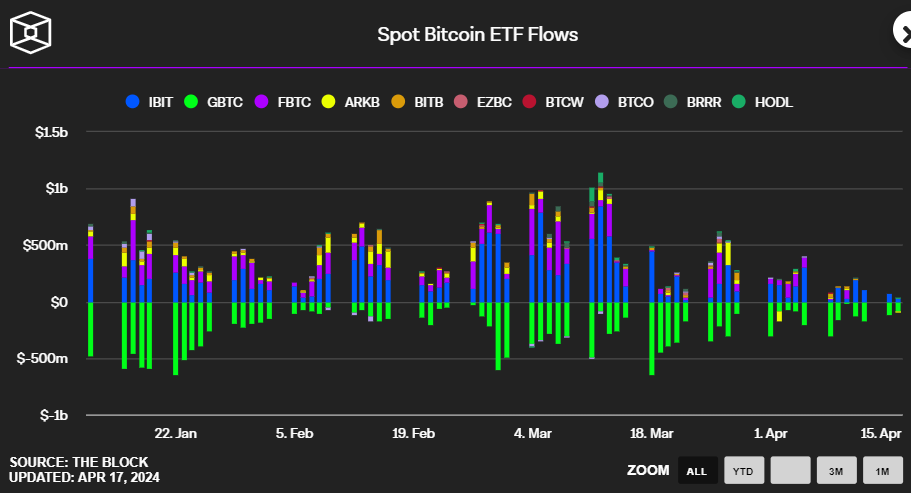

According to data presented by The Block, net ETF flows have been negative so far this week. That’s thanks to continued, albeit still slowing GBTC outflows of $110 million on Monday and $80 million on Tuesday.

At current levels, the Bitcoin price is down around 18% from its record high of nearly $74,000 last month.

Macro Risks Grow

As macro headwinds grow ahead of the halving on Saturday, price risks could be tilted toward further losses.

Since last November, US bond yields and the US Dollar Index (DXY) have recently vaulted up to their highest levels.

US economic data has come in stronger than expected in recent weeks, forcing the Fed to turn more hawkish. Fed Chair Jerome Powell emphasized a lack of progress on inflation this week.

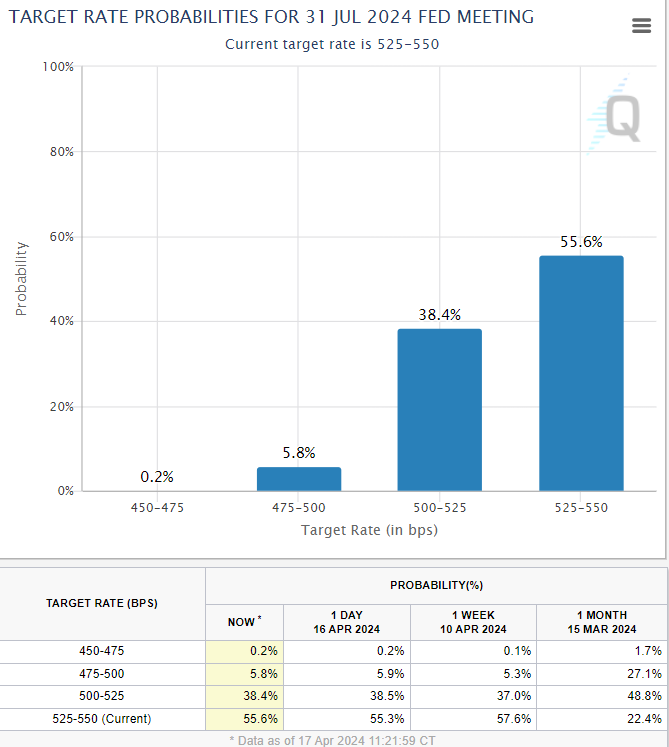

This has forced investors to downsize their Fed rate-cut bets substantially. As per the CME’s Fed Watch Tool, the money market implied probability of a July rate cut has faded to under 45% from around 80% one month ago.

This has hit risk assets across the board. As Bitcoin probes $60,000, the S&P 500 is down 5% from its recent peak and at its lowest in nearly two months.

Of course, elevated geopolitical tensions in the Middle East between Iran and Israel have also dented sentiment recently. The threat of another major war that could have an equally disruptive impact on the global oil supply continues to hang over markets.

Bitcoin Halving to Suppress the BTC Price

Nerves are also growing that the upcoming Bitcoin halving could be a “sell-the-news” event.

Widely followed crypto research house 10x Research recently predicted miners could dump $5 billion of BTC after the halving.

The selling pressure could continue for as much as 4-6 months, meaning the next leg higher in the BTC market might have to wait until October this year.

Bitcoin miners could sell $5 billion worth of BTC after halving , analysts at 10x Research believe .

The pressure on BTC from miners can continue for 4-6 months, and only then will a “post-halving rally” begin.

This has happened historically, analysts say. The chart shows an… pic.twitter.com/gyxniDON8h— Crypto 4 Light (@vladi4light) April 15, 2024

There are plenty of reasons for Bitcoin investors who are sitting on substantial paper gains to take profit.

Here’s Where the Bitcoin Price is Headed Next

Last weekend, Bitcoin’s technical outlook turned sour after it bearishly broke out of its recent pennant structure consolidation pattern.

However, the bears’ first profit target has been hit now that it has hit $60,000 and tested its March lows.

The key question now is whether Bitcoin can hold above its $60,000 support.

All of the above-mentioned arguments—i.e., slowing ETF flows, growing macro headwinds, and potential post-halving sell pressure—suggest risks are tilted toward a near-term break into the $50,000s.

However, the latest pullback in the Bitcoin price has flushed a lot of froth out of the market.

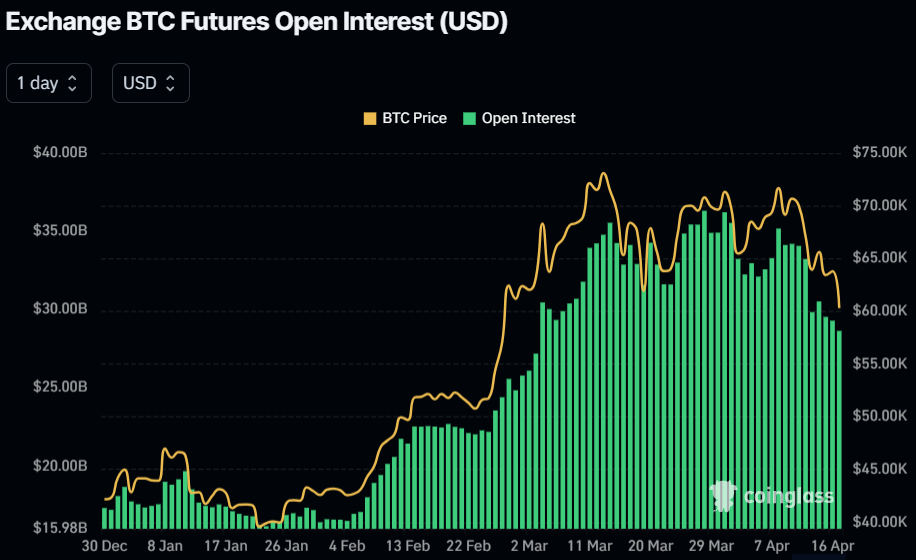

As recently as March 28, the value of open leveraged futures positions (or open interest) was $36.31 billion. According to coinglass.com data, it was last 22% lower at $28.64 billion.

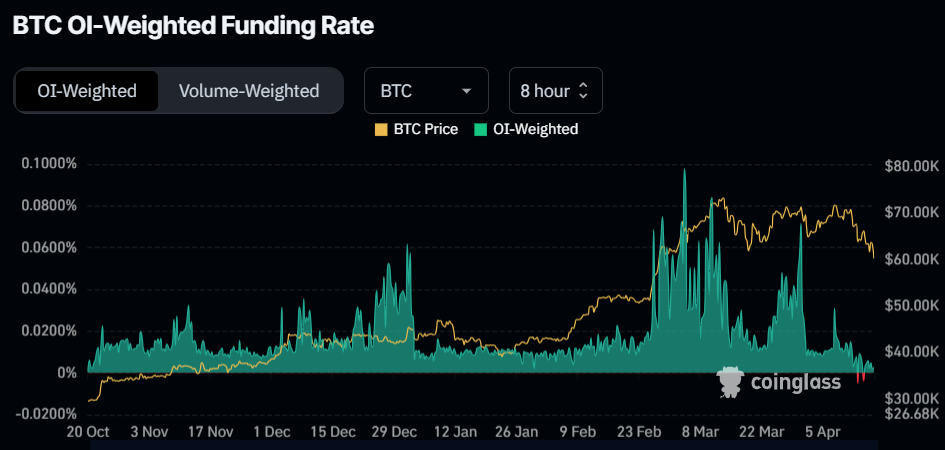

Meanwhile, funding rates to open leveraged Bitcoin futures positions recently flipped negative for the first time in over 6 months.

This suggests a weakness in demand amongst traders to take out leveraged long bets and perhaps a rising appetite to go short.

A less frothy market suggests that the foundations are there for a more sustained price recovery.

If fundamentals continue to deteriorate, a sustained breakdown into the $50,000s remains the most probable outcome, however.

Once the $60,000 support zone goes, a swift drop back to the next major support level at $53,000 is likely.

Investors to Buy the Dip?

However, once the BTC price drops back to these areas, we could see major investors stepping in to buy the dip.

Bitcoin’s long-term outlook remains highly positive. The narrative that it is “digital gold” continues to gain ground.

Many major US brokerages and wirehouses are yet to offer spot Bitcoin ETFs to clients, so access will continue to widen.

US government deficit spending is likely to remain high in an election year. And the US election could see the US regulatory landscape swivel more pro-crypto.

Meanwhile, the Fed is still expected to start cutting rates a little later than the markets hoped.

Also, once post-halving miner sell pressure eases, the lower BTC issuance rate will start acting as more of a tailwind.

On Saturday, the rate of BTC issuance to miners will drop 50% from 6.25 BTC per block to 3.125.

Bitcoin remains on course to hit and likely exceed $100,000 in the coming years. And if anything happens to force the Fed to start cutting interest rates sooner, expect the gains to come sooner rather than later.