Bitcoin on Ethereum Coin BTC20 Price Pumps 600% 48 Hours After Launch, Heading for $100m Market Cap

Bitcoin on Ethereum Coin BTC20 has seen its price explode 600% 48 hours after launch, with 10x gains imminent. As crypto traders start to pile into the hot coin, it is on course to hit a market cap of $100 million.

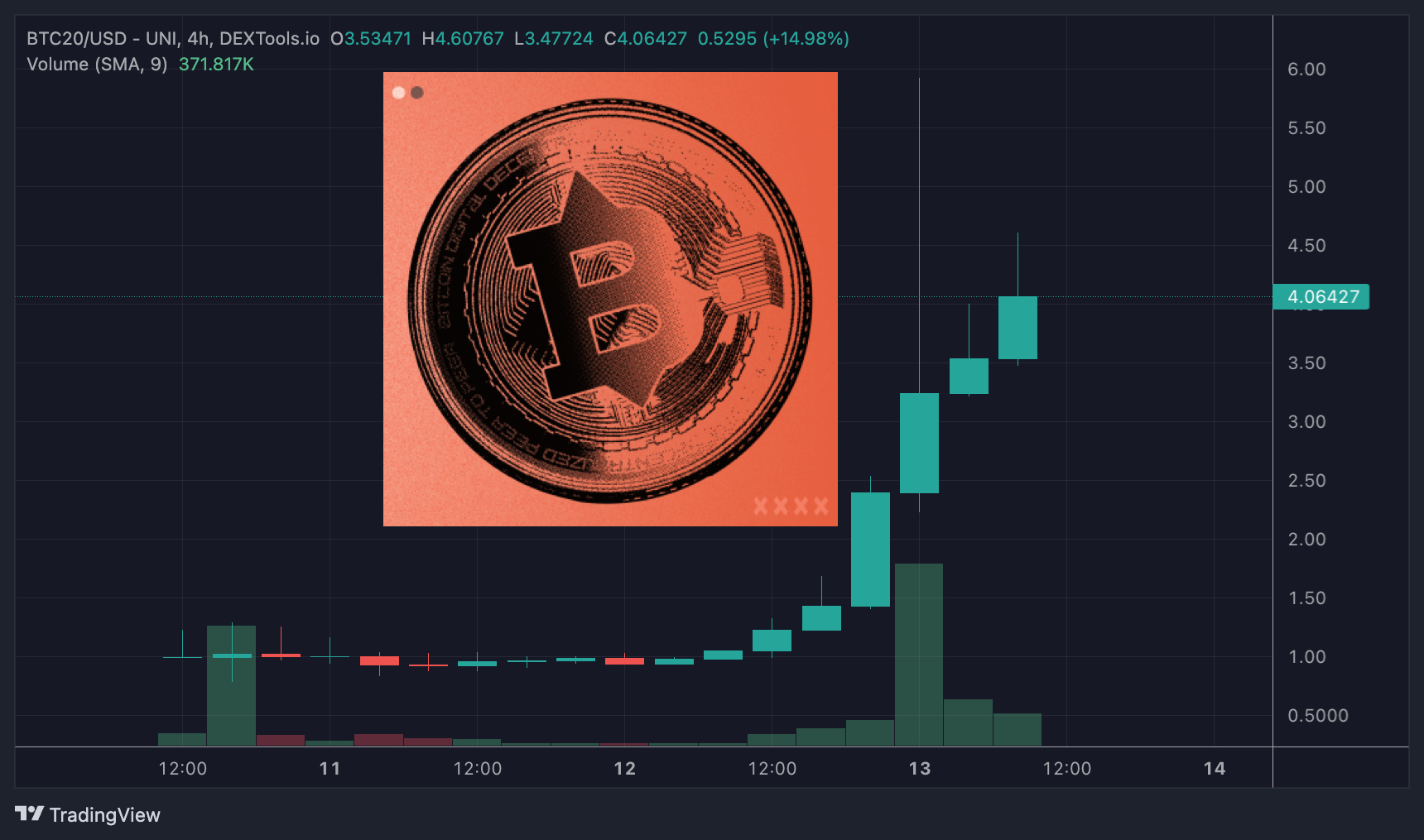

The BTC20 stake-to-earn coin mirrors the tokenomics of Bitcoin and is currently priced at $4.06, up more than 300% after listing for $1; the price has already briefly touched $6 for a 600% return, setting a marker for the near-term price target today.

Meanwhile, at the last count, 3,930,621 tokens of the 6,050,000 in circulation have been staked, amounting to 65% of the circulating supply, according to the latest BTC20 website real-time dashboard data.

The remaining tokens of the 21 million total supply are locked for paying out rewards – the annual percentage yield is currently 66.97%.

BTC20 simulates the block rewards on Bitcoin from 2011, which stood at 50 BTC per block produced. BTC20 rewards accrue every 10 minutes and can be claimed a minimum of seven days after first staking. Staking began operation last Wednesday at 3pm UTC.

After a lunch day that saw the BTC20 price establish a solid floor at $1, likely due to the stability that its yield-bearing tokenomics provide, it began to gird high yesterday and then exploded in parabolic fashion.

🔥 $BTC20 is Dominating the Charts! 🔥

— BTC20 (@BTC20Token) August 13, 2023

Exciting news, $BTC20 community! We're currently trending as the #1 #Token on @DEXToolsApp and have skyrocketed with a 400% increase since the #Presale!

This monumental achievement is all thanks to our dedicated community and believers… pic.twitter.com/2FtVze5XgS

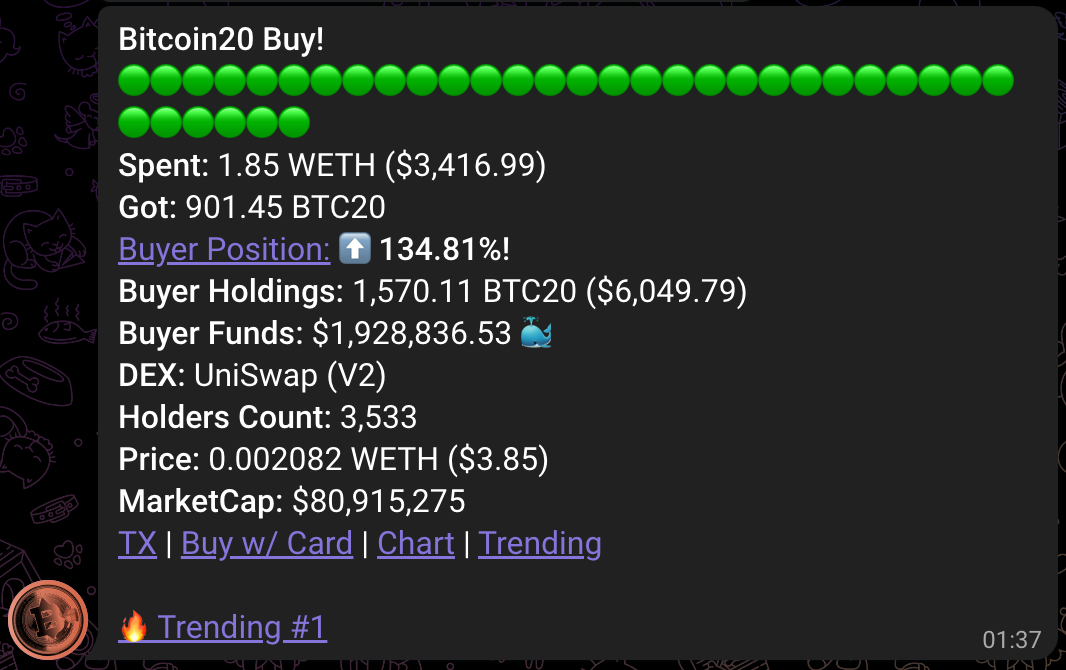

Whales buy BTC20 as they eye $1 billion market cap

Deep-pocketed whales are entering the market. One such buyer, with a wallet valued at nearly $2 million, has started building a position in BTC20, which is presently a modest sum of $6,049.

Such buyers will no doubt keep entering the market on near-term dips as they look to gains that could reach as high as 100x for a $1 billion market cap.

https://etherscan.io/tx/0xe62dc8d6299d3b41a77cd079c53c8ff99a20d3891af8b1a02ba8859d6e500ec3

BTC20 No.1 on DEXTools – the FOMO is just getting started

Since yesterday (Saturday) afternoon in the European session, BTC20 has been trending in the top 10 on top data and trading sites for decentralized exchanges, DEXTools. In the past hour, it has taken the No.1 spot as FOMO kicks in:

The token holder count has swelled to 3,922, 24-hour trading volume spiked over $3 million, and locked liquidity on Uniswap V2, registering $347k.

On the Uniswap V3 trading pair (BTC20/SDEX), where liquidity providers can command higher fees than the 0.3% on V2, the liquidity pool has reached $369k and 24-hour trading volume $661k.

Impressively 87.89% of the liquidity on Uniswap V2 has been locked, so there are no worries about the project being a rug pull.

On the contrary, BTC20 ($Bitcoin20) is gearing up to be the top Bitcoin derivative coin launch of the year, beating the likes of BTC 2.0 and HPOS10I (which has the ‘BITCOIN’ ticker on Uniswap).

BTC20 is on Track for 10x gains before first stakes unlock – more stakers to come on onboard

On the 4-hour price chart, the price trajectory points to a 10x gain by the seventh day of trading, on Wednesday, August 16, which is when the first stakers have the option of unlocking their coins.

Market participants will be watching that key milestone closely to see how token holders behave, given that the majority of the circulating supply is tied up in staking.

However, to realize the full APY return potential requires staking for 12 months. Bearing in mind that many probably opted for staking based on a long-term commitment to the project, it is a fair assessment that many will continue to lock up their coins to earn passive income.

Of course, others will be concerned with capital preservation and want to take some profits on their initial outlay, while leaving a portion of their tokens to continue to earn yield.

Token holders who want to continue staking simply leave their tokens in the staking smart contract, and the smart contract automatically accumulates the rewards until such time as the staking ends.

Here are more factors driving the BTC20 price higher – CMC and CEX listings

While some will come off stake entirely, that is likely to be more than balanced by buying demand underpinned by several factors.

Firstly, the attractive APY will bring more buyers to BTC20. If the overall number of stakers/amount staked falls, the APY will rise, enticing more passive income investors to buy and stake the token. Indeed, the team says they are introducing an easy-to-use ‘buy and stake’ button next week.

Secondly, the biggest advert for a coin is its price history and prospects. On that score, BTC20 will be pulling in more buyers as the coin continues to trend on popular crypto data sites.

Speaking of data sites, BTC20 will soon be listed on top crypto sites Coinmarketcap and CoinGecko. When that happens, hundreds of thousands more market participants will become aware of the coin and start buying and adding it to their watchlists.

Which CEX will be first off the mark to list BTC20? LBank, OKX, Binance?

A third factor is the prospect of a centralized exchange listing. Although the team says there are no listing plans in the works, at least according to the communications on the Telegram group, that does not stop CEXs from listing the coin off their own back.

Due to the keen competition among CEXs for business, their teams keep a close eye on market developments for hot trending coins pulling in significant trading volume – BTC20 is one such coin.

Trading volume on Uniswap is about $4 million in the past 24 hours. Now that the coin is trending as a hot pair on sites such as DEXTools, and will no doubt will soon be listed on CMC and CG, volumes will likely mushroom, and the price resume its parabolic assent as new money floods in.

The larger the trading volume and number of token holders, the more likely top CEXs such as OKX and Binance are to list the coin.

Marketing will now move into top gear to help the BTC20 price to pump to $10

Aside from its robust tokenomics, and the off-chain news flow identified above, there are also the marketing efforts of the BTC20 team to help to pump the price higher.

Crypto analyst Michael Wrubel with 310k YouTube subscribers, has already predicted BTC20 will start minting millionaires – it looks like he was on the mark. We should look forward to the folks at BTC20 to begin working with even more prominent influencers in the coming days.

So far, the marketing has been pitch-perfect. BTC20’s market positioning as ‘Bitcoin on Ethereum’ appeals to all those people who missed out on the various bull runs that Bitcoin has been on since its inception, and that’s a lot of people.

Token holders can expect a widening digital marketing push in the crypto industry, targeting popular sites such as CMC, DexTools, Dexscreener, and banner ads on popular news websites.

Telegram alpha groups are also beginning to stir, so expect the crypto Twittersphere to explode with mentions of BTC20, further building FOMO around the new coin.

Another coin getting in on the ‘version 2’ theme is the XRP20 coin, currently in presale. Although XRP20 is not affiliated with Ripple or XRP, its launch is inspired by those efforts.

Similarly to BTC20, it is also innovating with staking, allowing XRP20 token holders to earn rewards from staking the token. YouTube experts are forecasting 10x returns for early investors in the coin.