Bitcoin Price Prediction: BTC Hits $52,000; Surges with ETF Inflows & Coinbase’s Q4 Optimism

Bitcoin Price Soars Past $52,000: A Milestone Driven by ETF Inflows and Market Optimism

Coinbase’s Stock Soars Ahead of Q4 Earnings Amid Rising Confidence in Cryptocurrency

In anticipation of its Q4 earnings report, Coinbase saw its stock price surge by 37%, buoyed by investor optimism over expected robust trade volumes.

Experts are predicting a significant uptick in the company’s performance, with trade volumes projected to nearly triple to $142.7 billion.

This surge is anticipated to boost the company’s income by 22% to $825 million, with Q4 earnings per share estimated at $0.02, turning around from a $0.01 loss in the previous quarter.

Key Highlights:

- Stock Surge: Coinbase’s stock leap precedes its Q4 earnings, hinting at strong financial performance.

- Trade Volume Growth: Analysts expect trade volumes to skyrocket, driving substantial income increases.

- Recovery Signs: Despite a sluggish start for Bitcoin ETFs, recent inflows suggest a market rebound.

- Regulatory Challenges: Coinbase remains embroiled in SEC litigation but is optimistic about prevailing.

$COIN Earning is tomorrow, everyone including myself is trying to estimate as close as possible. So we zoomed in and tracking volume, asset price and etc.

I think it’s good time to step back and look at how Coinbase has evolved from 2021 to 2023 pic.twitter.com/VN4pCyh5p8

— CBduck 🛡️ (@CoinbaseDuck) February 14, 2024

The company’s resilience, even in the face of regulatory challenges, coupled with a broader cryptocurrency market rally—highlighted by Bitcoin’s ascent to $50,000—signals growing investor confidence.

This uptrend in Coinbase shares reflects a broader belief in the cryptocurrency market’s potential and particularly in Bitcoin’s value proposition.

Fidelity Lowers Fees for European Bitcoin ETFs

In a strategic move to stay competitive, Fidelity has announced a significant reduction in fees for its Fidelity Physical Bitcoin ETP (FBTC) from 0.75% to 0.35%.

This adjustment comes as Fidelity aims to align with the evolving landscape of cryptocurrency investments, following the footsteps of other asset managers like Invesco and CoinShares.

The reduction is a response to the burgeoning interest in cryptocurrencies worldwide and the recent launch of spot bitcoin ETFs in the U.S.

NEW:

🇪🇺 Fidelity has cut the fee on its European #Bitcoin ETF from 0.75% to 0.35%, according to etfstream. pic.twitter.com/RhAksSsrvw— Daily Bitcoin News (@DailyBTCNews_) February 14, 2024

Christian Staub, Fidelity’s Managing Director in Europe, highlighted the decision’s motivation: to cater to the increasing demand from investors seeking cost-effective entry points into the cryptocurrency market.

By lowering the fees, Fidelity aims to enhance the accessibility of its Bitcoin ETP, positioning it among the most affordable options in Europe.

This move is anticipated to not only attract more investors but also potentially broaden the acceptance and demand for Bitcoin, contributing to its market growth and price appreciation.

Bitcoin Price Prediction

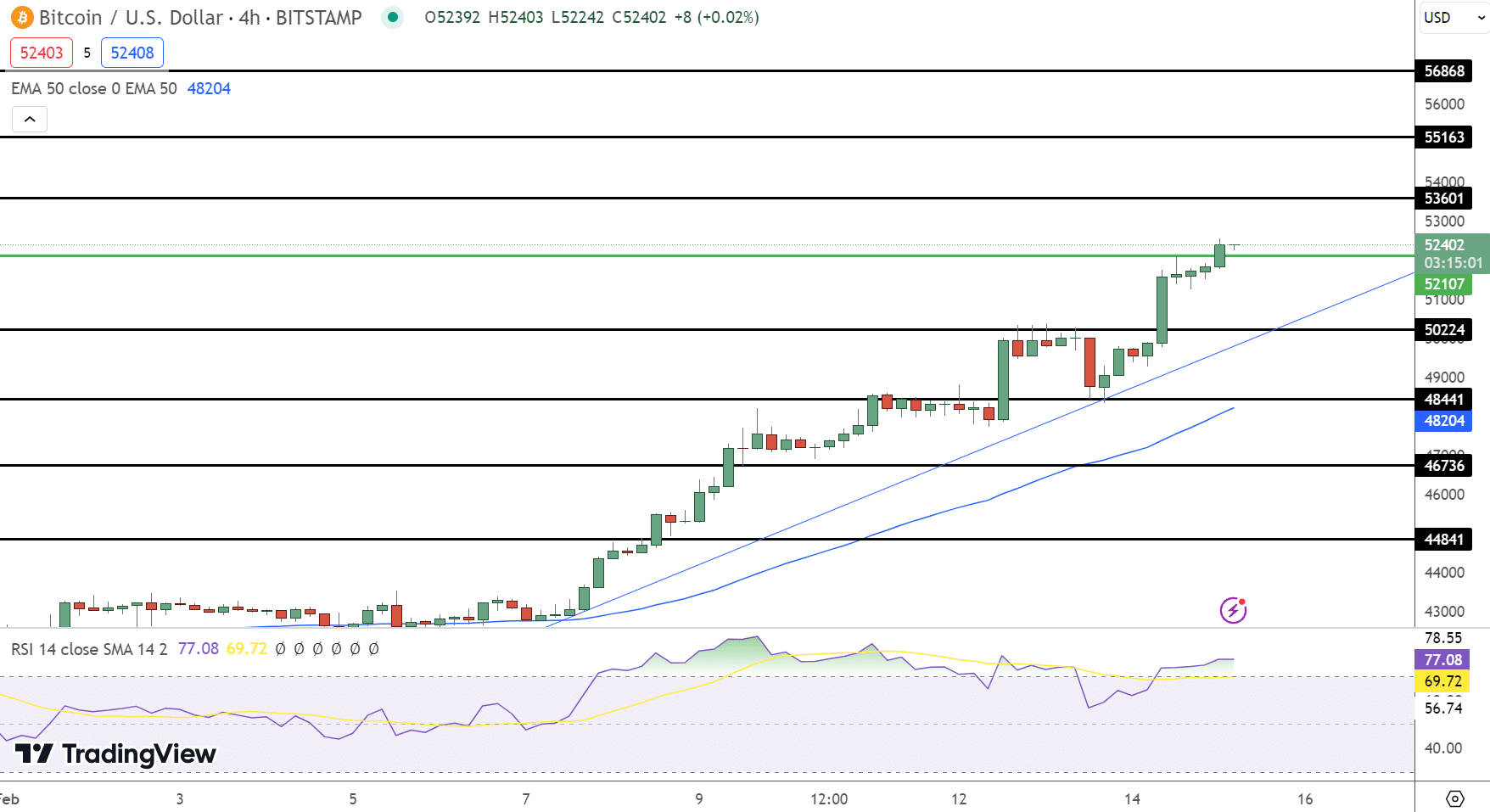

Bitcoin’s technical analysis shows Bitcoin hovering above its pivot point of $52,100, suggesting a potential climb.

Resistance levels lie ahead at $53,601.00, $55,163.00, and $56,868.00, while supports are seen at $50,224.00, $48,441.00, and $46,736.00.

With an RSI at 75, we’re nudging into overbought territory, implying vigilance. The 50 EMA at $48,200.00 further supports bullish sentiment.

A bullish engulfing candle pattern aligns with other indicators, endorsing the current uptrend.

Consequently, the outlook remains bullish above the pivot point, with any movement below this level warranting a reassessment.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.