10 Best Crypto Lending Platforms in 2024

The best crypto lending platforms make it easy to access the value of your crypto assets without selling. In this guide, we’ll review the best crypto loans currently available and detail the pros and cons of each.

Our top picks for crypto lending platforms include both centralized platforms and decentralized platforms. Centralized crypto lenders can be easier to use, whereas decentralized platforms run entirely on smart contracts. The latter may be better suited to more experienced users. We’ll also explore the differences between centralized finance (CeFi) platforms and decentralized finance (DeFi) crypto lending platforms.

Top List of the Best Crypto Lending Platforms

Here are our top 10 choices for the best crypto lending platform in 2024:

- Nexo – Best crypto lending platform with a built-in exchange and crypto credit card

- YouHodler – Crypto loans backed by 50 top assets with up to 97% LTV

- Binance – Centralized lending for a wide range of crypto assets

- Aave – Trusted DeFi lending platform available on 12 blockchains

- CoinRabbit – Reduce liquidation risks with LTV alerts

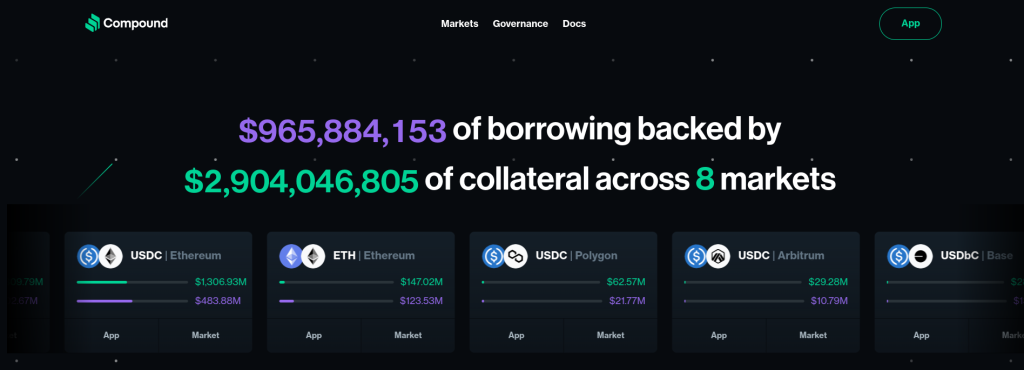

- Compound Finance – Safety-first collateral structure with the freedom of DeFi lending

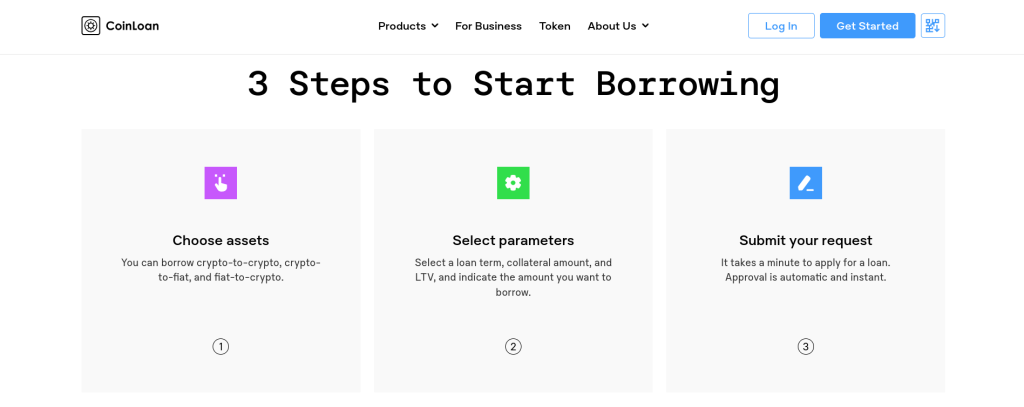

- CoinLoan – Optimize your interest by paying with CLT tokens

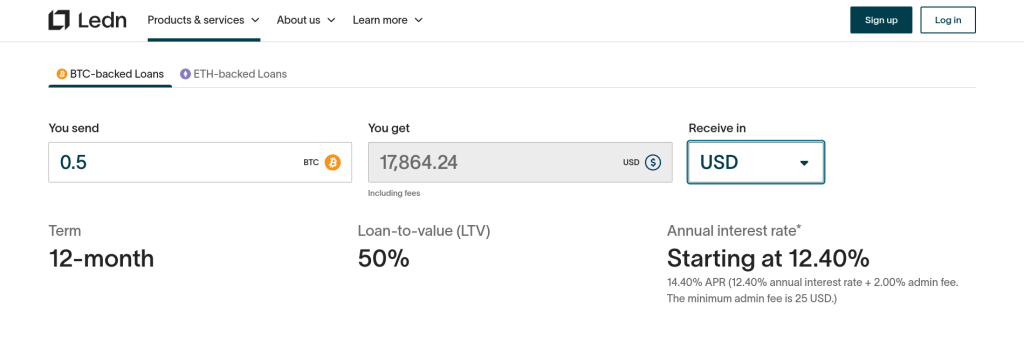

- Ledn – Take your loan disbursement in USDC or USD

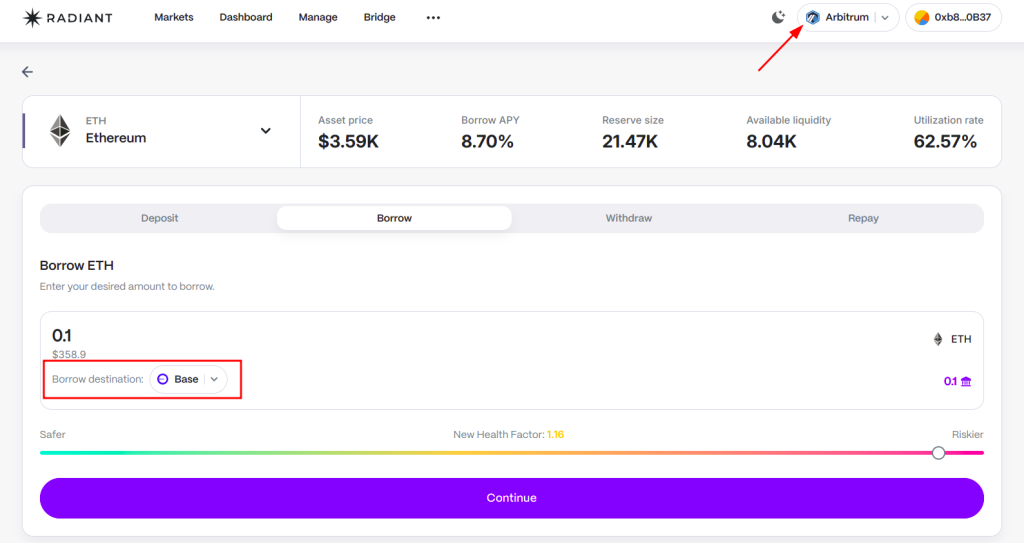

- Radiant Capital – Borrow on one chain using collateral on another chain

- Unchained Capital – Fund your startup or get operating funds with a Bitcoin loan

Top Crypto Lending Platforms Reviewed – A Closer Look

We tested dozens of platforms to find the best crypto lending platforms, many of which are best for a specific use case. For example, a platform like Unchained Capital is best suited for commercial lending, whereas Nexo is best for those who may need instant access to a crypto loan (with Mastercard support). By contrast, DeFi platforms like Aave, Compound, or Radiant offer better integration with other platforms in the DeFi space, allowing you to put your borrowed funds to work.

We also considered ease of use and the pros and cons of each lending platform. A handful of our top picks offer the convenience of a built-in exchange. This provides a fiat onramp, letting you buy crypto with your traditional currencies and then borrow against your crypto balance. Others require that you deposit crypto collateral you’ve purchased on your own.

Here are our top picks for crypto lending platforms, along with their pros and cons.

1. Nexo – Best Crypto Lending Platform with Instant Crypto Loans Starting at 0%

Founded in 2018, the Nexo platform offers a polished experience for users, with features mimicking bank services but for crypto assets. The time-tested lending platform has survived and thrived through both bull and bear markets and now serves more than six million users worldwide.

Of note, Nexo is not available to users in the US or Canada. However, the platform offers lending and borrowing services throughout much of the world and manages over $15 billion in assets.

Nexo combines an exchange with its lending services, letting users buy crypto assets on the platform or transfer assets purchased elsewhere. To borrow on Nexo, you have multiple options. Instant credit lines use your crypto collateral on the platform to provide instant decisions. Typically, funds are disbursed within 24 hours. Nexo also offers a crypto Mastercard, which users can toggle to debit or credit. In credit mode, the card uses your crypto collateral to access the instant credit line.

Nexo at a Glance

| CeFi or DeFi | CeFi |

| Regulation and Licenses | Financial Crimes Enforcement Network, Australian Securities and Investment Commission, Financial Transactions and Reports Analysis Centre of Canada, Financial Services Authority Seychelles |

| Contract Audits | N/A |

| Interest Rates | 0% to 13.9% |

| Max LTV | 90% |

| Standout Feature | Nexo Mastercard |

Pros

- Newbie-friendly platform

- Mastercard with debit and credit functions

- 0% loans available

Cons

- Not available in the US or Canada

- Confusing token-based tiers to earn lower rates

2. YouHodler – Borrow With up to 97% LTV Limits

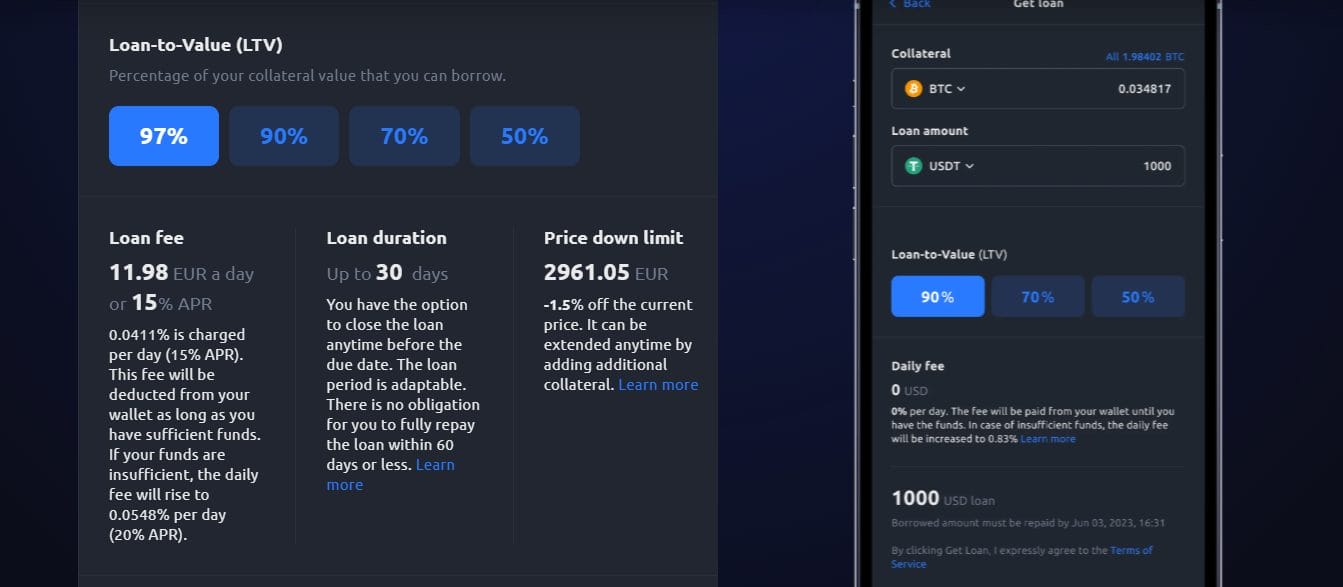

YouHoldler now offers short-term loans with LTV of up to 97%, the highest we’ve seen. Loans on the platforms can be secured with more than 50 cryptocurrencies, and the maximum loan term is one year.

The platform shares some similarities with Nexo. You can buy and sell crypto through an easy-to-use interface. You can also deposit to earn a yield. A new debit card lets you spend just like using a bank card. Youhodler’s exchange features also allow you to borrow against your holdings and automatically reinvest the proceeds. YouHoldler calls this Turbocharge.

Loans are easy to set up, with your choice of 50%, 70%, or 90% LTV and instant approval. YouHodler also offers a take-profit feature, which allows you to set a price to sell the collateral asset and close the loan automatically. However, loans use a daily fee, making it more difficult to calculate your true cost of borrowing on an annual basis.

YouHodler at a Glance

| CeFi or DeFi | CeFi |

| Regulation and Licenses | Regulated VASP in Italy and Spain, Regulated Financial intermediary Switzerland |

| Contract Audits | N/A |

| Interest Rates | Variable based on asset and duration |

| Max LTV | 97% |

| Standout Feature | Automatically take profit on collateral assets to close the loan |

Pros

- Integrated with buying tools to provide simple leverage

- Set a price to take profit on collateral assets

- Easy-to-use platform

Cons

- Higher interest rates

- Annualized borrowing costs not provided

- Not available in the US or Canada

3. Binance – Widest Selection of Cryptocurrencies for Borrowing

While best known for its advanced trading features and wide crypto selection, Binance also offers crypto lending. The platform’s loans center on on-site services, such as margin trades and staking in one of Binance’s numerous staking vaults. However, you can also withdraw your loan proceeds to use elsewhere.

Binance Flexible Loan uses assets deposited in the platform’s Simple Earn products as collateral. For example, you can deposit ETH in Simple Earn to provide a reliable yield and then borrow against that balance as needed. You can then deploy the funds in a higher-yield vault, trade with it, or withdraw to your wallet. Repay at your leisure, but be wary if interest rate changes and LTV levels.

Binance at a Glance

| CeFi or DeFi | CeFi |

| Regulation and Licenses | Autorité des Marchés Financiers (AMF), Organismo Agenti e Mediatori (OAM), Australian Transaction Reports and Analysis Centre (AUSTRAC) |

| Contract Audits | N/A |

| Interest Rates | Variable |

| Max LTV | 75% |

| Standout Feature | Low stable rates for BTC and ETH |

Pros

- Massive selection of cryptos for loans

- Flexible repayment

- Partial liquidation supported

Cons

- Variable rates can rise without notice

- Not available in the US or Canada

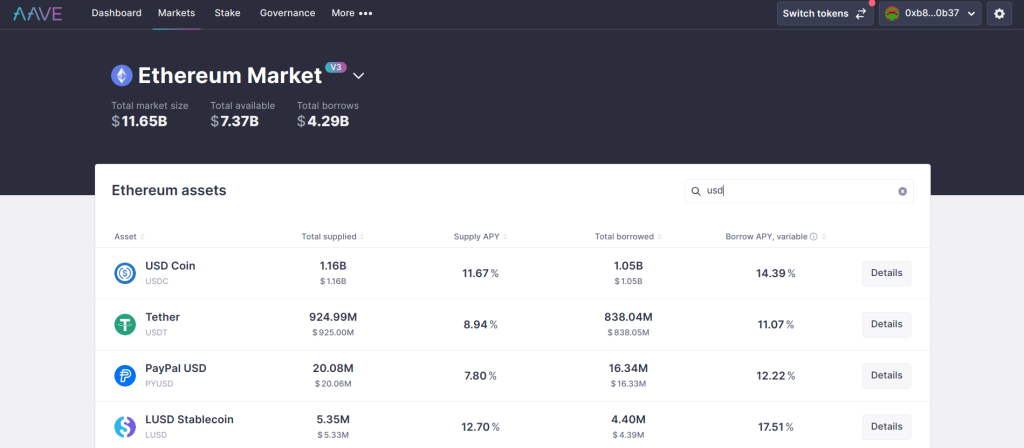

4. Aave – Borrow Against Crypto Assets on Any of 12 Blockchains

In the DeFi world, Aave is synonymous with lending. The decentralized platform provides crypto-backed loans for users on 12 chains, including Ethereum Mainnet, Arbitrum, and Base.

Aave’s supported cryptocurrencies have grown dramatically since its launch, and the platform now supports dozens of assets for collateral. However, some assets, such as Balancer and Curve, are isolated, meaning you can’t use other assets as collateral when borrowing. You’ll earn a yield on deposits, and borrowing APY starts at 0.29% at press time.

Aave uses interest rates based on a supply curve. As more of the lending pool is utilized, interest rates can take a sharp turn northward. However, this interest rate structure is common for DeFi lending platforms.

Aave at a Glance

| CeFi or DeFi | DeFi |

| Regulation and Licenses | N/A |

| Contract Audits | Peckshield, Certora, SigmaPrime |

| Interest Rates | Variable based on supply/demand |

| Max LTV | 75% |

| Standout Feature | Insurance fund powered by staking |

Pros

- Staking feature provides insurance for losses caused by sudden market moves

- Audited by leading smart contract auditing firms

- Available on 12 blockchains

Cons

- Interest rates can spike suddenly

- Reduced token choices on some networks

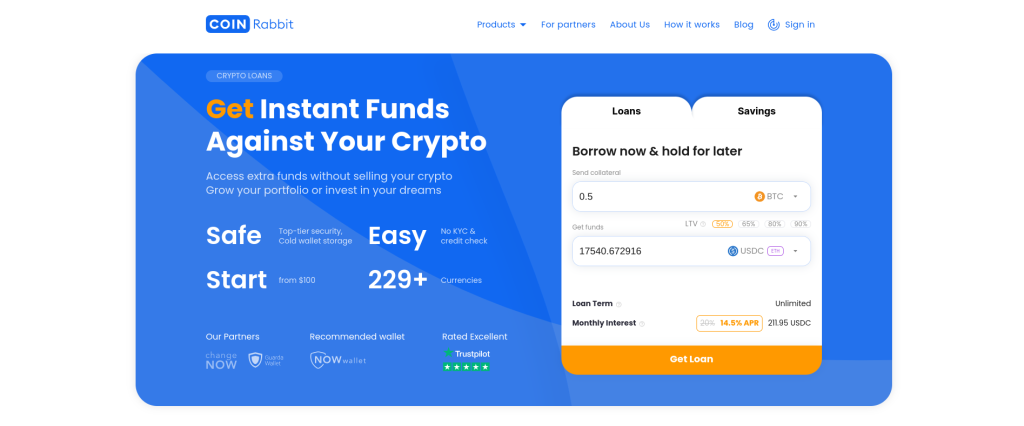

5. CoinRabbit – Get LTV Alerts to Protect Your Crypto Collateral

When LTV reaches a critical level, it’s often an unpleasant surprise on other platforms. Many times, crypto borrowers find out about liquidations the hard way. CoinRabbit keeps the lines of communication open by sending emails and SMS alerts if your loan collateral may be in jeopardy.

CoinRabbit’s easy-to-use interface provides a simple way to deposit collateral held in cold storage and borrow against your deposits. You’ll earn a yield on deposits held on the platform for more than 90 days, although interest begins to accrue immediately. More than 230 assets qualify as collateral for deposits.

Initial LTV levels are capped at 50% on CoinRabbit, which can make borrowing safer and reduce the risk of liquidations. Loan interest rates range from 12% to 17%.

CoinRabbit at a Glance

| CeFi or DeFi | CeFi |

| Regulation and Licenses | N/A |

| Contract Audits | N/A |

| Interest Rates | 12% to 17% |

| Max LTV | 50% |

| Standout Feature | No KYC required |

Pros

- No KYC or credit check

- Over 230 crypto assets supported for collateral

- Email and SMS notifications

Cons

- Higher interest rates than some platforms

- 90-day deposit required to keep interest earnings

- $100 fee for loans less than 30 days

6. Compound Finance – Safety-Minded DeFi Crypto Loans

While borrowing options may be limited on Compound, this crypto money market remains one of the most trusted and liquid DeFi lending platforms available. Compound Finance supports four of the leading blockchains: Ethereum, Base, Polygon, and Arbitrum.

Eligible collateral assets vary by chain. For example, on ETH Mainnet, you can borrow ETH using a select basket of assets as collateral. ETH collateral includes staked ETH tokens, all of which will grow in value relative to ETH, helping to prevent liquidations.

Compound Finance’s focus on blue-chip cryptos and well-matched collateral helps make the platform more stable and reduces the risk of liquidations. That stability attracts safety-conscious capital which then leads to lower interest rates due to higher supply. Compound’s ETH borrowing rates are among the lowest we’ve seen at less than 3%.

Compound Finance at a Glance

| CeFi or DeFi | DeFi |

| Regulation and Licenses | N/A |

| Contract Audits | OpenZeppelin, ChainSecurity |

| Interest Rates | Variable, as low as 1.63% |

| Max LTV | 90% |

| Standout Feature | Borrow up to 90% LTV in ETH using cbETH as collateral |

Pros

- Stable platform with low rates

- Massive liquidity

- Earn COMP tokens for ETH and cbETH deposits

Cons

- Limited selection of cryptocurrencies

- May require swapping before depositing collateral

- High utilization can spike rates

7. CoinLoan – Loan Rates Starting at 5.5%

CoinLoan’s Instant Loan makes it easy to borrow against your crypto. The platform supports about 30 types of crypto assets and offers loans with LTVs of up to 70%.

CoinLoan acts as a matchmaker, creating lending pools where lenders can earn a yield and borrowers can easily access funds. Loan term options range from thirty days to one year.

Similar to Nexo, the CoinLoan has its own token that plays a role in its ecosystem. Holding the CLT token unlocks the highest interest rates for lenders, and borrowers can save on interest costs by paying with CLT. However, loans come with an origination fee of about 1%, which can make short-term loans costlier.

CoinLoan at a Glance

| CeFi or DeFi | CeFi |

| Regulation and Licenses | European Financial License, FinCEN MSB Registration |

| Contract Audits | N/A |

| Interest Rates | 5.5% and up |

| Max LTV | 70% |

| Standout Feature | Earn interest on EUR or GBP |

Pros

- Newbie-friendly platform

- Instant loan approval

- Option for low-LTV (20%) loans

Cons

- No interest paid on collateral assets

- Not available in the US

8. Ledn – Use BTC or ETH to Borrow Cash, Funded in USD

Most crypto lending platforms let you borrow against your crypto and disburse a different type of crypto. To use your funds in the traditional finance world, you still need to sell the borrowed crypto and then deposit the funds. Ledn lets you skip a step. Borrow in USD if needed.

However, Ledn is more selective about crypto collateral. Only BTC and ETH are supported. This selective nature speaks to Ledn’s interest in creating a transparent lending platform that minimizes risk.

Interest rates start at 12.4%, whether borrowing in USD or USDC. In addition, each loan comes with a 2% administrative fee. Initial LTV for loans is capped at 50%. However, Ledn offers the option to automatically move Bitcoin from your standard account to your collateral account if your LTV reaches 70%. This feature can reduce the risk of liquidation if you hold additional funds on Ledn or use Ledn to buy BTC.

Ledn at a Glance

| CeFi or DeFi | CeFi |

| Regulation and Licenses | Cayman Islands Monetary Authority (CIMA) |

| Contract Audits | N/A |

| Interest Rates | 12.4% and up |

| Max LTV | 50% |

| Standout Feature | Borrow in USD or USDC |

Pros

- Borrow in USD

- Option for vault storage (no lending risk)

- Auto top-up collateral option at 70% LTV

Cons

- 2% administration fee

- 24 to 48-hour approval

9. Radiant Capital – Use Cross-Chain Collateral to Fund Your Crypto Loan

Similar to DeFi platforms like Aave and Compound Finance, Radiant Capital lets you deposit into a lending pool to earn a yield and then borrow against those assets. Where Radiant differs is in the ability to use assets on one chain to fund a loan on a different chain. Collateralize on Abitrum and borrow to Base.

This eliminates the need to use exploit-prone bridges or the multiple steps involved with sending your borrowed crypto to an exchange and then withdrawing on the chain where you need the funds. As a caveat, the loan must be repaid on the original chain where you hold your collateral.

Radiant’s protocol provides several ways to earn, but basic loans work similarly to other DeFi lending protocols. Deposit collateral to earn a variable yield. Borrow at a variable rate based on lending pool utilization. However, you can fund your loan cross-chain. Several popular chains are supported, including Ethereum Mainnet, although chain availability varies depending on which token you borrow.

Radiant Capital at a Glance

| CeFi or DeFi | DeFi |

| Regulation and Licenses | N/A |

| Contract Audits | OpenZeppelin, BlockSec, PeckShield, Zokyo |

| Interest Rates | Variable |

| Max LTV | 80% |

| Standout Feature | Cross-platform borrowing |

Pros

- Cross-chain borrowing

- Growing list of supported assets

- Decentralized, permissionless borrowing

Cons

- Requires knowledge of crypto wallets

- Relatively new project founded in 2022

10. Unchained Capital – Use Your BTC to Back Commercial Bitcoin Loans

Unchained Capital caters to the needs of BTC whales and early adopters with a larger stack who may need access to capital. In addition to custodial services and IRAs, the platform offers some of the best bitcoin loans. However, Unchained focuses on commercial loans. Need to access the value trapped in your Bitcoin to fund your startup? Unchained Capital offers a solution without selling.

The platform provides interest-only commercial loans designed to keep payments low during critical start-up months. Choose from a 6-month or 12-month term, with a balance payment due at the end of the term. Loans under $1 million are capped at a safety-conscious 40% LTV, and Unchained’s team can help you craft a custom solution for loans over $250,000.

Budget for a 1.25% origination fee. Borrowing rates start at 14%.

Unchained Capital at a Glance

| CeFi or DeFi | CeFi |

| Regulation and Licenses | Money transmitter licenses in 42 US states |

| Contract Audits | N/A |

| Interest Rates | 14% |

| Max LTV | 40% for loans under $1 million |

| Standout Feature | Well-suited to startup funding |

Pros

- Safety-focused low LTV

- High-value loans available

- Other services available for high-value investors

Cons

- BTC collateral only

- Interest-only loans are not perfect for all borrowers

What is a Crypto Lending Platform?

A crypto lending platform can be either a centralized company or an automated blockchain protocol that allows borrowing against crypto assets. These platforms serve both sides of the market, paying lenders a yield on deposited assets that borrowers can access.

The platform acts as an intermediary between lenders and borrowers. However, unlike traditional finance, such as banks, crypto lenders typically don’t require a loan application. This streamlines the lending process and allows users to transact freely.

How Do Crypto Lending Platforms Work?

Most crypto loans depend on collateral rather than credit checks and income verification, which are common with traditional lending. Your cryptocurrency assets act as collateral for the loan, removing the need for income verification. If the loan-to-value (LTV) falls below a certain threshold, the lending platform can liquidate the collateral to pay the loan balance. LTV compares the value of your loan to the value of your collateral.

While the mechanical details may differ from platform to platform, borrowing on a crypto platform typically follows a similar pattern.

- Deposit crypto on the platform: In many cases, you’re depositing to a lending pool. This means you can earn interest from your deposit.

- Borrow against your crypto: Choose an amount to borrow and a term, if applicable. In many cases, the borrowed funds are available immediately.

- Repay the loan according to the terms: Some crypto loans have fixed repayment requirements, although most let you repay according to your own schedule.

Depending on which platform you choose, your loan proceeds may be paid in cryptocurrency, such as a stablecoin like USDC. Many platforms also support borrowing other crypto assets, including ETH, BTC, and others. Alternatively, you can take your payout in USD, although the latter requires using a centralized platform that supports cash disbursements.

As you pay down any outstanding loans — or if the value of your collateral increases — you can borrow more, staying within LTV limits. On the other hand, if the value of your collateral decreases, you may need to deposit more collateral or pay down the balance to stay within LTV limits.

Different Types of Crypto Loans

Most crypto loans use collateral to secure the loan. However, the mechanics and purpose of the loan may differ. For example, margin trading loans are intended for trading with leverage by borrowing against your holdings (the margin). Another category of crypto loans, called flash loans, doesn’t require collateral at all.

Collateralized Loans

Most crypto lending platforms provide fairly simple collateralized loans. As described earlier, you deposit or lock your collateral and then borrow against the value. The collateral provides a safeguard against a default that would otherwise put the lender’s assets at risk.

Typically, collateralized loans require a deposit onto a lending platform, although some centralized lenders utilize a multi-signature wallet to hold the collateral. In either case, the lending platform monitors the value of the collateral versus the loan balance. The lending platform can sell the collateral to pay down the loan balance if the balance exceeds the allowed LTV percentage. The process is called liquidation.

With centralized lending platforms, this liquidation process may involve human interaction. However, on decentralized lending platforms, liquidations are typically handled by bots that earn a fee for finding liquidation-eligible positions and triggering the liquidation.

Crypto Loans Without Collateral

Through the magic of smart contracts, which are computer programs that run on the blockchain network, it’s now possible to get crypto loans without collateral. This type of crypto loan is called a flash loan, named after its speed. You borrow and repay in one blockchain transaction.

Flash loans use smart contracts to initiate a loan, do something with the proceeds (such as a trade), and then pay back the loan with interest within the same block transaction. The Marble Protocol introduced the concept of flash loans in 2018, but platforms like Aave V3 and Uniswap V2 made them accessible. Before executing, the network validates the math based on the market prices of the assets involved and the borrowing costs. If the flash loan can be paid off by the end of the transaction, the transaction can go through.

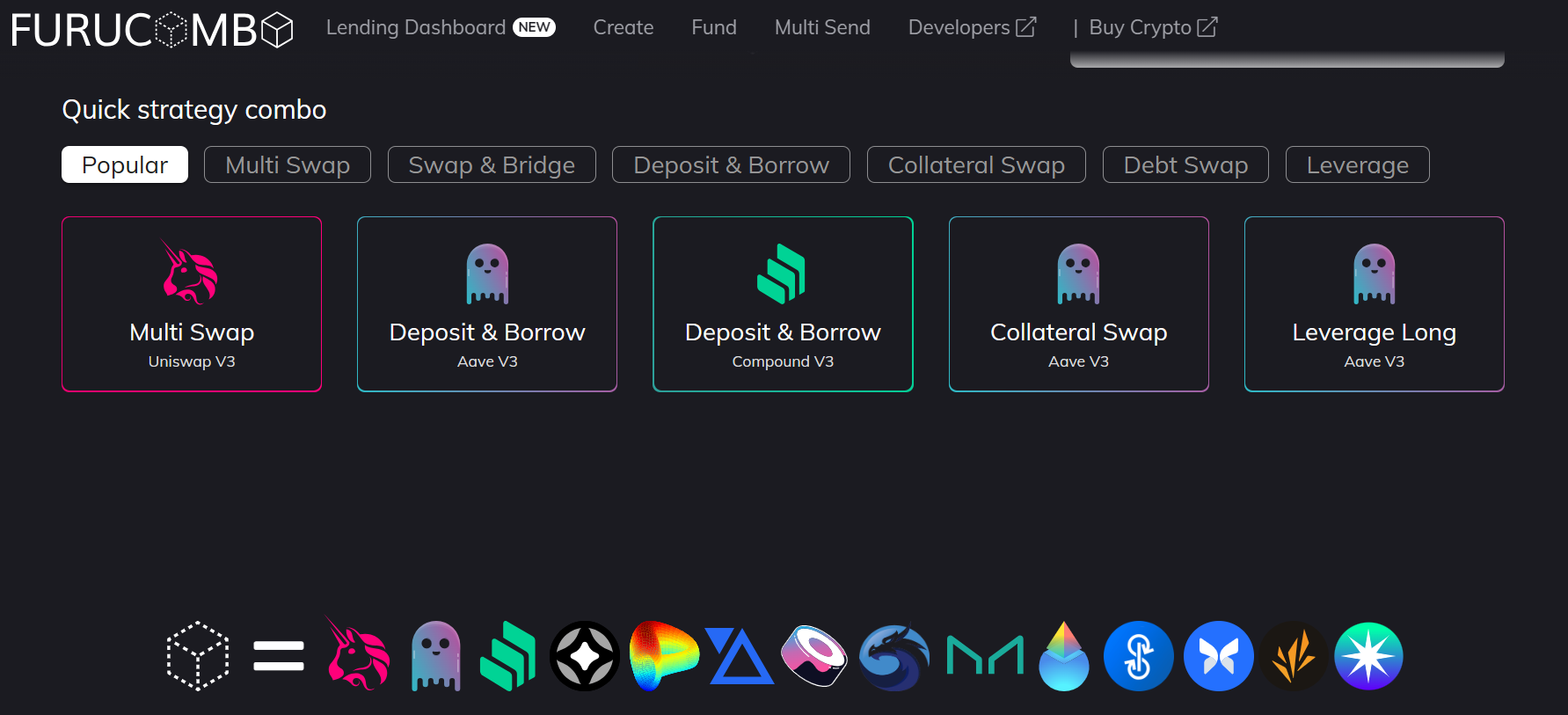

Crypto loans without collateral require building the transaction in the programming language supported by the blockchain network. However, drag-and-drop tools like Furucombo remove the need for programming, letting you build the transaction with ordered blocks.

Flash loans create opportunities for arbitrage trades in which small price differences between platforms can mean big earnings with enough leverage. Many DeFi exploits also utilize flash loans to maximize the value of the exploit.

Margin Trading Loans

Margin loans use collateral to enable borrowing for trades. Advanced trading platforms like Binance and Kraken let you borrow against your holdings on the exchange to maximize your trading.

Margin trading loans come in two forms: cross-margin and isolated margin.

- Cross-margin loans utilize multiple assets to secure the loan. For example, you might use ETH, USDC, and BTC holdings as margin for a leveraged BTC trade. If you hold multiple assets, cross-margin loans often offer higher borrowing limits.

- Isolated margin bases your borrowing ability on one asset, with only that asset used as collateral for the trade.

Margin loans allow you to amplify gains but can also amplify losses. If the market turns against your trade, your margin may be at risk. At a certain LTV level, the exchange can liquidate all or part of your margin to settle the trade. LTV levels typically vary depending on the trade and the assets used for collateral.

CeFi vs DeFi Loans: What is The Difference?

The most important distinction between CeFi and DeFi loans is that CeFi loans are facilitated through a centralized lending platform, whereas DeFi loans are facilitated using smart contracts. In the first case, a company makes the rules. In the second case, the rules of the smart contract are immortalized on the blockchain and largely unchangeable.

Centralized crypto lenders often make borrowing easier for new users and may even provide a crypto ecosystem for buying, selling, staking, and rewards programs in addition to lending. However, centralized lenders can be less transparent, meaning you don’t always know their financial strength or whether the platform’s management has taken on questionable risks. 2022 brought several crypto platform failures, including the Celsius Network collapse, toppling one of the biggest lending platforms.

By contrast, DeFi lending protocols can seem more intimidating to new users. However, once you become familiar with making on-chain transactions with a crypto wallet, many can be easier to use than their centralized counterparts. However, it’s also important to understand usage-based interest rates. Borrowing costs for new and existing loans can spike as the lending pool approaches full utilization.

DeFi crypto lending platforms may also be vulnerable to exploits. A vulnerability in the smart contract could put crypto deposits (collateral) on the platform at risk.

The Advantages of Crypto Loans

One advantage of crypto loans is that they cut the red tape common to traditional loans. Often, you’ll have instant access to funds and can repay at your leisure. In some situations, crypto loans can also provide a tax advantage compared to selling a crypto asset that has taxable gains to raise capital.

Fast Access to Loans

Most crypto loans offer instant access to the funds you borrow. This is particularly true for DeFi loans, in which the transaction happens as quickly as the blockchain can confirm a block. Your borrowed crypto appears in your wallet in seconds.

However, centralized lenders may take longer. For example, you might get access to your funds within 24 hours. If you need funds immediately, check the fine print to be sure the platform you choose meets your requirements.

No Credit Checks

Because crypto loans use your crypto assets as collateral, there are usually no credit checks. Specialty loans through a centralized lender are the only major exception. However, when using a DeFi platform like Aave, you won’t even need to provide a name. The entire transaction uses your crypto wallet address as your pseudonymous identity.

Repayment Terms Flexibility

Installment loans and credit cards use either a fixed payment or a minimum payment, locking you into a monthly commitment. By contrast, crypto loans use your crypto assets as collateral, with the LTV being the most important factor driving repayment requirements.

You can delay making payments with most crypto loans if you choose. The important thing to watch is your LTV. As interest costs pile up or if the value of your collateral decreases, you may need to make a payment or deposit more collateral to maintain your loan’s health rating.

Potential Tax Advantages

Crypto loans can be a cost-saving alternative to selling your crypto to raise funds. For example, if you bought Bitcoin at $15,500 and now Bitcoin is worth $70,000, you likely owe capital gains tax if you sell. By borrowing against your Bitcoin, you can access part of the value in your holdings without creating a taxable event.

The Risks of Crypto Loans

While crypto lending platforms provide fast access to funds, crypto loans also come with some risks. Both centralized and decentralized platforms have liquidation risks if the loan value exceeds LTV requirements, and both types of platforms also have security risks.

Volatility Risk for Collateral

Crypto prices are half of the equation when calculating LTV. Bitcoin reached nearly $70,000 in late 2021 before dropping to less than $16,000 in the bear market that followed. A loan using Bitcoin as collateral during that time period would have required additional collateral. Alternatively, the loan could be paid down or paid off.

The last option would be liquidation, in which the lending platform sells the BTC to satisfy the loan balance. Day-to-day volatility or a down month for crypto markets could put your collateral at risk.

You may also want to consider the value of the borrowed asset relative to the collateral. For example, if you use USDC (pegged to the UD dollar) as collateral on Aave and then borrow in ETH, you could end up with a more expensive loan if ETH’s value rises. You have to repay the loan in ETH, which could be worth much more than when you took the loan.

Security Risks

Both centralized and decentralized lending platforms also introduce security risks, although the types of exposure differ.

Centralized platforms usually have your proof of identity and other personal information that could create a risk of identity theft. Also, these platforms are typically secured by your login credentials. If someone gains access to your account, they have access to your crypto collateral and may even be able to buy using your saved payment information. Lastly, the amount of crypto on centralized platforms attracts hackers.

Decentralized platforms also attract hackers eager to exploit flaws in smart contracts. If someone is successful in exploiting the platform, it may be possible to drain the collateral deposits on the platform.

Rehypothecation Risks

Rehypothication refers to reusing collateral. This risk is something to consider when using centralized lending platforms. If the platform is using your collateral to back your loan but also using the same collateral to back a risky bet made elsewhere in the crypto world, your collateral may not be there anymore — regardless of what the numbers say on your user dashboard.

Interest Rates and Fees

Fees and interest can also put your collateral at risk. For example, some crypto loans require an origination fee. This takes some of your loan’s value, putting you at a deficit from the moment the loan is funded.

Interest rates also create an ongoing risk. With centralized lenders, you can often borrow at a fixed rate, which allows you to plan for payments. However, most decentralized lending platforms use a variable rate based on supply and demand. If the lending pool approaches full utilization, an 8% loan can become a loan with a 105% interest rate — or higher — and it can happen in a flash.

Methodology: How We Ranked the Best Crypto Lending Platforms

We considered several factors when choosing the best crypto lending platforms. These ranged from platform security and ease of use to interest rates and LTV limits.

Ease of Use 30%

We favored platforms that provide a simple interface. For DeFi platforms, we also considered options that support well-documented crypto wallets such as MetaMask.

Security & Audits 30%

We weighed security factors ranging from cold storage to protected vaults that eliminate the possibility of rehypothecation. Regulation, if applicable, also fell in this category. For DeFi platforms, we looked for recent audits by reputable smart-contract audit firms.

Interest Rates 20%

Interest rates for crypto lending companies tend to move with market rates as well as supply and demand for the lending pool. As such, this category receives lower weighting. However, some platforms had notably higher or lower rates compared to similar CeFi or DeFi platforms.

LTV Limits 10%

A high LTV (Loan to Value) limit could indicate a greater risk of liquidation due to market volatility, whereas a low LTV limit offers more safety. At the same time, higher LTV limits offer higher borrowing limits based on collateral. This category receives lower weighting as the LTV needs of each borrower are subjective.

Funding Options and Speed 10%

We also considered loan funding options as well as how fast loan funds become available. Of note, CeFi platforms were the only option for funding in USD. Some CeFi platforms may also take up to 48 hours to fund the loan. By contrast, DeFi crypto lending platforms usually offer instant disbursement.

Conclusion

A crypto loan offers powerful leverage that lets you put the value of your crypto to work without selling your assets. Often, it also avoids tax liabilities from disposing of the asset to raise funds. Instead, you simply transfer the funds, keeping ownership but using your crypto assets as collateral for a loan through a lending platform.

Study the risks involved with crypto loans before taking a loan. DeFi platforms can bring the risk of smart-contract exploits, whereas CeFi platforms can attract hackers looking for login credentials or keys to wallets. CeFi platforms may also bring additional risks of insolvency, possibly puting your collateral at risk.

References

- The DeFi ‘Flash Loan’ Attack That Changed Everything (coindesk.com)

- From $25 billion to $167 million: How a major crypto lender collapsed (cnbc.com)

- Digital Assets (irs.gov)

FAQs

What is a crypto loan?

A crypto loan is a loan that uses your crypto assets as collateral. By using your crypto to secure the loan, you can often get a loan instantly and without the paperwork and approval usually associated with traditional loans.

What is the best crypto lending platform?

For convenience, you can consider a platform like Nexo. Nexo offers instant loans and also provides a crypto credit card that can be used in debit or credit mode.

Can you get a crypto loan without collateral?

Most crypto loans require collateral. However, flash loans let you borrow without collateral by creating transactions that borrow and repay within one transaction.

What is the best crypto loan available?

Trusted DeFi platforms like Aave often offer the best way to borrow for short-term needs. However, interest rates can spike due to supply and demand for the lending pool. If you need fixed rates, you can consider a centralized lending platform like Nexo.

Are crypto loans risky?

Crypto loans can be risky, particularly if you choose a higher loan-to-value ratio that creates a greater risk of liquidation for your collateral. Platform risk is another consideration. A hack or insolvency can put your collateral at risk.

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell