Bitcoin Price Prediction as BTC Rallies 19% in a Month – Is the Bear Market Over?

In recent weeks, Bitcoin has experienced a significant rally, surging 19% in just one month, leading many to question whether the bear market is finally over. This update delves into Bitcoin price predictions and analyzes various factors contributing to the cryptocurrency’s recent gains, while also assessing the likelihood of a sustained upward trend.

Will Bitcoin’s Hashrate Growth Slow Down in April?

Bitcoin’s one-day mean hashrate reached 398EH/s last weekend, sparking speculation on social media. However, it’s important to remember that Bitcoin’s hashrate is back-calculated from block production, and luck plays a more significant role in short periods than in longer timeframes, making one-day data less accurate.

Regardless, Bitcoin’s monthly average hashrate grew significantly year-to-date from 273EH/s in January to 330EH/s in March. Yet, metrics analyzed by TheMinerMag suggest that growth could slow down in the coming months.

Net spending on property, plant, and equipment (PP&E) by North American public mining companies began shrinking in Q3’22, as shown in data from 18 companies. With only 12 companies reporting cash flow activities for Q4’22, the trend seems to have continued. These 12 companies saw net PP&E spending decrease from Q1 to Q4.

Following this post, we tried several ways to find the highest correlation coefficient between U.S miner shipments and #Bitcoin average hashrate.

— TheMinerMag (@TheMinerMag_) March 29, 2023

The best we got is 0.94. It projects March's average at 325EH/s v.s the actual 330EH/s and projects April's at 347EH/s 👀 👀 https://t.co/n1uKkicrNZ

Previous data revealed that Bitcoin miner shipments to the US surged in September 2022 and January 2023, each about six months after the end of Q1’22 and Q2’22, respectively. These quarters saw nearly $2 billion in net PP&E spending by public miners.

Considering the six-month lead time, the reduced PP&E spending in the second half of 2022 suggests that miner shipments to the US may slow down in the coming months, potentially slowing down the hashrate contribution from the US to the network.

If Bitcoin doesn’t surge well above $35,000, the older generation of equipment is less likely to become profitable and be turned on again.

US Economic Data & Macro Factors Cause Bitcoin Investor Caution

Investors are closely monitoring a series of US economic reports this week, beginning with manufacturing activity data, set to be released later today. Nonetheless, it is anticipated that the results will reveal the US manufacturing sector has stayed in a contraction phase for the fifth straight month.

"US dollar Price Setup This Week: EUR/USD, GBP/USD, USD/JPY"Key focus on global manufacturing activity data (including US ISM manufacturing due today) and US payroll data due Friday. What is the outlook on EUR/USD, GBP/USD, and USD/JPY?

— FBS Market News (@FBS_marketnews) April 3, 2023

In the meantime, the primary attention will be on nonfarm payroll data, scheduled for release on Thursday. Traders will be seeking additional signs of labor market fragility, which could lead to a less aggressive Federal Reserve stance this year.

https://www.twitter.com/miruliq/status/1642520939337486336?s=20Due to forthcoming economic data from the United States, traders appear reluctant to make substantial bids. Moreover, macroeconomic elements like inflation, financial instability, and regulatory shifts may influence the Bitcoin market, resulting in notable price fluctuations.

Bitcoin Price

The current price of Bitcoin stands at $28,150, with a trading volume of $10.1 billion over the past 24 hours. In the last day, Bitcoin’s value has declined by 0.20%. As per CoinMarketCap, Bitcoin holds the #1 position, boasting a market capitalization of $548 billion.

The technical outlook remains consistent, as Bitcoin trades within a narrow range between $28,250 and $28,900. If Bitcoin successfully breaks the triple-top pattern at $28,900, it could potentially propel the cryptocurrency towards its next resistance level at $29,600.

On the other hand, if the market faces a downturn, the immediate support level for Bitcoin lies at $27,600. A decisive breakout from the trading range between $28,200 and $28,900 will be critical in establishing the future trajectory of Bitcoin’s price movement.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the latest ICO projects and altcoins by regularly checking the carefully selected list of the top 15 cryptocurrencies to keep an eye on in 2023.

This list has been compiled by industry experts from Industry Talk and Cryptonews, guaranteeing that it showcases only the most promising and high-potential cryptocurrencies available in the market.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

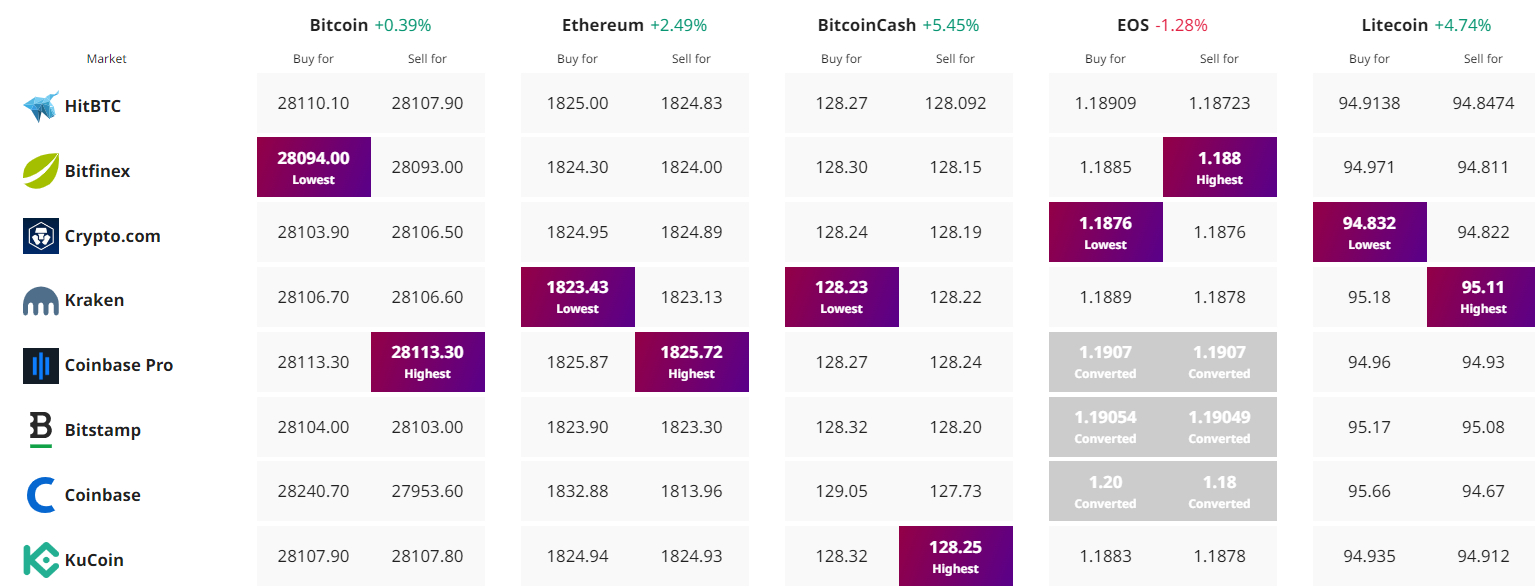

Find The Best Price to Buy/Sell Cryptocurrency