Bitcoin Miner CleanSpark Shifts to Neutral in JPMorgan’s Ratings

The major Wall Street investment bank JPMorgan has adjusted its price targets and ratings for several Bitcoin mining stocks, including CleanSpark and Riot Platforms.

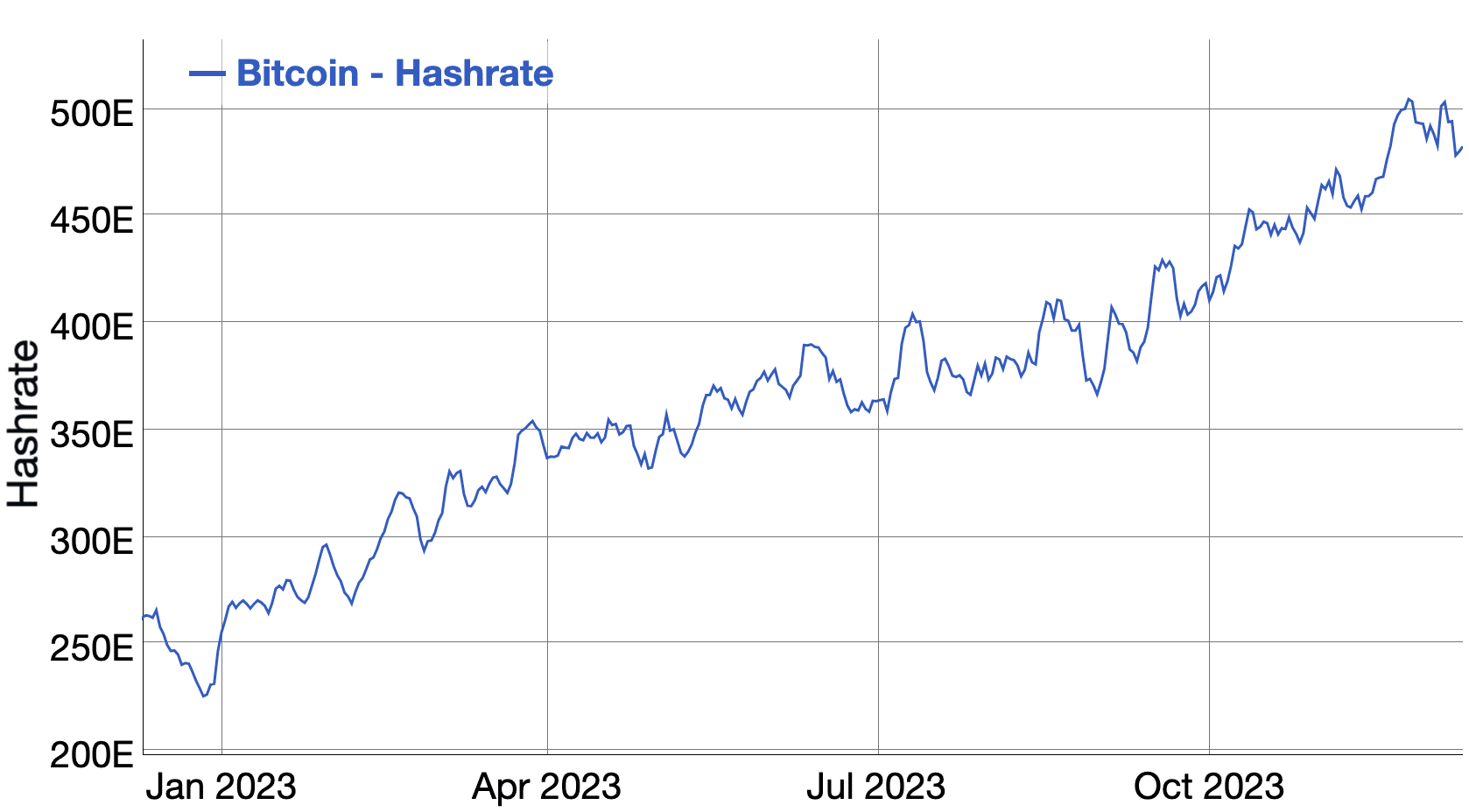

The adjustment in ratings came in response to the recent surge in Bitcoin’s price and the hashrate of the Bitcoin network, along with relevant news specific to each company, according to a research report released on Friday that was reported on by CoinDesk.

Given the 12% increase in Bitcoin prices and a 2% rise in the network hashrate since the bank’s last review, JPMorgan raised the spot BTC price used in its calculations to $44,000 from $38,000.

At the same time, the bank also increased its baseline network hashrate assumption to 485 EH/s, up from 475 EH/s during the last review.

The Bitcoin network’s hashrate has trended up throughout 2023, and stood at 470 EH/s at the time of publication on Monday.

In the updated assessments, JPMorgan downgraded CleanSpark, which is listed on Nasdaq with the ticker CLSK, to a “neutral” rating from “overweight,” lowering its price target on the stock to $8 from $9.

The bank justified this move by highlighting that CleanSpark shares had surged over 130% in the past month, reaching what the bank considers fair valuation.

Conversely, Riot Platforms (RIOT) saw an upgrade from “underweight” to “neutral,” accompanied by an increased price target of $12, up from $8.

Meanwhile, JPMorgan maintained its “overweight” rating on Iris Energy (IREN), emphasizing its status as the top pick in the sector.

The bank also raised its price target for Iris Energy to $9.50 from $9.

JPMorgan optimistic about Bitcoin ETF

Back in October this year, a JPMorgan report by analyst Nikolaos Panigirtzoglou reiterated that the SEC will likely approve multiple spot bitcoin ETFs within 2023, and warned that the SEC is likely to be challenged in court if it decides to reject the ETFs.

“We believe that a new legal battle on the issue of spot bitcoin ETF approval is not something that the SEC would be willing to face again,” Panigirtzoglou said at the time.

In the past, Bloomberg Intelligence analysts Eric Balchunas and James Seyffart have stated that they believe there is a 90% chance of an ETF approval by the SEC by January next year.