Another Overseas Crypto Exchange Wants to Break into South Korean Market

Another international crypto exchange wants to gain a foothold in the elusive South Korean market, with a platform named Bitbest planning to launch in 2024.

Per the South Korean media outlet Fn Today, the firm said it had launched a “global site” ahead of the “official launch” of “Bitbest Korea” in South Korea next year.

The company is headquartered in the South Pacific nation of Vanuatu, per its official website.

Crypto firms of all sizes have been trying to force their way into the lucrative East Asian market for years.

But since Japan and South Korea started to regulate crypto in the late 2010s, large international players have struggled to keep up.

The global market leader Binance has been trying to force its way into both Japan and South Korea since it was forced to exit the former in 2018.

The firm has since turned to the mergers and acquisitions market for answers in both countries.

Binance Japan launched in Japan in August this year, following the crypto giant’s acquisition of Sakura Exchange BitCoin in November 2022.

The platform has recently added 13 new trading pairs in a bid to woo domestic customers and boost its offering to 100 coins.

🇯🇵 Binance Japan Adds 13 New Crypto Pairs

The crypto exchange giant @binance is hoping to corner the Japanese market by expanding its crypto pairing offerings by 13.#CryptoNews #newshttps://t.co/YYr7AXHFnH

— Cryptonews.com (@cryptonews) November 17, 2023

Binance has also allegedly attempted to repeat this tactic in South Korea, reportedly pursuing a deal to buy the Gopax exchange.

But the firm is yet to complete a full takeover, and has faced pushback from politicians fighting crypto-related scandals.

Until earlier this year, Huobi Korea was the only outlier – but even this company failed to build on its parent company’s name.

In January, Huobi Korea announced plans to cut its ties with Huobi Global, and stated that it wanted to trade under a different name.

The news broke at around the same time the crypto exchange giant Coinbase decided to shutter its Japanese operations.

🇰🇷 South Korean Traders Drive Recent Crypto Surge as Exchanges’ Market Share Jumps to 13%

Traders in Asia, especially in South Korea, have emerged as key drivers behind the recent rally in the crypto market over the past two months.#CryptoNews #Koreahttps://t.co/4LTjDCiruy

— Cryptonews.com (@cryptonews) November 16, 2023

Why Is it So Hard for Crypto Exchanges to Trade in South Korea?

Breaking into the domestic crypto market has proven exceptionally difficult in South Korea, home of some of the strictest crypto regulations in the world.

Crypto exchanges are subject to regular audits and spot checks from regulators.

They are also required to submit documentation that proves they meet certain technical and security-related standards.

Exchanges must also submit details about their management structure and prove that they have enough assets to pay their customers in the event of a hack.

Furthermore, they must also convince a domestic bank to partner with them if they want to offer crypto-to-fiat trading.

This has proven very difficult for all but the biggest domestic exchanges.

To compound matters, the government has also told banks that if they team up with an exchange, the bank must absorb any associated risks.

As such, no international exchange has yet gained access to the crypto-to-won markets.

Upbit: An Obstacle for Would-be Crypto Newcomers to South Korea?

A final hurdle in the way of any crypto exchange hoping to trade in South Korea is the Upbit exchange.

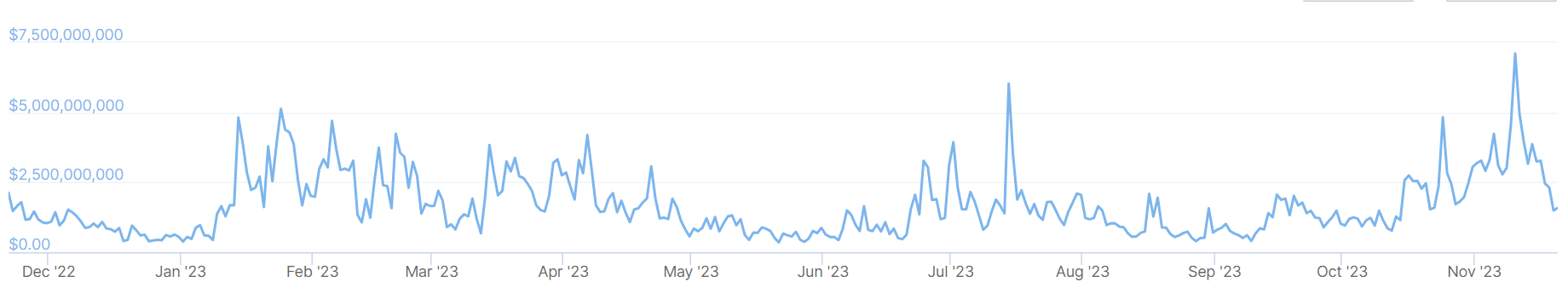

A graph showing trading volumes on the Upbit crypto exchange over the past 12 months.

This trading platform has grown to become the nation’s largest by far, cornering some 80% of the market – and leading rivals to adopt increasingly bold tactics as they try to close the gap.