Bitcoin Price Prediction as Federal Reserve Interest Rate Decision is Announced – Time to Buy?

Amidst the US Federal Reserve’s latest policy meeting on Wednesday, Bitcoin price finds itself in a consolidation phase near the $29,300 mark.

The much-anticipated announcement revealed a 25 basis points (bps) increase in the policy rate, setting the federal funds rate within the range of 5.25% to 5.5%.

As the decision aligns with market expectations, investors are closely observing its potential ramifications on the cryptocurrency market.

*WHAT DO YOU THINK FED CHAIRMAN JAY POWELL WILL SAY AT HIS PRESS CONFERENCE TODAY?

— Investing.com (@Investingcom) July 26, 2023

🇺🇸🇺🇸 pic.twitter.com/wBFlTWOIrM

With all eyes on Bitcoin’s response to the Fed’s move, traders are pondering whether this development presents an opportune time to make strategic moves within the cryptocurrency space.

FED Implements Expected Quarter-Point Rate Hike, Reaches 22-Year High

As anticipated, the Federal Reserve decided to raise its benchmark interest rate by 0.25 percentage points on Wednesday.

This move comes after the central bank refrained from a rate increase in June to assess the impact of its previous aggressive monetary tightening measures.

💥 Buckle up, dollar enthusiasts! 💵💪 The Federal Reserve just hiked the rate to 5.50% from 5.25%! 🚀📈 Time to put on your financial seatbelts and see how the dollar rides this roller coaster! 🎢🤔 #FedHikeRate #StrongDollar #EconomicThrills

— Arslan B. (@forex_arslan) July 26, 2023

However, to bring inflation back to the targeted 2%, Fed officials concluded that further rate hikes were necessary.

As a result, the fed-funds rate target now ranges from 5.25% to 5.5%, reaching a level not seen since early 2001.

Impact on Bitcoin Price and the Cryptocurrency Market

The Federal Reserve’s decision to raise interest rates to a 22-year high can potentially have significant ramifications for the cryptocurrency market, including Bitcoin.

Higher interest rates often attract investors towards traditional financial assets, which could lead to a short-term decrease in demand for riskier assets like cryptocurrencies.

As the Fed continues tightening monetary policy to combat inflation, some investors might shift their focus to less volatile and more stable assets.

This shift in investment behavior might temporarily dampen the demand for cryptocurrencies, causing Bitcoin’s price to experience fluctuations and a possible dip in the short term.

Cryptocurrencies, particularly Bitcoin, have increasingly been recognized as potential inflation hedges and safe-haven assets, especially during periods of economic uncertainty.

As a result, despite the initial impact of the rate hike, investors may turn to Bitcoin as a store of value and a hedge against inflation, which could help stabilize its price or even contribute to its growth in the long run.

Bitcoin Price Prediction

According to the most recent assessment of Bitcoin’s price, it remains in a sideways trading pattern, unaffected by the rate hike, as investors had already anticipated and factored in the expected increase from the Federal Reserve.

The market’s behavior aligns with the popular saying “buy the rumor, sell the fact,” indicating that the rate hike was widely expected, causing little surprise or impact on Bitcoin’s price.

Regarding technical analysis, the $29,550 level is recognized as a significant resistance point for Bitcoin, while the psychological level of $30,000 holds notable importance.

The appearance of doji and spinning top candle patterns above the $28,900 level suggests a potential weakening of bearish sentiment, which might pave the way for a bullish trend.

However, it is essential to consider the 50-period exponential moving average around $30,000, which could act as a resistance level.

Based on the present trading patterns, Bitcoin’s price is anticipated to stay within the bracket of $29,550 and $28,850.

A potential upward breakthrough above $29,550 might lead to price targets in the range of $30,200 or even $30,900.

On the contrary, a bearish decline below $28,850 could push Bitcoin’s price toward the $28,000 level.

Traders are recommended to perform comprehensive analyses, considering relevant factors, before making any trading choices, given the rapid changes that can occur in market conditions.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the most recent initial coin offering (ICO) ventures and other cryptocurrencies by regularly exploring our thoughtfully curated selection of the top 15 digital assets to keep an eye on in 2023.

This meticulously compiled list has been curated by industry experts from Industry Talk and Cryptonews, guaranteeing you professional advice and valuable perspectives.

Stay ahead of the curve and explore the possibilities of these cryptocurrencies as you navigate the dynamic realm of digital assets.

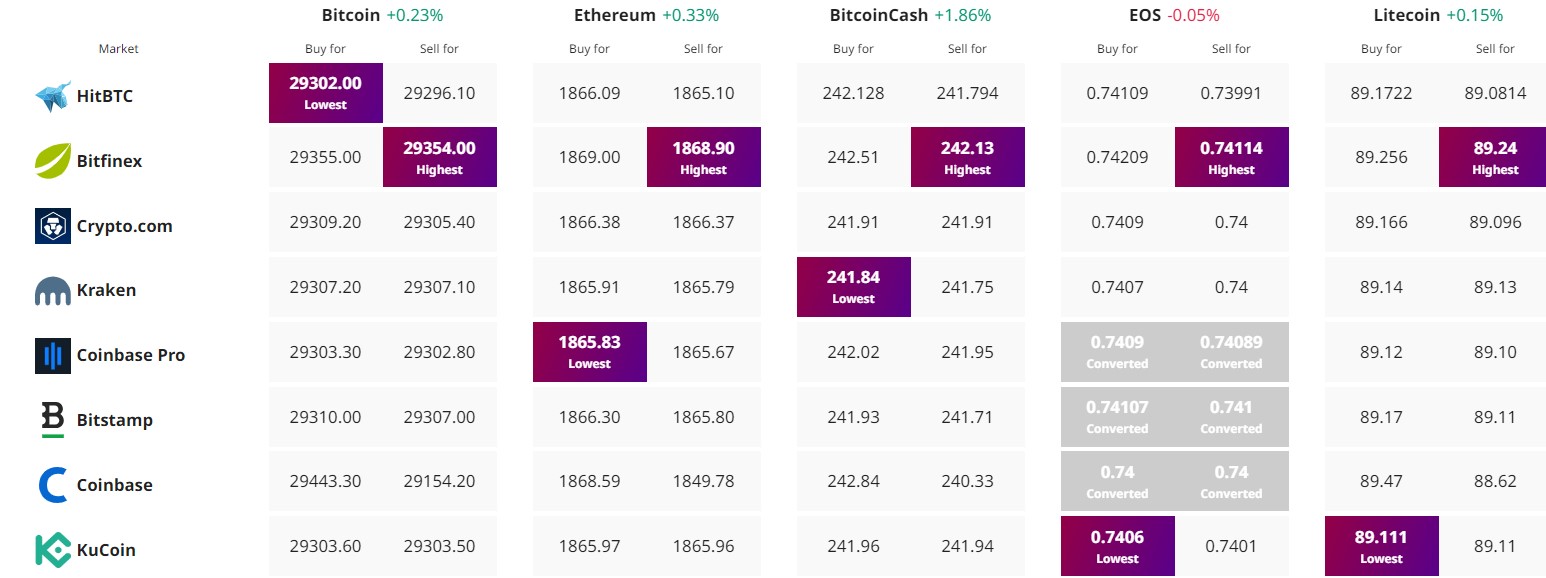

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.