Bitfinex Raises USD 1 billion, CTO Claims

Major cryptocurrency exchange Bitfinex “is able to raise” c. USD 1 billion in tethers (USDT) and USDT equivalents, “in 10 days, in a private sale,” Paolo Ardoino, Chief Technical Officer of the exchange, confirmed, later clarifying that the investments “were made.”

“Private companies, giants in our industry and outside, made investments for > 100m each. A legion of inside and outside users made investments for > 1m each,” the CTO tweeted today.

Later, the CTO added that “most was raised by investor who contacted directly iFinex [the operator of Bitfinex] and subscribed directly with iFinex.”

Previously, Bitfinex stated that it wants to raise USD 1 billion via the sale of its LEO token.

The company says it will use the proceeds “for working capital and general business purposes, including capital expenditures, operating expenses, repayment of [debts] and other recapitalization activities.”

“LEO will be the utility token at the heart of the iFinex ecosystem. Token holders will experience benefits across the entire portfolio and are expected to obtain benefits from future projects, products, and services,” according to the exchange.

Also, they claim that “on a monthly basis iFinex and its affiliates will buy back an amount of LEO from the market equal to a minimum of 27% of the consolidated gross revenues of iFinex from the previous month, in perpetuity until no tokens are in commercial circulation.”

Bitfinex aims to open a LEO:USDT market for peer-to-peer trading following the conclusion of the sale of tokens.

As reported, Bitfinex made a whopping USD 404 million in net profits last year (24% more than in 2017) and paid USD 261.7 million in dividends while they are still struggling to recover allegedly lost USD 851 million.

Bitfinex and the company’s stablecoin Tether are still embroiled in a complex legal battle with the Attorney General (AG) in New York. The AG has accused the operator of “covering up” loans and “misappropriating” some USD 851 million – in a case that involves a Panamanian company, Crypto Capital.

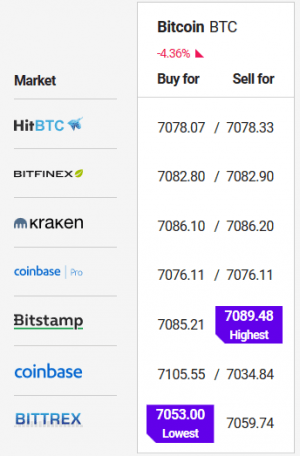

At pixel time, tether trades above USD 1, while the risk premium on Bitfinex has practically disappeared as it may be more expensive to buy bitcoin on other exchanges than on Bitfinex. Recently, bitcoin was trading at around USD 300 premium on the exchange, last Friday it dropped to USD 70.