Bitcoin Price Prediction as BTC Rebounds Above $20,000, Binance Buying FTX

Bitcoin price prediction was bearish; however, it has shifted to bullish above the double bottom level of $19,230. Binance, a cryptocurrency exchange, has signed a non-binding letter of intent (LOI) to buy the FTX exchange. Binance CEO Changpeng Zhao said this would assist in relieving pressure on the FTX exchange’s liquidity.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

Sam Bankman-Fried, CEO of FTX, comments on how things have gone “full circle” with Binance being the exchange’s first and last investor. Details of the agreement are being kept confidential. Whenever Binance chooses, it can terminate the agreement.

1) Hey all: I have a few announcements to make.

— SBF (@SBF_FTX) November 8, 2022

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

Bankman-Fried says the innovation might be good for the whole business sector. The “amazing work” Zhao has done in “developing the global crypto ecosystem” was also commended.

As a result of the merger, the crypto market has seen a new round of buying, with BTC rising by 6% in the last few hours. In addition, the FTX token (FTT) value has risen by more than 46%, from $14 to $21.

Earlier today, the market was risk-off, sending cryptocurrencies lower amid rumors of FTX insolvency. According to Coinglass, a cryptocurrency data platform, investors liquidated approximately $112.83 million in cryptocurrency in one hour.

The recent drop was most likely the result of cryptocurrency contagion caused by FTX’s concern following a recent disagreement with Binance.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

In any case, with the recent updates from Binance and SBF, the market’s risk-off sentiment is shifting to risk-on, boosting investor confidence and driving a bullish market reversal.

Crypto Investor Numbers Double in Brazil

According to data released last week by the Federal Revenue, the number of cryptocurrency investors in Brazil nearly doubled in the third quarter of 2022. Compared to the second quarter, which ended on June 30, when 794,981 taxpayers said they bought or sold digital assets, 1,490,618 taxpayers said they did so as of September 30.

Largest #economy in Latin America – #Brazil has reached 1.5 million #crypto investors

— NewsCrypto.io (@NwcPublic) November 8, 2022

Adoption took off, growing 350% y/y and ≈100% q/q despite the bear market

Crypto is here to stay💯

With our platform, you’ll learn everything you need to know to be an early adopter (link👇)

According to the tax agency’s income study, which Infomoney.com.br cites, the number of cryptocurrency investors increased by 14.03% between August and September. Furthermore, the year-over-year total indicated 3.5 times greater growth than in September 2021.

According to the data, more than 1 million more taxpayers declared crypto purchases in 2022. The Tether (USDT) stablecoin is the most popular digital asset in Brazil, according to the report. Bitcoin (BTC), the market leader with over BRL 4,500 billion in transactions, came in second with USDT purchases totaling 25.9 billion reais.

Increased crypto adoption is considered good, therefore, this news is good for the overall crypto market and the BTC price.

Feds Seize $3.36 Billion in Stolen Bitcoin

The US Department of Justice announced that it had discovered approximately $3.36 billion in stolen bitcoin during an unannounced 2021 raid on James Zhong’s home. On November 4, Zhong entered a guilty plea to one count of wire fraud, which carries a maximum sentence of 20 years in prison.

According to the DOJ, in 2021, US police searched Zhong’s home in Gainesville, Georgia, and discovered approximately 50,676 bitcoin worth more than $3.36 billion. It is the DOJ’s second-largest financial seizure, following the seizure of $3.6 billion in allegedly stolen bitcoin linked to the 2016 breach of the cryptocurrency exchange Bitfinex, which the DOJ revealed in February.

Feds seize $3.36 billion in bitcoin, the second-largest recovery so far… #damn https://t.co/mGeF4DUL96

— Bastard Bear (@Bastard_Bears) November 7, 2022

According to authorities, Zhong stole bitcoin from the Silk Road dark web marketplace, where narcotics and other illegal goods were bought and sold using Bitcoin. Silk Road was shut down by the Federal Bureau of Investigation in 2013. Its founder, Ross William Ulbricht, is serving a life sentence in prison.

Bitcoin Price Prediction

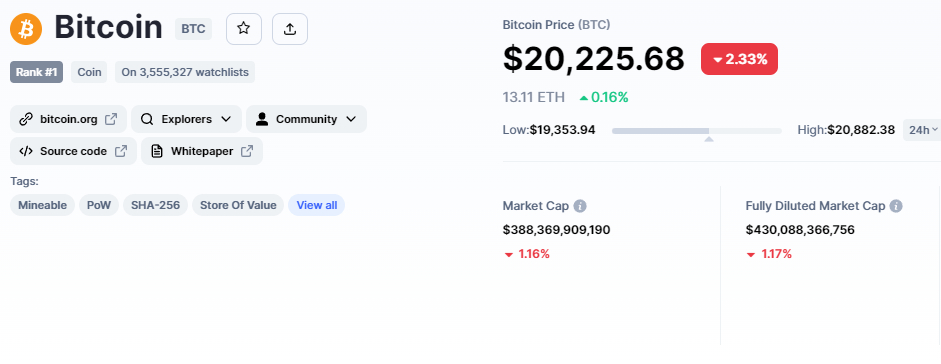

The current Bitcoin price is $20,480, with an $81 billion 24-hour trading volume. On November 08, BTC/USD started the day at $20,610, and It fluctuated between a high value of $20,692 and a low value of $19,240.

Bitcoin has recovered more than 7% since the Binance buying FTX news was released. CoinMarketCap is now the leader, with a $393 billion live market cap.

On the technical front, Bitcoin has risen above a $19,266 support level that was extended by a double-bottom pattern. On the 4-hour timeframe, Bitcoin has formed a bullish engulfing, indicating the possibility of a bullish reversal, and the RSI indicator has also begun to rise out of the oversold zone.

On the upside, Bitcoin may encounter significant resistance at the $20,635 level, which is supported by the 50-day moving average and the previously violated upward trendline. That particular trend was previously acting as a support, but it is now likely to act as a resistance.

Increased demand and a bullish crossover above the $20,635 level may expose BTC to resistance levels of $20,985 or $21,400. Alternatively, Bitcoin’s immediate support continues to stay at $19,266 and $18,650.

A Crypto Pre-Sale With Massive Potential

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides traders of all skill levels with real-time analytics and social data, allowing them to make more informed decisions.

It began its token sale two weeks ago and has now raised more than $5.4 million, while also confirming its first CEX listing on LBank Exchange.

1 D2T currently equals 0.0513 USDT, but this will soon increase to $0.0533 in the next stage of the sale and $0.0662 in the final stage.

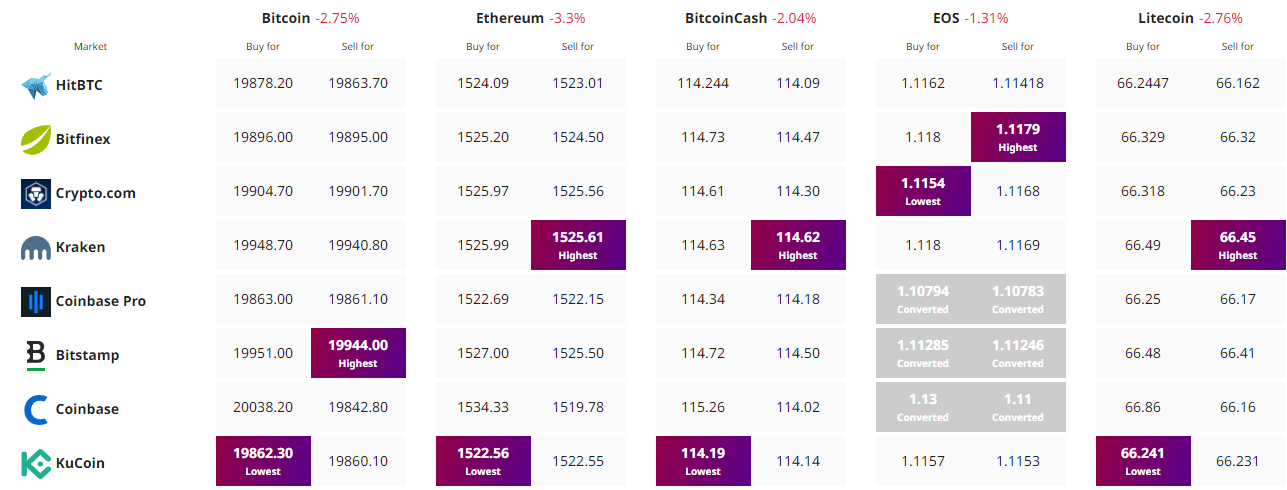

Find The Best Price to Buy/Sell Cryptocurrency

Updated on November 8, 2022, at 21:00 UTC: As of November 8th, Bitcoin’s price has fallen by 14% from its all-time high of $21,500 on November 4th to a new annual low of $17,166, with most altcoins following suit. Similarly, FTT was down over 85% but is now trading at over $2.70.