Bitcoin Price Currently at Pivotal Point, Research Suggests

The price of bitcoin (BTC) sits at a pivotal point where major support is found below it, and strong resistance above it, new research from blockchain analytics firm Into The Block suggests.

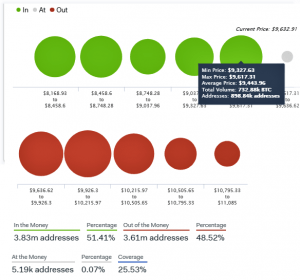

In a Twitter thread, the company, which uses machine learning and advanced statistics in analyzing the market, shared new findings from a model referred to as “In/Out of the Money Around Current Price” (IOMAP), which it says “identifies the ten most relevant clusters of investor positions at a range of +-15% of the current price.”

According to the model, 1 million bitcoin addresses holds a total of about BTC 830,000 (USD 8 billion) that have been purchased around the USD 9,800 level. According to the firm, this has the potential to act as a significant barrier of resistance to the upside, as many of these investors – who are currently at a loss – may be looking to sell their positions as soon as the price reaches their break-even level.

Similarly, almost 900,000 wallets hold a total of BTC 732,000 (USD 7 billion) that were purchased between USD 9,300 and USD 9,600. According to the theory, this creates strong support under the current price as many of these holders would be enticed to buy more should the price again dip down to reach their original buying price.

As a result, any price moves above the USD 9,800 level, or below the USD 9,300 – USD 9,600 level, could lead to a strong continuation in the same direction for the bitcoin market, making the current price level a key area to watch for traders.

“The analysis offers a very granular view of investor positions that are susceptible to near-term price movements,” Into The Block wrote while explaining that their model may also be used in combination with more traditional technical analysis, saying:

“Given that we are looking at individual investor positions, the IOMAP analysis can be used to complement traditional support/resistance models by quantifying the positions of individual investors.”

At pixel time (12:17 PM UTC), BTC trades at c. USD 9,741 and is up 1.4% in a day, trimming its weekly losses to 5%.

BTC price chart:

Learn more: Expect More Volatility in Bitcoin, Retail is Most Bullish – Analysts