Bitcoin Price Prediction: BTC Slips 2.5% as Regulatory Winds and National Reserves Shape the Future

As Bitcoin price oscillates in its valuation, showing a recent dip of 2.5% in seven days, several fundamental and geopolitical factors are coming into play to chart its future course.

Trading at $27,231 with a Monday surge of 1.50%, the cryptocurrency titan is facing pivotal moments.

Market speculation is rife as anticipation builds over the SEC’s potential approval for Bitcoin ETFs, a move that could significantly alter the crypto landscape.

Furthermore, the revelation that the US government holds a more substantial Bitcoin reserve than any other country globally brings additional dynamics into the equation.

Meanwhile, the Australian Treasury’s inclination to regulate cryptocurrency exchanges, focusing less on the tokens themselves, offers a fresh perspective on how nations choose to navigate the intricate web of digital currencies.

SEC’s Potential Green Light for Bitcoin ETFs Fuels Market Buzz

Bitcoin is currently witnessing heightened interest and market activity, largely influenced by a positive market sentiment surrounding the potential approval of a spot Bitcoin Exchange-Traded Fund (ETF) by the US Securities and Exchange Commission (SEC).

Benzinga (and others) reporting that Reuters is reporting that the SEC will NOT be appealing Grayscale case. pic.twitter.com/yd9BBtRwv5

— Eric Balchunas (@EricBalchunas) October 13, 2023

After the SEC chose not to oppose the court’s ruling on the Grayscale Bitcoin ETF, there’s an escalating conversation about the likelihood of the SEC approving various Bitcoin ETFs within the next 3 to 5 months.

This prospect has sparked significant excitement in both financial and cryptocurrency circles, symbolizing a possible turning point in the mainstream adoption and regulatory endorsement of Bitcoin.

US Government: The Leading Holder of Bitcoin Globally

The US government possesses the largest state-owned collection of Bitcoin in the world, amassing a total of 207,189 bitcoins valued at approximately $5 billion, primarily from asset seizures.

While many nations have liquidated their crypto reserves, the US has consistently expanded its holdings.

A recent study by Sachin Jaitly of Morgan Creek Capital highlighted a significant correlation between the rising money supply, concerns about inflation, and sovereign Bitcoin adoption.

Interestingly, the U.S. has auctioned off Bitcoin worth $366.5 million over time, potentially foregoing substantial gains from its appreciation.

Nonetheless, the influence of the US government’s $5 billion Bitcoin reserve on hedging against inflation remains minimal, given the magnitude of the government’s comprehensive balance sheet.

https://www.twitter.com/WSJ/status/1713502486760202433 The news of the U.S. government's substantial Bitcoin holdings might instill confidence in cryptocurrency markets, potentially contributing to Bitcoin's rising price today as investors view government interest as a positive signal. The Australian Treasury wants to control cryptocurrency exchanges rather than tokens The Australian Treasury has released a consultation paper outlining plans to regulate the country's digital asset sector, with a focus on cryptocurrency exchanges. Under these proposed regulations, crypto exchanges operating in Australia might need to acquire a financial services license from the Australian Securities and Investment Commission (ASIC) if they hold over $3.2 million or serve more than $946 per individual. This move is seen as a significant step in addressing consumer protection while fostering innovation in the digital asset space.Notably, this development appears to have positively influenced Bitcoin (BTC). While the impact on the crypto market remains uncertain, the news of regulatory clarity and support for the industry in Australia has garnered positive sentiment among investors. This, coupled with broader market factors, suggests an improved market outlook and could contribute to BTC's ongoing price appreciation.Australian Treasury Suggests Regulatory Oversight for Crypto Exchanges, Excludes Tokens

— Imperial Wealth Crypto (@crypto_iw) October 16, 2023

The Australian Treasury has proposed a regulatory framework for the cryptocurrency industry, focusing on exchanges and service providers rather than individual tokens.

The framework may…

The revelation of the US government’s considerable Bitcoin holdings could bolster confidence in the cryptocurrency markets, possibly influencing today’s uptick in Bitcoin’s value as investors interpret this governmental involvement as a bullish indicator.

Australian Treasury Eyes Regulation of Crypto Exchanges Over Tokens

The Australian Treasury recently unveiled a consultation paper detailing its intentions to regulate the nation’s digital asset sector, particularly emphasizing cryptocurrency exchanges.

If these proposed regulations take effect, cryptocurrency exchanges in Australia could be required to secure a financial services license from the Australian Securities and Investment Commission (ASIC) should they hold more than $3.2 million or serve individual customers with amounts surpassing $946.

This initiative is largely perceived as a pivotal move towards bolstering consumer protection while simultaneously encouraging innovation within the digital asset domain.

Australian Treasury Suggests Regulatory Oversight for Crypto Exchanges, Excludes Tokens

— Imperial Wealth Crypto (@crypto_iw) October 16, 2023

The Australian Treasury has proposed a regulatory framework for the cryptocurrency industry, focusing on exchanges and service providers rather than individual tokens.

The framework may…

Significantly, this regulatory shift seems to have cast a favourable light on Bitcoin (BTC).

Although the exact ramifications on the broader crypto market are yet to be ascertained, the introduction of regulatory clarity and a supportive stance for the industry in Australia has evoked positive reactions from investors.

This sentiment, in tandem with other prevailing market drivers, indicates a more bullish market perspective, potentially fueling BTC’s current price trajectory.

Bitcoin Price Prediction

From a technical standpoint, the 4-hour chart provides insightful revelations. The pivot point for Bitcoin currently rests at $27,254.

On the upper side, resistance levels are seen at $27,946, followed by $28,713 and a further resistance at $29,430.

Conversely, on the downside, Bitcoin finds immediate support at $26,474, with subsequent supports at $25,770 and $25,002.

In wrapping up the analysis, the overarching trend for Bitcoin leans bullish, especially if it maintains its stance above the crucial $27,255 mark.

Over the short haul, the current momentum combined with the bullish technical indicators suggests Bitcoin may very well challenge the resistance level of $27,946.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

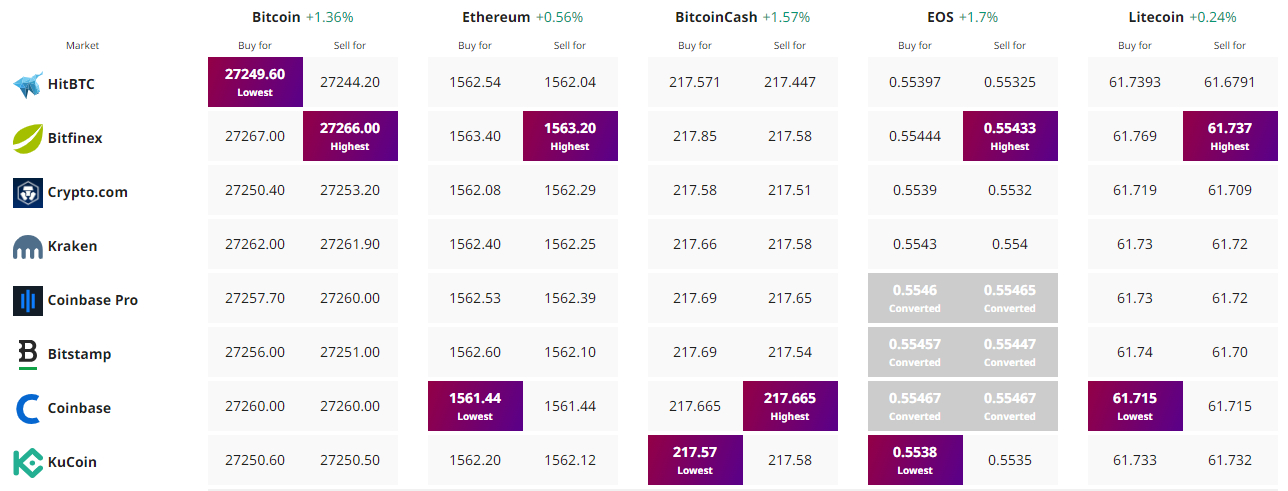

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.