Bitcoin Price Prediction and Potential Breakout; Eyes on FOMC and Fed Rate

The most prominent cryptocurrency, Bitcoin, is currently being closely monitored for potential price predictions and breakout opportunities.

Traders and investors are eagerly awaiting the upcoming Federal Open Market Committee (FOMC) meeting and Fed Rate announcement, as these events have the potential to impact the cryptocurrency market significantly.

The decisions and statements made by the FOMC regarding monetary policy and interest rates can profoundly affect the direction and volatility of Bitcoin and Ethereum.

As market participants anticipate these crucial updates, the focus remains on predicting the future price movements and potential breakouts for both cryptocurrencies.

BTC Price Seesaws Below $26,000 After CPI Release, Investors Await Fed’s Rate Hike Decision

Following the release of the May Consumer Price Index (CPI) on Tuesday, Bitcoin experienced a momentary boost as inflation showed signs of decline.

The leading cryptocurrency, with the highest market capitalization, was trading at $26,008, representing a less than 0.50% decrease in the hour following the US Bureau of Labor Statistics announcement.

The CPI revealed a 4% increase, which was slightly better than the anticipated 4.1% and lower than April’s 4.9%.

The latest #CPI report reveals that #inflation in the United States has eased to a yearly rate of 4%, beating expectations. https://t.co/0oEkwlduQH

— Bitcoin.com News (@BTCTN) June 13, 2023

While the US economy and Bitcoin are both doing well today, any hiccup caused by tomorrow’s interest rate decision or the impending recession in the US is likely to be favorable for crypto assets.

Many people believe that the Federal Reserve won’t raise interest rates this month, but many experts and economists think that the Fed will keep this pause in place for the full year 2023.

Given that the 2024 US presidential election campaign is about to begin, the Central Bank must change its focus from lowering inflation to preventing a recession.

We think this is a feasible objective with interest rates where they are right now, but higher rates could be the final straw.

Exchange: Asset Freeze to Stop Binance US Operations; Request from SEC to Be Rejected

The US-based cryptocurrency exchange Binance US has asked a federal judge to deny the US Securities and Exchange Commission’s request to freeze its assets.

Defense lawyers claimed in a court document that the corporation couldn’t pay its staff or vendors or operate the trading platform.

#Asset freeze requested by the #SEC to halt #Binance US operations, lawyers argue in court filing. https://t.co/WPWH69hojI

— Bitcoin.com News (@BTCTN) June 13, 2023

Last week, the US Securities and Exchange Commission (SEC) sought court approval to freeze cryptocurrency assets held on Binance.US, Binance Holdings Ltd., and Changpeng Zhao, the founder, and CEO of Binance, citing concerns about the security of user funds.

According to the court document, one of Binance US’s banking partners has notified the cryptocurrency exchange that it will no longer hold its assets starting from June 14.

The partner has also suspended all transactions on Binance US’s account pending the court’s decision on the SEC’s request.

On Thursday, Binance US informed its customers about the suspension of dollar deposits and withdrawals.

The exchange advised customers to withdraw their holdings in US dollars by June 13 as it transitions to a cryptocurrency-only trading platform.

Bittman’s S19 Mining Rigs predominate highlights of a New Study Bitcoin Network Hash Rate

A new mining study titled “The Signal & The Nonce,” published by Coin Metrics researcher Karim Helmy, introduces a novel method for examining the hash power of the Bitcoin network.

The study utilizes nonce patterns to unveil the market share held by each major application-specific integrated circuit (ASIC) mining rig that drives the network’s operations, presenting an innovative technique.

Coin Metrics’ latest study shows three primary Bitmain Antminer models now command the majority of today's #Bitcoin hashrate. https://t.co/CdWPSupI9A

— Bitcoin.com News (@BTCTN) June 13, 2023

The analysis also examined Bitcoin’s energy consumption and compared it to the electricity consumption indices developed by the Centre for Alternative Finance at Cambridge University and Dichotomist.

Coin Metrics’ research indicates that the network consumes less power than the indices published by these two organizations.

The researchers state that this new methodology offers several advantages over the existing body of research.

Bitcoin Price Prediction

Bitcoin is currently facing resistance at the $26,250 level and finding support around $25,500, which will play a crucial role in determining its future direction.

The 50-day Exponential Moving Average (EMA) at $25,800 acts as a support level, but a downward triangle pattern suggests a bearish outlook.

If the support level of $25,500 is broken, it could increase selling pressure, potentially driving the price toward support levels at $24,940, $24,710, or even $24,385.

Traders are closely monitoring the upcoming FOMC meeting and Fed Rate announcement as they can impact Bitcoin’s price.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

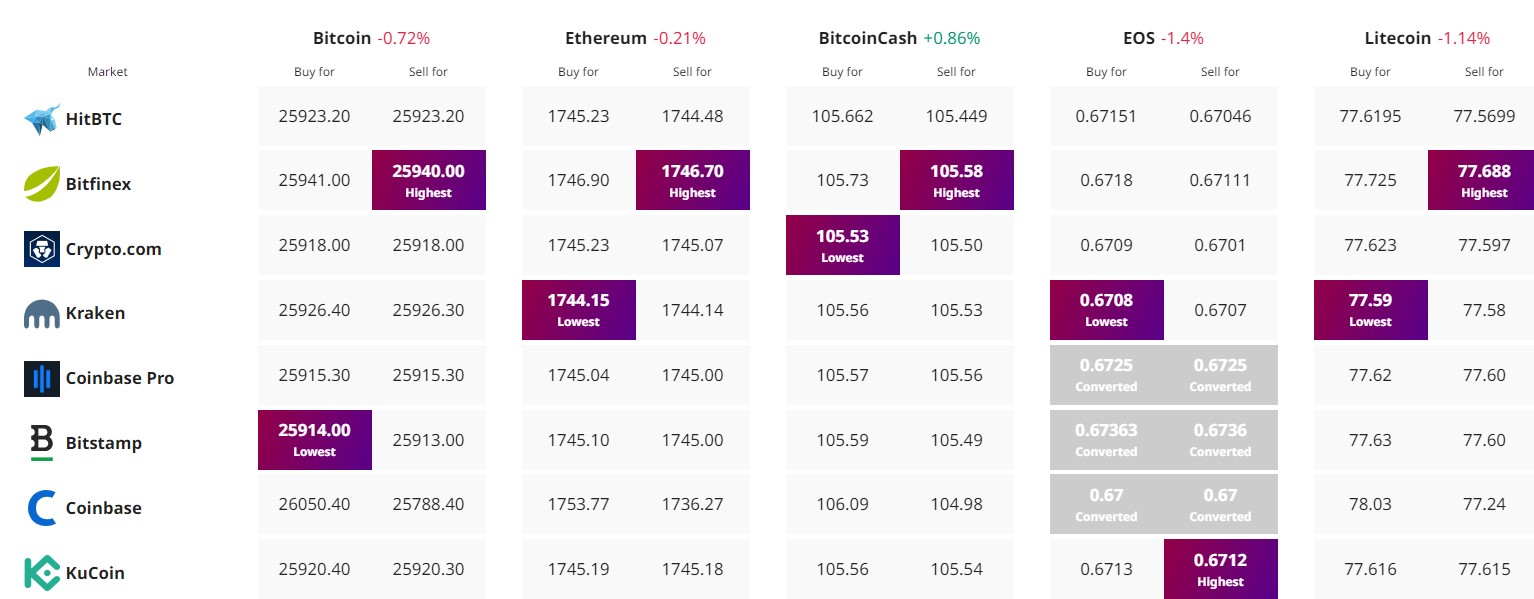

Find The Best Price to Buy/Sell Cryptocurrency