Bitcoin Price Prediction: BTC Soars 3.5%, Fed Cuts Stir USD, Zodia Joins Ripple’s Network

In a striking display of market dynamics, Bitcoin’s price surged to $40,630, marking a notable 3.50% increase on Monday. This uptrend in Bitcoin’s value coincides with a weakening US Dollar, as market speculation intensifies around potential Federal Reserve rate cuts.

Adding to the cryptocurrency sphere’s vibrancy, Zodia Custody, supported by banking giant Standard Chartered, has made a strategic move to join Metaco’s Global Crypto Storage Network, a platform owned by Ripple. This integration highlights the growing interconnectedness and sophistication of the global cryptocurrency infrastructure.

Fed Rate-Cut Speculation Weakens Dollar

In anticipation of a critical employment report set to influence U.S. interest rates, the markets responded cautiously to Federal Reserve Chair Jerome Powell’s comments, sparking early-week volatility in the dollar. Amidst this backdrop, Bitcoin surged in the Asian market, breaking the $40,000 barrier for the first time in over a year.

The dollar’s decline was fueled by Powell’s acknowledgment of a slowing economy and the possibility of policy tightening, alongside reduced expectations for further rate hikes. Market indicators pointed to a 60% chance of a rate cut by March.

Dollar on shaky ground as Fed rate cut bets strengthen https://t.co/ga3waJBzwn pic.twitter.com/M7ZAKH5Qda

— Reuters (@Reuters) December 4, 2023

Concurrently, Bitcoin’s value ascended as the dollar weakened, reaching new heights. The pressure exerted on the dollar by Powell’s remarks led investors to anticipate US regulatory approval for stock-market traded Bitcoin funds, further driving Bitcoin’s upward trajectory.

Zodia Custody and Standard Chartered Enter Ripple’s Metaco Crypto Network

The integration of Zodia Custody into Metaco’s cryptocurrency network, powered by Ripple, is expected to have a positive impact on Bitcoin (BTC) prices. This development is part of a broader movement towards reducing counterparty risk and providing secure custody solutions, thereby enhancing institutional engagement with cryptocurrencies.

This partnership paves the way for global institutions to access more secure and efficient cryptocurrency storage solutions, potentially leading to increased investment and interest in the Bitcoin market.

🔥 JUST IN: Standard Chartered-Backed Zodia Custody Joins Ripple-Owned Metaco’s Global Crypto Storage Networkhttps://t.co/6Wxl2VtqHO #xrp $xrp #XRPCommunity #crypto #blockchain

— Cryptic Poet (@1CrypticPoet) December 4, 2023

Such advancements in Bitcoin storage infrastructure are likely to bolster investor confidence and contribute to the overall positive sentiment in the sector. Zodia Custody’s entry into Metaco’s network underscores the growing trend of institutional adoption, which is a key factor driving Bitcoin’s price upwards as institutions seek reliable digital asset management solutions.

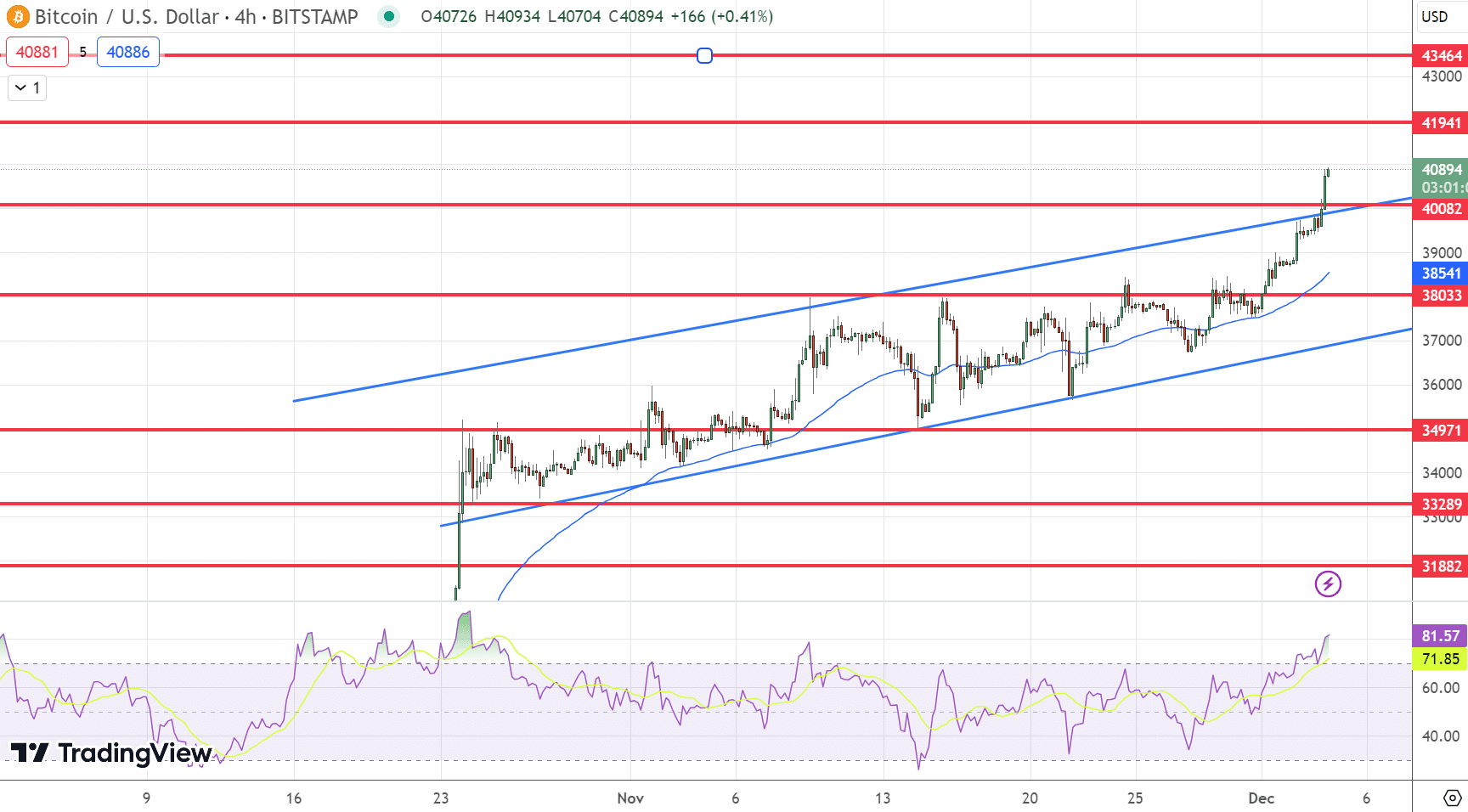

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.