Bakkt Delay Sends Bitcoin Lower, Community Disappointed

Members of the crypto community are obviously not pleased with the news that the much-anticipated Bakkt futures trading platform may not come as soon as the market has been hoping for. Despite the importance of the Bakkt futures launch might be overestimated, the news trimmed Bitcoin’s gains yesterday.

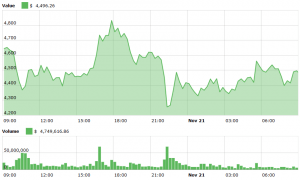

Bitcoin price chart:

___

The community reacted:

____

Others blamed the news for the heavy sell-off in the crypto market over the past few days:

____

____

Whatever the reason for the delay may be, some speculate that it has more to do with low liquidity and little trading interest in the futures market, rather than “the volume of interest in Bakkt.”

Speaking about the size of the bitcoin futures market back in August, Chris Concannon, president and chief operating officer of the Chicago Board Options Exchange (CBOE) told Bloomberg: “I’ve learned that there’s been more articles than volume. It’s a little bit shocking to me the attention this market gets versus its size. The entire crypto market is a fifth of Apple.”

CBOE and CME, an American financial market company operating an options and futures exchange, combined traded about 9,000 contracts a day in the third quarter, according to Bloomberg data. Craig Pirrong, a finance professor at the University of Houston and an expert on futures trading, stressed in October that “Institutional players have stayed on the Bitcoin sidelines, and as long as they are, the futures contracts are likely not to generate substantial amounts of volume.”

New date – January 24

Bakkt made a splash in the crypto world when it was first announced back in August, with the support of well-known brand names like Microsoft, BCG, and Starbucks. It was set up by the New York-based Intercontinental Exchange (ICE), and aims to offer 1-day physically settled bitcoin futures for institutional clients from its base in the US.

Many in the crypto community have expressed great hopes that the company can help boost institutional interest in cryptocurrency, and possibly be a catalyst for the next wave of buying in the market.

Now, according to the new update from Bakkt’s CEO Kelly Loeffler, the launch date of the institutional-grade trading and “warehousing” platform will be pushed back to January 24, 2019, from an originally scheduled release in December of this year. The new release date is still subject to regulatory approvals, and the company promises to keep the community updated on progress and relevant milestones as the launch approaches.

“Given the volume of interest in Bakkt and work required to get all of the pieces in place, we will now be targeting January 24, 2019 for our launch to ensure that our participants are ready to trade on Day 1,” Loeffler wrote in the statement.

A hot topic

Whether the recent market crash has something to do with Bakkt is currently one of the popular topics in the community, and many are joking that traditional investors want to “buy the dip.”

“When retail investors miss the train, they miss the train. When institutions miss the train, they bring the train back,” Reddit user u/Subfolded quoted a Wall Street saying. This seems to be the general consensus: that the prices are being manipulated by whales that want institutional investors to enter the market below its real value. However, there is also a smaller group of people that just don’t see it: u/McDonald5 sarcastically writes, “Get your tin foil hat ready, it’s a CONSPIRACY!”

The first group, meanwhile, is the significantly louder one. “Bitcoin was very stable over the last few month but suddenly right before ETFs and BAKKT, everything drops. It’s only my opinion but a lot of money can enter with ETFs and a drop just doesn’t make sense. Normally we get pumps from news like this and dumps when it’s released. This time I feel like somebody is making sure opposite happens,” writes u/toohottoospicy.

u/Raymikqwer replies, “I feel like the majority of Reddit seems to think everything is conspiracy involving whales or some other nonsense. There’s always the possibility that everything was just MASSIVELY overbought in December/January and it’s still correcting to a price the market deems as fair.”