What is Ethereum 2.0 and How Does it Work?

Since its launch back in 2015 Ethereum has grown to be not only the second-largest cryptocurrency in the world, but also a key network within the wider blockchain ecosystem. Many projects have since been launched using its network, and in September 2022, a significant merge took place creating Ethereum 2.0. But what is Ethereum 2.0?

In this article, we will explore the merge, the differences between Ethereum vs Ethereum 2.0, the concepts of Proof-of-Stake, Proof-of-Work and we’ll forecast the long-term potential of this rapidly growing DeFi network.

What is Ethereum 2.0 (Merge)

Ethereum 2.0 or ETH2 is the set of upgrades that have been made to the original version of the network, primarily a shift from a proof-of-work (PoW) algorithm to a proof-of-stake (PoS) model. The prime driver of the upgrade was to make Ethereum more sustainable, scalable, and secure.

This process, known as the merge, was rooted in a decision that came in 2020 when the Ethereum Foundation began running two models. One was a PoW (Ethereum Mainnet) and the second was PoS (Beacon Chain). The aim for this unification had been to increase the accessibility of those who participate in helping to manage the blockchain, which could help the long-term scalability of Ethereum.

Ethereum vs Ethereum 2.0: What is the Difference?

Now many Ether enthusiasts may still be asking what is ETH 2.0? and how it is different from the version launched in 2015. As briefly touched on above, the primary difference between the original version of Ethereum and ETH 2 is the switch to a proof-of-stake algorithm from proof-of-work.

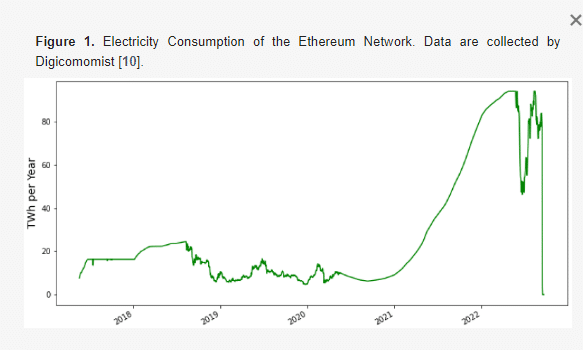

Prior to the merge, Ethereum operated primarily as a PoW model, which saw users verifying transactions on the blockchain through mining. These miners would use high-powered computers to solve algorithmic problems, which when completed validate the transactions held within a block. Once done, miners would receive a reward for their efforts. This process requires a lot of electricity, and even birthed mining farms, where supercomputers were being used for those trying to earn rewards.

This had a negative impact on the environment and came at a time when governments across the globe had started shifting to green initiatives. PoS has seen the network pivot away from mining blocks to validate transactions, essentially due to its lack of sustainability. Now this validation comes in the form of staking, with stakers earning rewards of around 2.84% Annual Percentage Yield (APY) for their participation.

Although similar to mining in that it requires the validation of transactions, proof-of-stake works by a user staking their ETH or relevant crypto into the network. By doing this, stakers highlight their intent to become validators, and can now partake in verifying transactions within the blockchain. Like miners, stakers receive rewards for their participation, with rewards dependent on how much crypto they have staked on the network.

Additionally, the new PoS model can handle roughly 100,000 transactions per second, significantly more than the 15 per second on the legacy version of the network.

Proof-of-stake vs Proof-of-work

Now, let’s go deeper into the concepts of Proof-of-stake vs Proof-of-work and highlight key differences.

Energy Efficiency

One of the main differences between proof-of-stake and proof-of-work is the impact these models have on the environment. As illustrated above, the PoW algorithm uses a significant amount of electricity, with the energy dependency of PoS almost 100% lower than its predecessor. According to an article from The Verge, on the old system, “the cryptocurrency network was estimated to use as much electricity annually as the country of Bangladesh.”

In the wider crypto space, Elon Musk previously decided to stop accepting Bitcoin as a payment option at Tesla, citing issues with its carbon footprint. After this decision back in 2021, Musk commented, “We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

Capacity to Scale

As a result of the shift to PoS in order to validate transactions on the blockchain, more users are able to participate in the process. By making PoS more accessible than PoW, the number of transactions per second has significantly risen, moving from 15 before the merge, to over 100,000 post-merge.

In addition to this, CoinDesk has found that “As of September 15, 2023, there are 806,759 active validators on Ethereum. The number of active validators has increased 43%. The number of Ethereum validators is set to exceed 1 million by the end of this year.”

Increased Decentralization

Since the ETH merge, not only has the network improved its scalability, and reduced its energy output, it has also increased its decentralization. The Ethereum 2.0 release has meant that the number of participants validating transactions is on the rise, as seen above.

Previously, there was a greater barrier to entry due to the PoW mechanism, as only those with high outputting computational power would have been able to compete, and verify transactions on the blockchain. As found by the National Bureau of Economic Research (NBER), “the top 10% of miners control 90% of the mining capacity, and just 0.1% (about 50 miners) control 50% of mining capacity.”

Disadvantages of Proof-of-stake

The downside of proof-of-stake is also its greatest strength, and that as previously stated is its scalability. Although PoW required a high level of electricity, and computing power, this was the main separator on what made the best miners. Now, PoS validation, and rewards are determined by how much cryptocurrency a person has staked, which could lead to undue influence on transaction validation.

In addition to this, security could be marginally lower than with its PoW iteration, due to the factors mentioned above. The more participants you have in the network, could logically increase the chances of attacks.

How Ethereum 2.0 Works?

Following the Ethereum merge, the main premise of ETH 2.0 has been its shift to a staking mechanism. Operating with this new concept, Ethereum now works by using validators to verify transactions on the blockchain, rather than energy-intensive miners.

In order to participate in ethereum 2.0 staking, here is what you will need to do. Firstly, you will need to lockup a set amount of cryptocurrency into the Ethereum network via a smart contract, which will then give you the opportunity to validate blocks within the blockchain. This can be done by opening an account with one of the best Ethereum staking platforms in 2024. By doing this, you become a validator, and the algorithm will select validators or stakers to verify transactions, based on the amount of crypto locked in.

So ultimately, the more you have staked into the network, the higher the percentage chance of being selected to validate blockchain transactions. Once verification has been completed, you will receive a reward in the form of crypto for your work.

Why Move to Ethereum 2.0?

The main reason for the switch to Ethereum 2.0 is the benefit it will have for the environment. Heavy carbon emitters in various industries have already started looking at ways to become greener, and this move is no different. Be it with renewable energy, or electric vehicles, the world is going green, and this could be a key shift for crypto to keep in-line with this.

Additionally, this migration will increase accessibility within the ecosystem, where more participants can partake in helping to manage the blockchain, by verifying transactions. As a result, the overall network will become more decentralized, with more opportunities issued to stakers to benefit from being a part of the ecosystem.

The Future of Ethereum 2.0

A few years have passed since the merge, and the ecosystem has continued to evolve. Although the Ethereum 2.0 price has yet to rally to a record high, there has been significant growth since this tweet below from Vitalik.

September 2022, ETH was trading just under the $1,300 level, and at the time of writing this, the price was just above the $2,300 mark. Gradually, the decision to pivot to proof-of-stake, and its environmental impact could lead to further adoption, especially by mainstream actors looking to enter crypto, and need a green-friendly solution. The speed of validating transactions has been the biggest development, with its current capacity of 100,000 per second.

Heading into 2024 Vitalik Buterin, Ethereum’s Co-Founder also laid out a roadmap, which included development in several areas, “the Merge, the Surge, the Scourge, the Verge, the Purge and the Splurge.”

In terms of its wider impact on crypto, the decision to move to PoS has prompted many to ask, why can’t Bitcoin? As seen in this article from MIT, and earlier from Elon Musk’s decision to halt Bitcoin payments at Tesla, there are growing calls for other major participants to join this green crypto revolution.

Closing Thoughts: Is Ethereum Right for You?

Ethereum is up by over $1,000 since the merge, so from a financial perspective, it appears that the future is green, pun intended. Despite this, the question still remains, is it the right investment for you? Overall, it seems that Ethereum is putting emphasis on scalability and simplicity, which are key areas if the network wants to achieve wider adoption.

From everything we have seen in this article, the shift to proof-of-stake has gradually started to be fruitful, and in the long term could become a marquee moment in crypto history. If you believe this shift will lay the foundation for future advancements, then, it is a no-brainer to consider an investment in this cryptocurrency.

FAQs

What is the benefit of the Ethereum merge?

The Ethereum merge has enabled more participants to help validate transactions on the blockchain. The number of transactions per second has now increased as a result, with over 100,000 per second. Lastly, it is nearly 100% more energy efficient.

What is the difference between Proof-of-Stake and Proof-of-Work?

Proof-of-Stake requires the users to stake crypto in order to validate transactions on the blockchain. Proof-of-Work requires users to complete complex mathematical calculations using high-powered computers to verify activity on the network.

Is Ethereum 2.0 a good investment?

The price of Ethereum has risen since the launch of ETH 2.0, and could surge higher should it gain more mainstream adoption.

References

- Ethereum more sustainable (The Verge)

- Mining’s negative impact on the environment (Thomas Reuters)

- Ethereum Merge will lower pollution (The Verge)

- Elon Musk previously decided to stop accepting Bitcoin (CNBC.com)

- Number of block validators growing (CoinDesk)

- 10% of miners control 90% of mining (National Bureau of Economic Research)

- Ethereum’s Co-Founder also laid out a roadmap (Yahoo Finance)

- Why can’t Bitcoin move to PoS (MIT Technology Review)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eric Huffman

Eric Huffman

Michael Graw

Michael Graw