A New Adoption Case: Paying Bills With Crypto in Australia

Although accepting cryptocurrency may be the furthest thing from various service providers’ minds, two fintech startups in Australia have decided to let crypto holders pay their bills with cryptocurrency. Regardless of whether the business accepts crypto or not, Cointree and Gobbill are there to act as intermediaries and give adoption a much-needed boost.

Cointree is a cryptocurrency exchange founded in 2013 in Melbourne that now has 56,000+ members and over AUD 100 million worth of lifelong successful transactions, according to their website. Gobbill, founded in 2015 and launched last year, is a digital finance assistant that automates bill payments using artificial intelligence for small businesses and households.

The partnership of the two businesses means that Gobbill acts as a go-between, taking the funds from its users and paying the bills on their behalf. Cointree also had its own service that lets users pay bills. However, Cointree operations manager Jessica Rendon told the Australian Financial Review (AFR) that she hoped this partnership would make it an easier process and open it up to more people who had not dealt with cryptocurrencies before.

Both of the startups are licensed: Gobbill has an Australian financial services licence under ASIC, while Cointree is licensed under AUSTRAC to meet anti-money laundering and counter terrorist financing obligations.

Gobbill co-founder Shendon Ewans thinks crypto is here to stay. “Fast forward into the future and what we’re seeing is, like it or not, this will be part of our daily lives,” he was quoted as saying by the AFR.

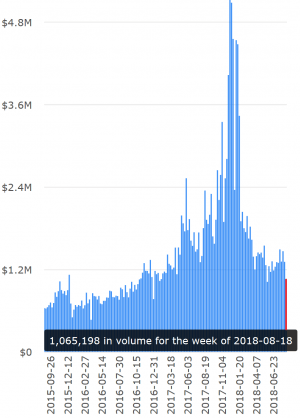

Weekly LocalBitcoins, a peer-to-peer bitcoin marketplace, volume (Australian Dollar – 1 AUD = 0.73 USD):

Crypto adoption in Australia is already well on its way. Since March 1st this year, Aussies are able to buy their bitcoin and ethereum for fiat in more than 1,200 newsstands all across the country. The state of Queensland is also investing in TravelbyBit, a business that sells travel experiences for cryptocurrency.