Bitcoin Price Prediction: Unlocking the Timing of Consolidation Breakout and Price Surge

Bitcoin, the leading cryptocurrency in the market, has been experiencing a period of consolidation, where its price has been range-bound and showing limited volatility.

Traders and investors eagerly anticipate the breakout from this consolidation phase, as it could potentially signal a significant price surge.

In this Bitcoin price prediction, we will explore the factors and indicators that can help unlock the timing of the consolidation breakout and provide insights into the potential price movement of Bitcoin.

Get ready to delve into the exciting world of Bitcoin price prediction and uncover the key to unlocking its next big move.

President Biden Unveils Budget Proposal: Additional $1 Trillion in Spending Cuts

In addition to the previously proposed deficit reductions of nearly $3 trillion, achieved through a combination of expenditure cuts and increased revenue, President Biden announced in a news conference that his latest budget proposal would further reduce spending by over a trillion dollars.

He clarified his stance: “I will not agree to a deal that protects wealthy tax evaders and cryptocurrency traders at the expense of food assistance for nearly 1 million Americans.”

The President’s $6.9 trillion budget proposal emphasizes the importance of modernizing regulations, particularly for digital assets.

He has called for applying wash sale rules to digital assets and regulating related party transactions, aiming to subject crypto assets to the same oversight as more traditional investments.

Joe Biden compares crypto traders to “wealthy tax evaders”

— Bitcoin Magazine (@BitcoinMagazine) May 21, 2023

Printing trillions and blaming #Bitcoin pic.twitter.com/SrfUi3l1V5

The comments made by Biden may have contributed to the decline in Bitcoin prices on Monday. According to Kiyosaki, Bitcoin and Gold remain the best protection against fraud and incompetence.

Despite politicians insisting on a smooth landing, experts are raising concerns about the ongoing discussions on the US debt ceiling potentially leading to a significant global financial disaster.

Robert Kiyosaki, however, disagrees with this assertion and advises investors to safeguard themselves by investing in gold, silver, and bitcoin.

The disagreement between Republicans and Democrats on whether the US should raise the debt ceiling persists, raising concerns about the possibility of the US defaulting on its debt for the first time.

Even if an agreement is reached, the damage to the world’s largest economy may already have been done.

"Buying #Bitcoin as an insurance against corruption and incompetence."

— Bold – the ₿itcoin Credit Card (@BoldBitcoin) May 20, 2023

– Robert Kiyosaki pic.twitter.com/VO1TN0hcLW

As a result, despite President Biden’s lack of concern, Robert Kiyosaki, the author of Rich Dad, Poor Dad, known for his pessimistic views on the current global economy and its future, stated that there will not be a “soft landing.”

Robert Kiyosaki Criticizes Biden as “Senile, Corrupt, and Incompetent” in Tweet

Kiyosaki also criticized the nation’s leaders for the high levels of corruption present. According to him, investors can protect themselves by purchasing three assets, one of which is the largest cryptocurrency by market size.

SOFT LANDiNG? HARD LANDING? Or CRASH LANDING? I say crash landing. I hope I am wrong yet that is what I believe. Corruption is high & leaders corrupt. Buy gokd, silver, Bitcoin. Still best insurance against corruption & incompetence,

— Robert Kiyosaki (@theRealKiyosaki) May 18, 2023

Kiyosaki expressed his disagreement with Biden in a separate tweet, referring to the current US president as the most “senile, corrupt, and incompetent” leader in the nation’s history.

Strike, a Bitcoin-based payments software, has made a significant move by relocating its global headquarters to El Salvador and expanding its acceptance of Bitcoin payments to 65 additional countries.

Since its launch in 2019, Strike has aimed to become the world’s equivalent of Venmo or Cash, with operations currently in the United States, El Salvador, and Argentina. Led by 29-year-old entrepreneur Jack Mallers, the company announced on Friday its expansion to a total of 65 countries worldwide.

Strike expands Bitcoin payments to 65 countries, moves global headquarters to El Salvador🇸🇻👏🏼 https://t.co/Cd6ShnNr4p

— Milena Mayorga (@MilenaMayorga) May 19, 2023

The increased accessibility of cryptocurrency payments through the Strike App contributed to the support for declining Bitcoin prices on Monday.

Bitcoin Price

The current price of Bitcoin is $26,875, and its trading volume over the past 24 hours amounts to $10 billion.

In the same timeframe, Bitcoin has experienced a decrease of 0.71%. It currently holds the top position on CoinMarketCap with a market capitalization of $520 billion.

There are currently 19,380,362 BTC coins in circulation out of a maximum supply of 21,000,000 BTC coins.

Bitcoin Price Prediction

On the technical front, Bitcoin is showing signs of support around the $26,600 level, with the closing of candles forming a triple bottom pattern.

This indicates a potential bullish reversal in the near term, targeting the $27,200 level.

However, on the higher timeframes, such as the four-hour chart, there is resistance around 27,200 and support near 26,600.

Additionally, the 50-day exponential moving average has acted as support at $26,700, further supporting the possibility of upward momentum in BTC.

Therefore, it is important to monitor the $26,600 level, as a break above it could lead to a bullish move towards 27,200, and potentially even $27,500.

Top 15 Cryptocurrencies to Watch in 2023

Cryptonews Industry Talk introduces a captivating selection of cryptocurrencies that are positioned for a promising trajectory in 2023.

These digital assets have been meticulously chosen due to their positive outlook, showcasing significant potential for both short-term and long-term growth.

With their distinctive characteristics and cutting-edge technologies, these cryptocurrencies are well-positioned to flourish and make remarkable strides in the future.

Prepare to embark on an exploration of the thrilling opportunities that await these digital currencies.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

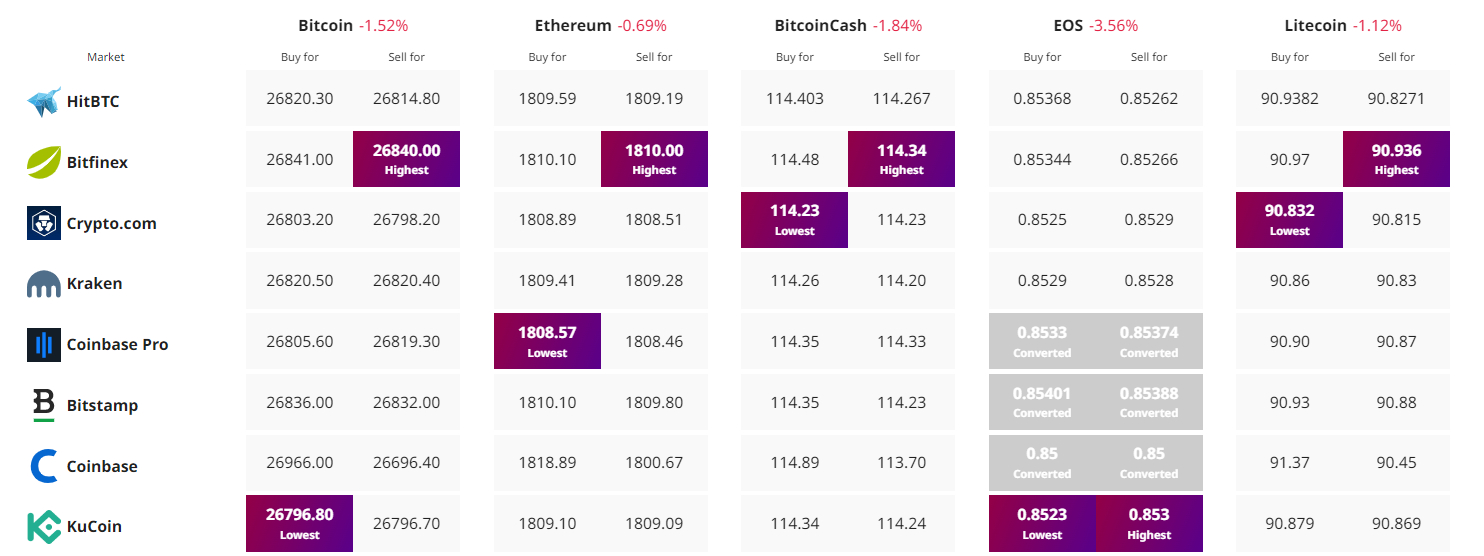

Find The Best Price to Buy/Sell Cryptocurrency