Bitcoin Price Growth Could Continue, Says South Korean Analyst

Bitcoin price growth could continue, a South Korean crypto analyst has predicted, as “crypto fever” slowly takes hold in the nation.

According to Hanguk Kyungjae, the “consensus” among the nation’s “industry experts” is that Bitcoin (BTC) prices will keep going up.

The media outlet said that forecasters think the coin “will continue its upward trend for the time.” But experts warned of a forthcoming “short-term adjustment in prices.”

Bitcoin Price Growth: Potential for Further Rises?

The media outlet quoted Ju Ki-young, the CEO of the Bitcoin on-chain analysis firm CryptoQuant, as saying:

“If the market’s maximum degree of overheating is 100, we are currently at around 50.”

However, Ju noted that retail investors are still proceeding with relative caution. South Korean media outlets in 2018 and 2022 were dominated by tragic tales of crypto investments that went wrong at the end of the last BTC bull markets.

On-chain momentum indicates enough fresh capital inflow to initiate the next #Bitcoin parabolic bull run. https://t.co/BrvWO1dbc4

— Ki Young Ju (@ki_young_ju) March 13, 2024

And many appear to be in two minds about whether to return to the markets. Certainly, many retail investors have indeed returned, as rising kimchi premium rates indicate.

The kimchi premium is a phenomenon whereby spiking retail investment in a shallow pool of domestic crypto exchanges drives demand higher than supply.

This results in South Koreans spending more per unit of crypto than their counterparts in other parts of the world.

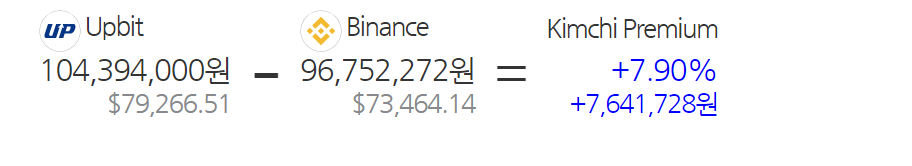

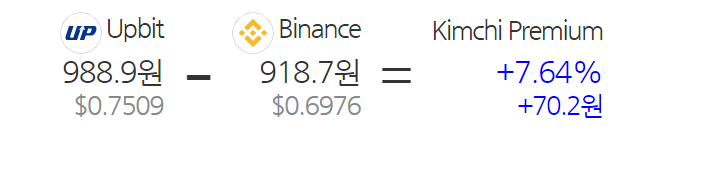

The Bitcoin kimchi premium dropped from a high of 10% earlier this month to just shy of the 8% mark on March 13, per Cryprice calculations.

That means that the price per BTC in South Korea is currently over $6,070 higher than on international crypto trading platforms such as Binance.

South Korean traders were paying a similar markup for altcoins like XRP, Cryprice’s data indicated.

Kimchi Premium: Still a Long Way to Go Before Fever Pitch?

However, kimchi premium rates of 7-10% are a far cry from the 20-30% markups seen in South Korea during previous bull runs.

And that would appear to indicate some people are still reluctant to return to a market that has burned them badly in the past. Ju explained:

“We are not in a situation where everyone is jumping into crypto investment.”

Ju conceded that it was “difficult to predict” an exact price ceiling for BTC. But he added that he expected Bitcoin price growth to test the $114,000 mark. He explained:

“We are in the middle of a bull market, and there is the potential for further rises in the future.”

Social Media Post Captures Mood in South Korea?

Meanwhile, a viral social media post from the South Korean comedian Kim Kyung-jin appears to have captured the mood of many retail investors.

On March 11, Kim posted a graph on his Instagram page showing the price of Bitcoin surpassing the 100 million won ($76,000) mark on a South Korean exchange price chart. He mused:

“Bitcoin is supposed to be a scam. So why are prices rising like this?”

Another comedian, Park Jun-hyung, jokingly asked Kim if he had any BTC holdings.

To this and other comments, Kim answered that he was “regretful” and “frustrated” – presumably by his failure to invest in the coin.