Bitcoin Price Slides Below USD 7,000 on China Crackdown News

Bitcoin (BTC) price slumped to a six-month low on Friday as China’s central bank launched on Friday a fresh crackdown on cryptocurrency trading in Shanghai. (Updated at 14:40 UTC: updates in bold).

People’s Bank of China (PBOC) Shanghai headquarters said in a statement it would crack down on a resurgence of illegal activities around virtual currencies, and cautioned investors not to confuse such instruments with blockchain technology, Reuters reported. The move came a day after financial regulators in Shenzhen launched a similar campaign, it added. Moreover, as reported, the PBOC is preparing to launch its own digital currency.

At pixel time (14:39 UTC), BTC trades at c. USD 6,940, dropping by 13% in the past 24 hours and reaching the level last seen in May 2019. The price is also down by 7% in the past month, trimming its annual gains to 54%.

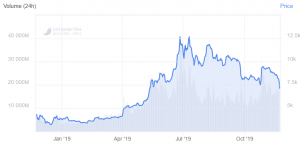

Bitcoin price chart:

“Volumes are up today but not in a good way. Bitcoin trades across exchanges, as reported by Messari.io is up to nearly USD 800 million in the last 24 hours. The CME bitcoin futures have also been rising due to the volatility and increased speculation. By now, the main level of support we’d been monitoring around USD 7,300 has been busted and we’re now looking at the lowest levels since the May rally,” Mati Greenspan, Founder of QuantumEconomics.io, said today, adding that there’s little in the way of support below this level.

Money flows in the past 24 hours, in million USD

| Trading Pair | November 21 (16:10 UTC) | November 22 (15:00 UTC) |

|---|---|---|

| BTC/USDT | 1,800 | 2,950 |

| BTC/USD | 375 | 611 |

| BTC/CNY | 120 | 137 |

| BTC/JPY | 48 | 98 |

| BTC/EUR | 69 | 112 |

| BTC/GBP | 36 | 40 |

Source: Coinlib.io

Also, crypto analyst Tone Vays said recently that he thinks “we’re going to go lower than USD 7,000 before the halving.” Vays doesn’t think that BTC will hit its all-time high in 2020. In a year from now, he sees it a bit over USD 10,000. Nonetheless, once that barrier of USD 20,000 is broken, USD 50,000 and USD 100,000 can follow “pretty quickly,” but it’ll not be next year, he says. Instead, Vays adds, “I’m really looking for the bull market to really take off around 2022-2023.”

Meanwhile, as reported today, while the price is dropping, the Bitcoin mining difficulty and hash rate went up. This has led some market observers to believe that we may not see a mass miner capitulation yet.

Reactions:

{no_ads}