Binance and FTX Stormed Crypto Derivatives Market in November

Before major cryptocurrency exchange Binance announced its investment in cryptocurrency derivatives exchange FTX, both platforms registered the biggest gains in the crypto derivatives market in November.

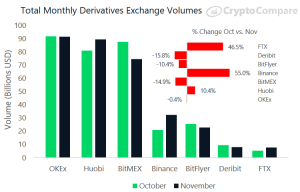

Last month, Binance saw a rise in total monthly derivatives exchange volumes (all volumes in USD, based on an aggregation of all products) of 55%, the most among the included exchanges, CryptoCompare, a provider of the crypto market data, said in the November 2019 exchange review . The second place is taken by FTX with a jump of 46.5%. Only one more of seven exchanges saw a rise, while others fell – Huobi with 10.4%.

Last week, Binance’s CEO, Changpeng Zhao, said that the exchange sees FTX’s “potential in becoming a major player in the crypto derivatives markets.”

That said, OKEx, almost unchanged since October, was the top derivatives exchange last month, trading a total of USD 91.5 billion USD. Huobi is right behind it, having traded USD 89.5 billion.

While Deribit and FTX represented 2% of the market each in November, OKEx represented the majority of daily derivatives volumes, or 28% of market share, with USD 3 billion a day in trading. Huobi is again right behind it with 27% of the market share or USD 2.98 billion, then BitMEX with 23% (USD 2.5 billion) and bitFlyer with 10% (USD 760 million).

The three products traded the most are Huobi’s Quarterly BTC Future (USD 46.1 billion), BitMEX’s BTC perpetual future (USD 37.9 billion), and Binance’s BTC perpetual future (USD 32.3 billion), trading last month USD 1.5 billion, USD 1.3 billion and USD 1.1 billion per day, respectively.

Looking at the most traded perpetual Bitcoin futures products by total monthly volume, the report finds BitMEX’s BTC perpetual futures at the top with USD 37.9 billion, followed by BTC perpetual futures products offered by Binance (USD 32.3 billion) and BitFlyer’s BTC (USD 22.8 billion). And while Binance’s BTC perpetual futures increased 54%, reaching USD 32.3 billion, BitMEX’s fell 23% to USD 37.9 billion.

Meanwhile, the three exchanges that generated most of the trading volume for ETH perpetual futures are: BitMEX which traded USD 147 million in daily volume and represents 48% of market share; OKEx which traded USD 84.6 million and represents 28% of market share; and Deribit with USD 25 million in daily volume, representing 8% of market share.