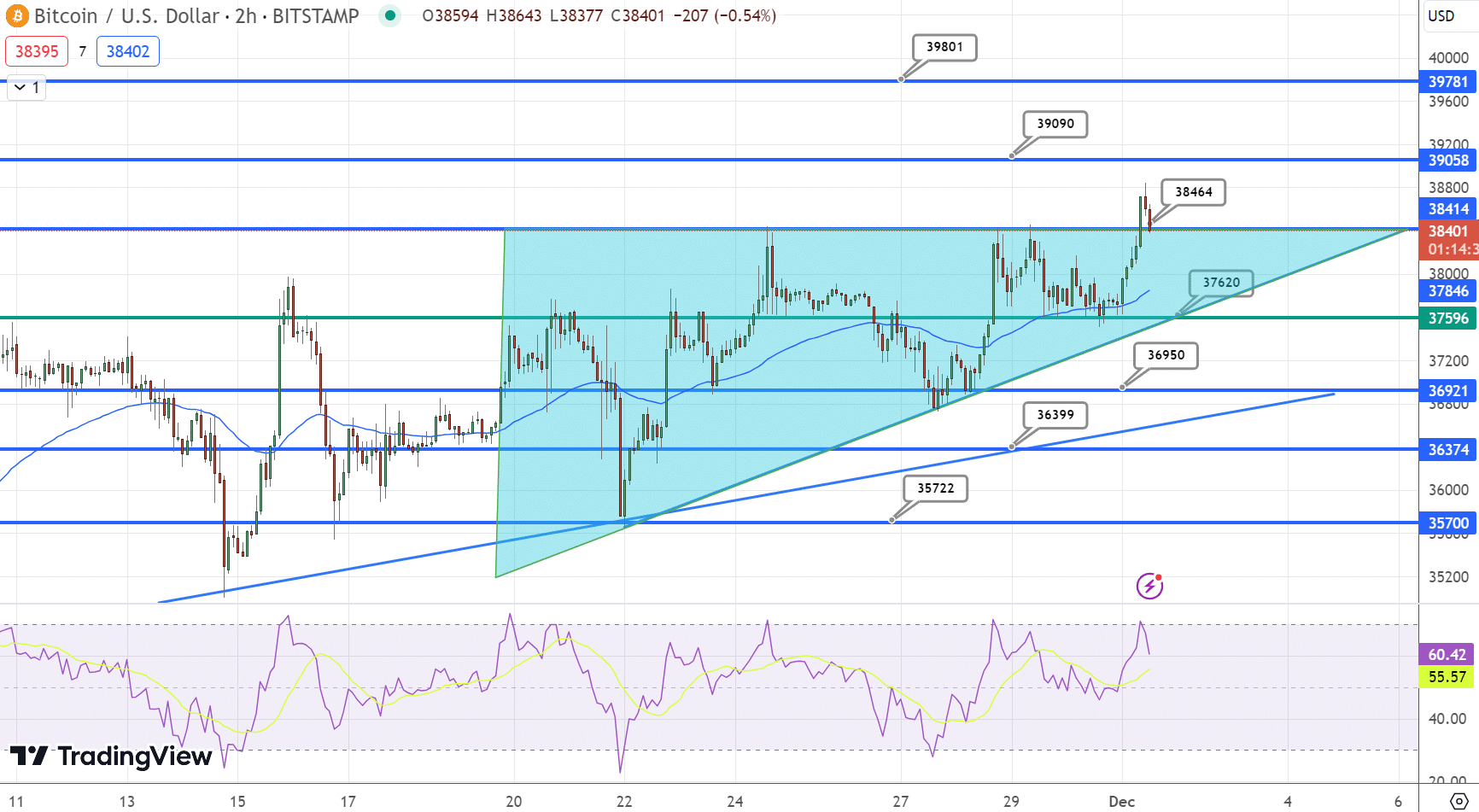

Bitcoin Price Prediction as Whales Poised to Push Price Above $40,000 – Will They Succeed?

As the cryptocurrency world closely watches, Bitcoin stands on the brink of a potential breakthrough, with its current price hovering around $38,150. With a substantial 24-hour trading volume of $19.4 billion, Bitcoin has shown a modest but noteworthy increase of nearly 0.50% in the last day.

Dominating the charts as the top-ranked cryptocurrency on CoinMarketCap, it boasts a formidable market capitalization of $746 billion. With 19,557,587 BTC coins in circulation against a maximum supply of 21,000,000 BTC coins, the stage is set for the so-called ‘whales’ to possibly drive the price above the $40,000 threshold.

The question on everyone’s mind is: Will they succeed?

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.