Best Crypto to Buy Now January 2 – Mina Protocol, Sei, Sui

With the SEI price climbing to around $0.76, reflecting a robust market performance, SEI has positioned itself as one of the best cryptos to buy now alongside Mina Protocol’s MINA, despite its recent trading activity showing potential near-term pullback risks following an overextended rally. Sui’s SUI also seems primed for further gains based on major upgrades ahead.

The crypto presales Sponge V2 and Launchpad XYZ are similarly gaining recognition for their untapped potential in the cryptocurrency market.

Best Crypto to Buy Now in the News

Mina Protocol’s MINA price has turned bearish so far today, falling over 4% to around $1.49 as of writing.

Despite MINA trending higher over the past week, its trading volume has been diminishing in recent sessions.

This divergence between the rising price and decreasing volume signals that upside momentum may be fading for MINA.

The overbought RSI for MINA also suggests the recent rally may have been overextended, indicating the potential for further near-term pullbacks.

Meanwhile, Sei Network’s SEI token has surged to around $0.72, supported by strong technical indicators.

SEI’s RSI shows it is not overbought, while the MACD illustrates building bullish momentum.

With a market capitalization now standing at around $1.7 billion, reflecting a near 90% weekly increase, SEI’s rapid growth signals traders are increasingly bullish.

Over $5.79 million is locked in key Sei Network dApps, highlighting strong ecosystem adoption.

With 120 projects now building on Sei, utilization of the network continues to rise.

Sei v2 is functionally code complete and has begun audits with both @osec_io and @zellic_io

Get ready Seiyans

— Jay (@jayendra_jog) January 2, 2024

The audited Sei V2 code, set to bridge Ethereum and Cosmos, has stoked excitement surrounding the upcoming mainnet launch and airdrop specifics.

Sui’s native SUI has also attracted increasing interest lately. Its price has climbed to $0.8683, marking a 5.20% rise.

SUI maintains an active presence, with its market cap nearing $989 million and trading volume hitting $288 million.

Technicals are signaling growing upside momentum for SUI, with the RSI indicating it still has room to run before being overbought and the MACD highlighting building bullish strength.

Notable crypto trader Bluntz Capital on X expects Sui prices to surge over 35% from current levels, potentially reaching $1 and beyond.

With its unique architecture and focus on scalability, SUI has positioned itself as a smart contract platform to watch.

Amidst the advancements of established tokens, early-stage projects like Sponge V2 and Launchpad XYZ are attracting attention as new Bitcoin alternatives worth checking.

These crypto presales are currently under the spotlight, offering new opportunities that investors and enthusiasts are taking note of as they look for the best crypto to buy now.

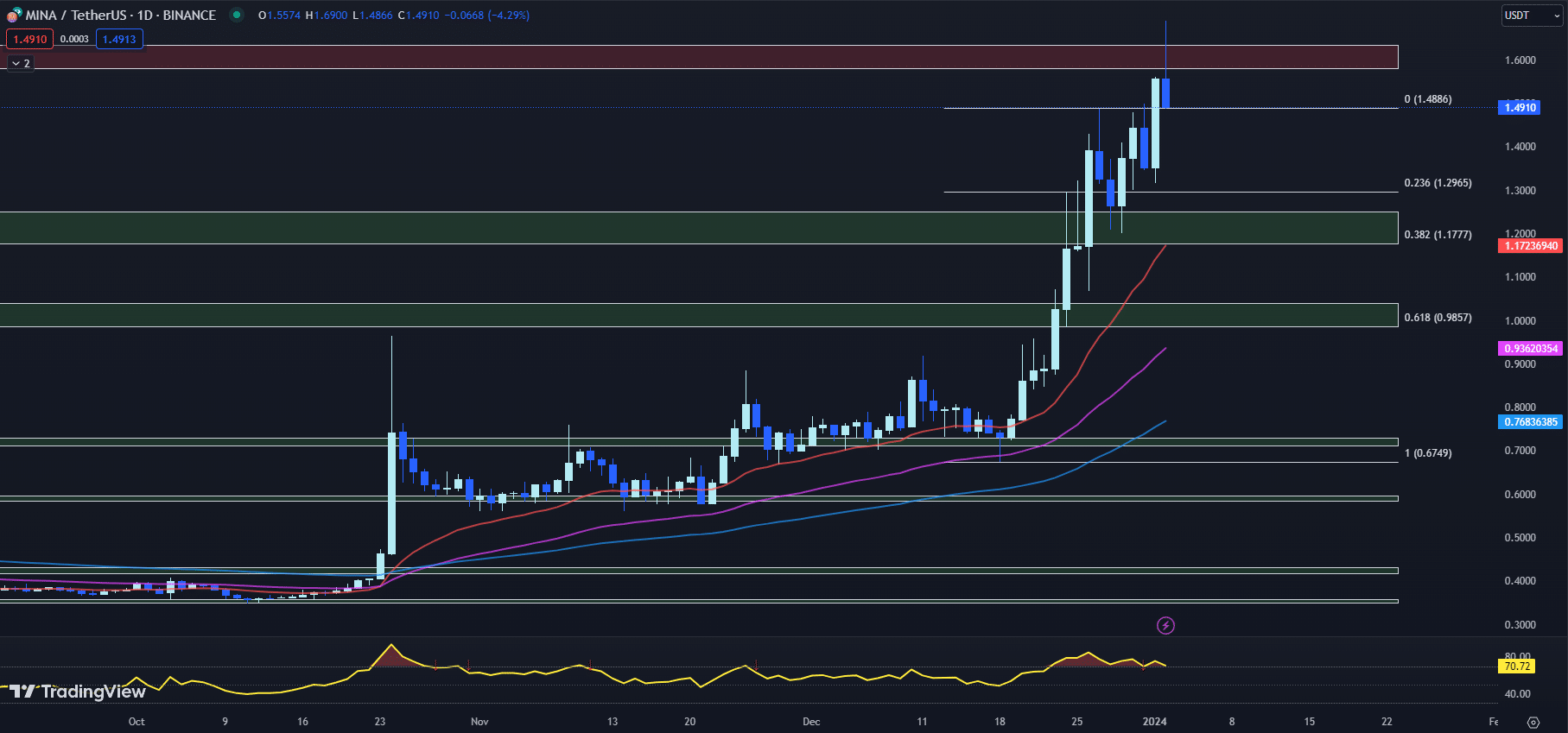

MINA Price Hits $1.69 for the First Time Since May 2022

The MINA price has seen a significant run-up over the past few weeks, gaining over 15% yesterday to reach a multi-year high of $1.69 earlier today.

However, this move may have been overextended, as MINA has pulled back 4.29% so far today to $1.4910 amidst profit-taking.

With the MINA price retreating from overbought territory, technical indicators suggest a consolidation or continued retracement may occur before MINA can stage its next advance.

Examining the key moving averages, the MINA price remains comfortably above its 20-day EMA of $1.1724 and its 50-day EMA of $0.9362. The strengthening of these short and mid-term moving averages over the past month reflects building upside momentum.

However, the 100-day EMA resides at $0.7684, well below current levels. This indicates the MINA price may still be overextended relative to its long-term trend.

The RSI for MINA has pulled back from yesterday’s peak of 75.64 down to 70.72. While still in overbought territory, this comedown from extreme overbought levels shows waning upside strength.

The MACD histogram has also retreated from 0.0457 to 0.0401, reflecting slowing bullish momentum.

With the MINA price hitting resistance between $1.5817 and $1.6337, which aligns with psychological resistance at $1.60, the path of least resistance appears to be to the downside in the near term.

Initial support rests at the Fib 0.236 level of $1.2965, followed by the horizontal support zone spanning $1.1773 to $1.2513. This aligns closely with the Fib 0.382 level of $1.1777.

While MINA staged an impressive short-term breakout, overbought readings on key indicators suggest further consolidation is likely needed before MINA can renew its uptrend.

The MINA price may drift back towards the $1.17 to $1.25 support zone as bulls take a breather. However, the bullish 20 and 50-day EMAs indicate the medium-term uptrend remains intact.

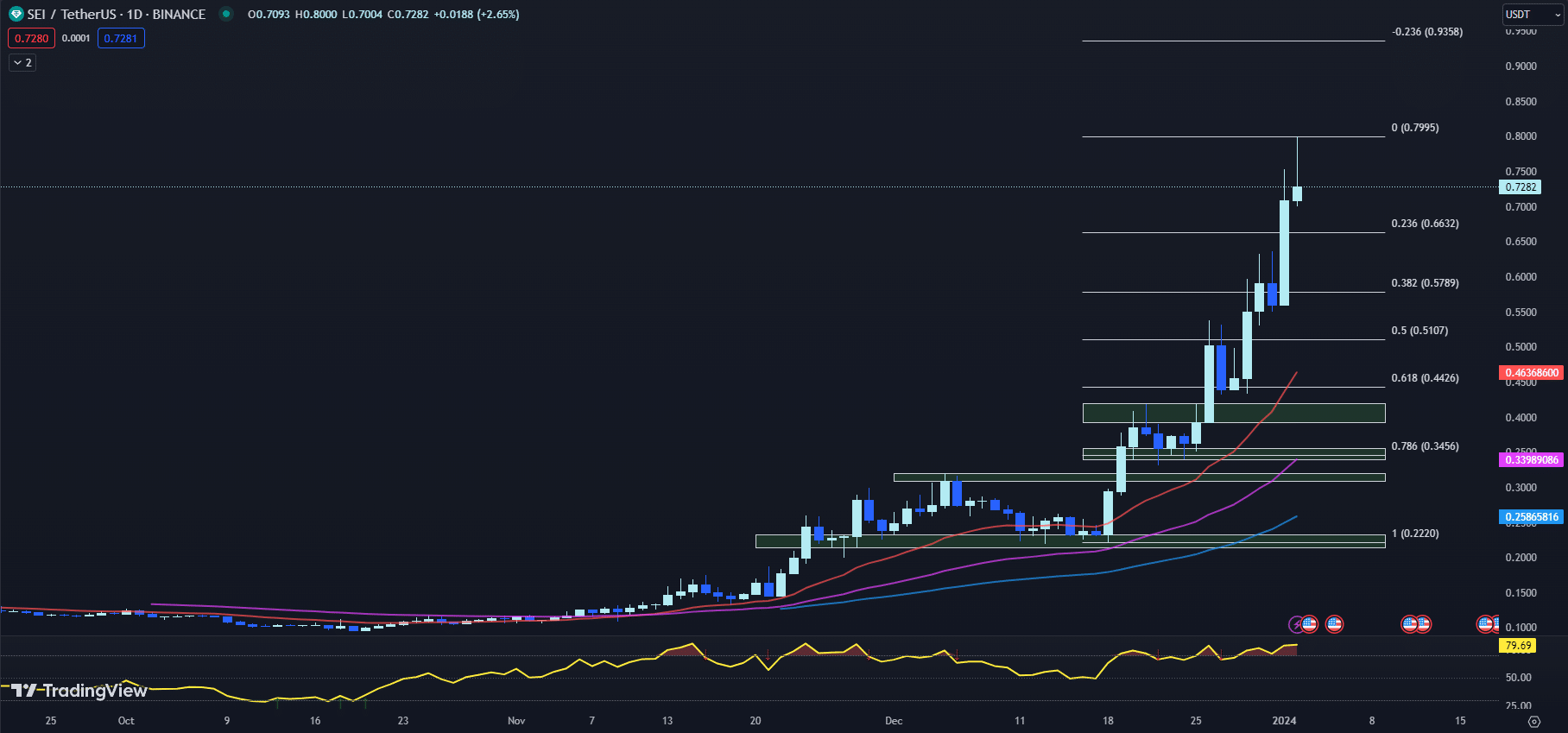

SEI Price Hits New All-Time High, Showing Strong Uptrend

The SEI price has continued its strong uptrend by setting a new all-time high of $0.80 earlier today.

After reaching this peak, the SEI price has slightly pulled back to the current level of $0.7282 but remains up 2.65% so far on the day.

The 20-day EMA for the SEI price currently stands at $0.4637, remaining in bullish alignment above the 50-day EMA at $0.3399.

With the faster 20-day EMA trending well above the slower 50-day EMA, this shows the uptrend remains strong and intact.

The widening gap between the two EMAs points to accelerating momentum to the upside for the SEI price.

The RSI currently reads 79.69, up from yesterday’s 75.64 level. With the RSI now moving into overbought territory above 70, this signals that the SEI price may be overextending in the short term.

While overbought readings can persist for some time in strong uptrends, traders should watch for the RSI to peak and start turning lower from these elevated levels.

A pullback in the RSI back below 70 would suggest upside momentum is waning for the SEI price.

The MACD histogram sits at 0.0398, down slightly from 0.0457 yesterday. Nonetheless, the positive histogram value reinforces the bullish view.

Traders will want to see the MACD continue making higher highs alongside the SEI price.

With the SEI price achieving a record high today on expanding volume, investor enthusiasm appears strong.

The current resistance level sits at the new all-time high of $0.80. If SEI can break above this psychologically important round number, it could quickly run up to test the Fib -0.236 extension level around $0.9358.

On pullbacks, the SEI price has initial support at the Fib 0.236 level of $0.6632.

As long as dips hold above this level, the uptrend should remain intact. Sustained trade below $0.6632 would signal a trend change to the downside.

In summary, the SEI price remains in a strong uptrend according to technical indicators. Investors should look to buy on dips above key support levels.

Upside appears open-ended at this time, with $0.80 and $0.9358 as the next target areas.

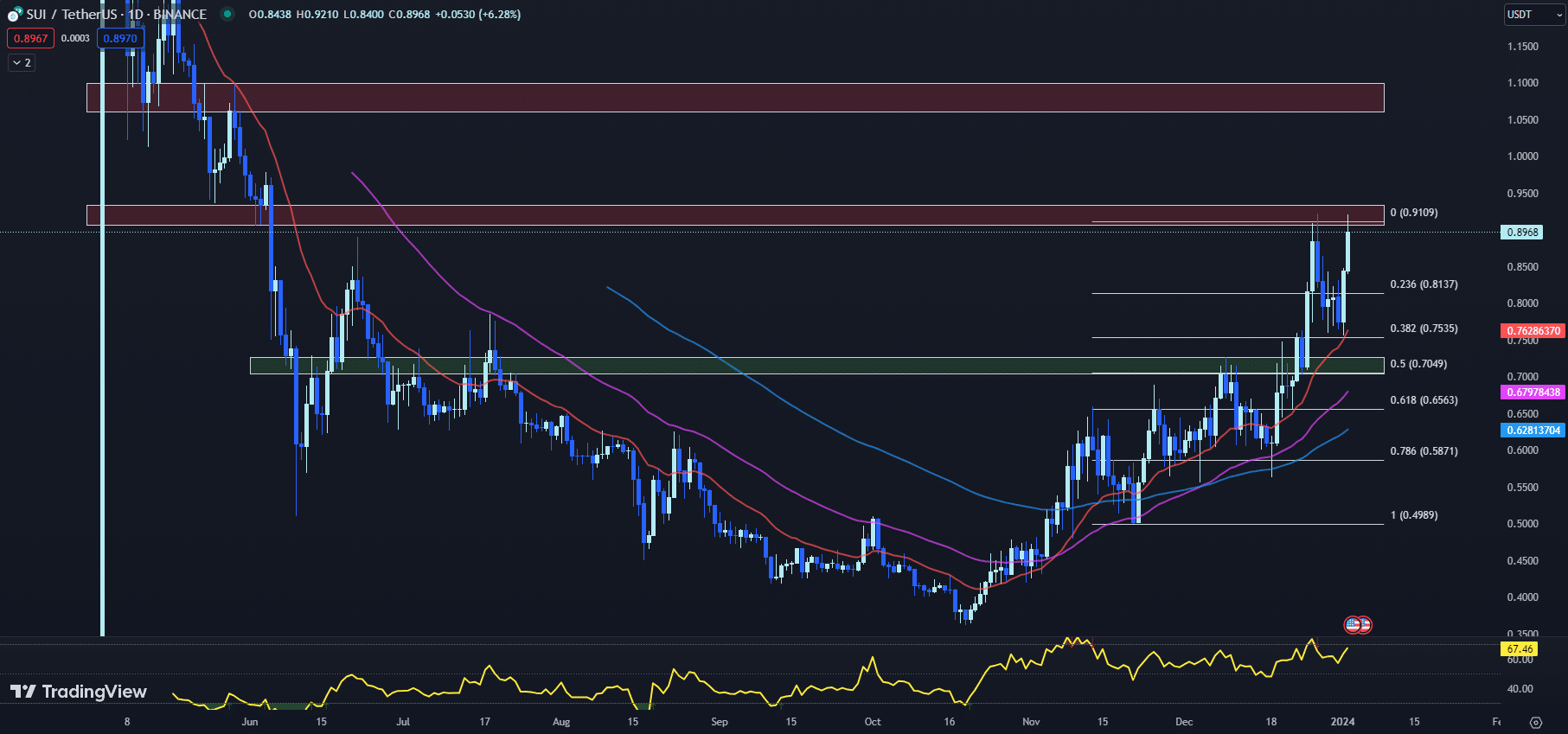

SUI Price Shows Strength but Faces Potential Pitfalls Ahead

The SUI price has shown continued strength in recent days, with the token up over 6% so far today to $0.8968.

This latest move to the upside comes after SUI picked up nearly 9% yesterday, as bullish momentum appears to be accelerating.

However, some warning signs are rising that point to potential pitfalls ahead for the SUI price.

With the SUI price retesting the same resistance levels it faced last week, but the RSI trending lower, a bearish RSI divergence could be materializing.

The RSI currently stands at 67.46, down from last week’s peak of 73.64 when SUI hit resistance around $0.90.

This divergence between price and momentum indicates a waning upside strength that could foreshadow a selloff.

The 20-day EMA for the SUI price sits at $0.7627, with the 50-day EMA at $0.6798.

With SUI trading well above these short and mid-term moving averages, the path of least resistance appears to remain to the upside for now.

However, the 100-day EMA lingers down at $0.6281, underscoring the potential downside risk if bullish momentum stalls.

The MACD histogram has ticked up to 0.0090, an increase from yesterday’s reading of 0.0068.

But this remains relatively flat, indicating consolidation and caution at these elevated levels after the recent run higher.

With the SUI price currently testing horizontal resistance between $0.9071 and $0.9333, bulls must decisively push through this area for the uptrend to continue.

Failing to close above resistance could attract selling pressure and lead to a pullback.

On the downside, initial support comes in at the Fib 0.236 level of $0.8137.

Below that, the 20-day EMA of $0.7627 looks to offer a critical test of buyer interest on any meaningful dip.

In assessing the price action and indicators, the SUI price appears to be at an inflection point.

While the recent surge is enticing, bearish RSI divergence casts doubt over upside follow-through.

And with overbought technicals, the path of least resistance may be to the downside in the near term.

Prudent SUI investors may look to tighten stop losses on long positions around the $0.90 resistance.

If the SUI price breaks down through the $0.81 support, momentum signals could quickly deteriorate.

In that scenario, a retest of the $0.68 50-day EMA would become increasingly likely.

Upside conviction will grow if the SUI price can close decisively above the $0.93 resistance.

That could open the door to a run toward psychological resistance at the $1.00 level.

But failure around current highs could lead to a sharp pullback as the rally stalls out.

With conflicting signals, trading within defined risk limits appears prudent.

The SUI price is at an important technical juncture, and the next directional move could set the trend in the weeks ahead.

Monitoring price action around key support and resistance, along with momentum indicators, will be crucial in gauging whether the SUI uptrend has room to run or if a reversal is imminent.

While short-term traders try to time market cycles of top coins, long-term investors seek to identify the next big disrupters early on. Sponge V2 and Launchpad XYZ hope to capture this interest through their crypto presales.

Exploring New Horizons: The Search for Top Bitcoin Alternatives in 2024

The year 2024 marks an era of expanding horizons in the crypto space, as attention shifts from Bitcoin to a diverse array of cryptocurrencies.

Investors are increasingly turning their focus to various alternative cryptocurrencies, which offer unique investment prospects.

This shift is largely motivated by the opportunity to invest in up-and-coming cryptocurrency projects at a stage where their price has room for growth.

Sponge V2, the enhanced version of the original Sponge meme coin, is quickly becoming a popular Bitcoin alternative, attracting investors who are keen on the vibrant meme coin market.

Meanwhile, Launchpad XYZ is advancing rapidly with its AI-based cryptocurrency analysis tools, potentially bringing new insights to the industry.

As 2024 progresses, savvy investors are keeping a close watch on these Bitcoin alternatives.

This vigilant approach is key to identifying the best crypto to buy now, considering their potential for future appreciation and the prospects for returns on investment.

With Bitcoin alternatives like Sponge V2 and Launchpad XYZ, the market is ripe with options that could be beneficial for those looking to diversify their cryptocurrency portfolios.

Traders Rotate Into Altcoins Like Sponge V2 – Could it Be the Best Crypto to Buy Now?

Meme coins show no signs of losing steam, as seen with the upcoming presale for Sponge V2, a token upgrade to the popular Sponge meme coin.

Sponge is modeled after the beloved meme character SpongeBob SquarePants but is not affiliated with Nickelodeon.

Time to get to work #SPONGERS! 🧽#SpongeV2 $SPONGE #Presale pic.twitter.com/pObUJEsJiR

— $SPONGE (@spongeoneth) January 2, 2024

The original Sponge token quickly gained a footing when it launched in May 2023 amidst the speculative meme coin craze.

Capitalizing on this momentum, developers are now releasing an upgraded Sponge V2 token through a presale event.

The improvements seek to transform Sponge into a gaming platform, tapping into the explosive expansion of Web3 gaming.

Meme coins have the potential to provide returns fuelled by hype, an aspect seen in the notable upticks of Dogecoin and Shiba Inu in 2021.

With the presale coinciding with renewed hype, Sponge V2 may be one of the best crypto to buy now for speculative investors.

Sponge already exhibited this pattern last spring, with prices rising nearly 100x shortly after launch.

Investors like Justin Sun, founder of TRON, appear eager to pursue these speculative gains again, rotating into altcoins like Sponge.

Existing Sponge holders can swap to V2 now through a staking program on the V2 dashboard.

New buyers can simply purchase Sponge V1 directly and stake to earn V2 tokens.

With a peak of $2.3 billion in meme coin volume last week, the stage is set for Sponge V2 to ride the mounting surge of hype and deliver potential returns.

As meme coin mania kicks into overdrive, Sponge V2 offers risk-hungry investors a promising way to capitalize on the resurgence.

And for Sponge’s vibrant community, it marks a new chapter brimming with possibilities if the prevailing winds of hype keep filling its sails.

Launchpad XYZ Presale Shows Strong Demand for What Could Be the Best Crypto to Buy Now

A new crypto platform called Launchpad XYZ seeks to bring institutional-grade analytics and AI-powered trading tools to mainstream investors.

The project is currently running a presale of its native token, LPX, which has attracted over $2.38 million from crypto investors as of writing.

The presale offers tiered NFT passes starting at $50, with higher tiers providing additional benefits.

With the presale ending soon, crypto analysts are rushing to obtain LPX tokens and maximize presale bonuses before the public listing.

📉 Take your analysis to the next level with advanced charting tools from #LaunchpadXYZ.

Chart your path to success. ⚡️#Crypto #Web3 #Blockchain pic.twitter.com/1dZ02jVmNg

— Launchpad.xyz (@launchpadlpx) December 29, 2023

Launchpad XYZ seeks to be an all-in-one platform for crypto trading and investing.

The core of their offering is a proprietary AI engine called the Launchpad Quotient (LPQ) that will generate data-driven crypto trading strategies for each user.

The platform will analyze over 400 data sources using machine learning algorithms. This includes on-chain metrics, social media sentiment, and other factors.

According to the whitepaper, the goal is to make institutional-grade analytics available to any crypto investor looking to determine the best crypto to buy now.

The platform will also feature an AI-powered crypto-matching tool to align coins with individual risk profiles and goals.

Launchpad XYZ intends to simplify crypto investing for newcomers through this intuitive interface.

Beyond its AI focus, Launchpad XYZ will offer fractional real estate investing and has plans for an NFT marketplace and a decentralized exchange in 2024.

With this diverse feature set, the project is set to be a versatile platform for Web3 users.

The project’s momentum has fuelled predictions that its LPQ technology could disrupt crypto trading and investing when the platform goes live later this year.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.