Best Crypto to Buy Now November 13 – Celestia, Klaytn, Filecoin

Major blue-chip crypto markets are mixed on Monday, with Bitcoin (BTC) dipping back into the mid-$36,000s and Ether (ETH) mounting a challenge of the $2,100 level once again, while most other major altcoins also pull back ahead of the release of key US inflation and retail sales figures later in the week.

The data will have a bearing on market expectations for how much more, if any more tightening the US Federal Reserve will embark upon in the months ahead.

Traditional markets have been increasingly betting in recent weeks that the Fed’s tightening cycle is over, with US stock and bond prices up significantly in November as a result.

But Fed officials have remained hawkish and keen to remind the market that more hikes remain on the table.

If this week’s US data supports the narrative being pushed by the Fed that risks remain tilted towards higher interest rates, this could send US stocks and bond prices lower, creating macro headwinds for crypto.

But investors are likely to continue to buy the dip, amid still growing optimism for near-term spot Bitcoin and Ethereum ETFs.

This optimism has driven huge institutional inflows into the crypto space over the last three weeks, with regulated crypto investment products attracting around $300 million in capital inflows per week over the past three week, according to the latest report from CoinShares.

The continued narrowing of the Grayscale Bitcoin Trust’s discount to the spot value of its Bitcoin holdings further demonstrates how palpable the optimism is.

As per YCharts, the discount just hit its lowest level in over two years at 10%, suggestive investors continue to bet that Grayscale will get its way and be able to convert its Bitcoin Trust to an ETF in the near future.

With markets mixed on Monday, here are some of the best cryptos to buy on November the 13th.

Celestia ($TIA)

New modular blockchain token Celestia has been pumping in the last four days, reaching a new all-time high near $6 per token on Monday, with a market cap of last around $700 million as per CoinMarketCap.

The token, only launched on the 31st of October, caught the attention of crypto speculators thanks to its exciting airdrop and bullish momentum remains strong.

Bitcoin ETF Token ($BTCETF)

Despite only launching its presale a few days ago, Bitcoin ETF Token has already been able to pull in over $500,000 from investors because of its audacious pitch into the lucrative Bitcoin ETF theme that underpins the current crypto rally.

$BTCETF is also garnering attention because of its DeFi attributes.

$BTCETF tokens can be bought in presale today and staked to earn an annual percentage yield currently sitting at 487%, as per the project’s official staking dashboard.

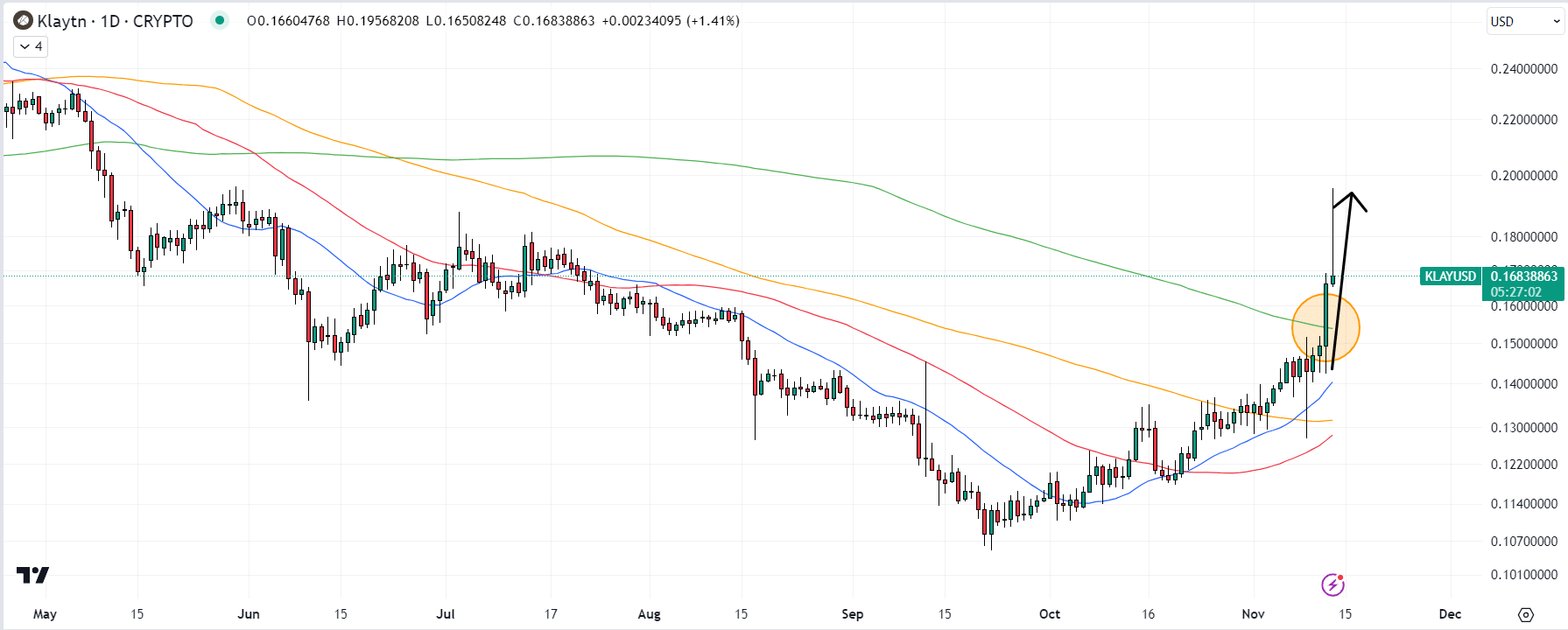

Klaytn ($KLAY)

$KLAY, the native token of the layer-1 proof-of-stake Klaytn blockchain, whose hybrid design is to act as a bridge between legacy institutions and their private blockchain networks and public crypto networks, has been pumping in the last two days.

The cryptocurrency was up as much as 17.5% earlier in the day on Monday, with the bulls in control after $KLAY pumped above its 200DMA on Sunday.

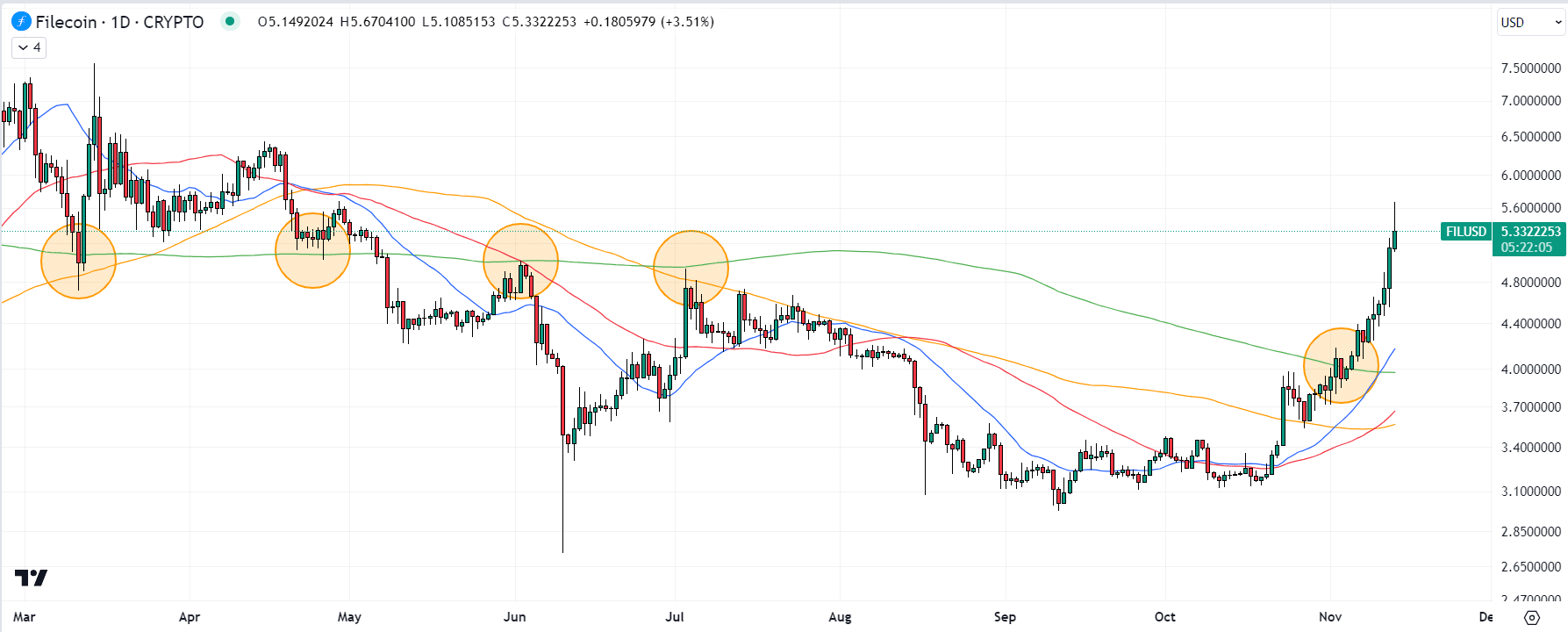

Filecoin ($FIL)

Filecoin ($FIL), the cryptocurrency that powers Filecoin’s decentralized storage network which is “designed to store humanity’s most important information”, continues to melt higher on Monday.

The cryptocurrency, last trading around $5.30s, is up a staggering 70% since October’s lows in the $3.13 area following another 3.5% gain on Monday.

The bulls remain firmly in control following Filecoin’s convincing break to the north of its 200DMA earlier this month.