Japan: Hacked Exchange Sale Confirmed, Self-regulation Approved

Tech Bureau, the operator of Japanese exchange platform Zaif, has confirmed it will transfer all of its cryptocurrency operations to Osaka-based financial services company Fisco by November 21.

The platform, which was the subject of a crippling USD 63 million hack in September, had recently been handed an unprecedented third business improvement order from the regulatory Financial Services Agency (FSA), and despite its initial attempts to forge ahead with customer reimbursement plans and system improvements, has instead confirmed it is throwing in the towel.

Tech Bureau announced its intention to transfer Zaif to Fisco earlier this month, but, per news outlet TSR, has now also confirmed the move – and has added that customers who suffered losses in the hack may not be able to receive compensation. The company stated, “Please be forewarned that we may not be able to respond to [customers’ compensation] requests.” Fisco has previously announced that it will instead take over responsibilities toward the Zaif customers: “Under the Official Agreement, Fisco Cryptocurrency Exchange shall assume customers’ rights with Tech Bureau in regard to seeking a return of deposited cryptocurrency and the remaining cryptocurrency that was not lost.”

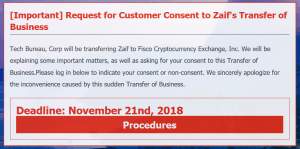

Announcement by Zaif on its website:

At the time of writing, trading volume for the last 24 hour at Zaif stood at USD 9 million, according to CoinMarketCap.

Top 10 markets at Zaif:

Meanwhile, the FSA yesterday approved a self-regulation request from a group of 16 licensed exchanges. The move represents a major coup for the Japan Virtual Currency Exchange Industry Association (JVCEA), who had been angling for official self-regulatory status since April this year. The association believes the move will help it rebuilt customer confidence in an industry that has been badly shaken after the damaging Zaif and Coincheck hacks earlier this year.

The terms of JVCEA’s self-regulation will involve a rigorous auditing process of its members, and stringent security checks. FSA staff welcomed the news, with Reuters quoting an official stating that “industry experts will make better rules than bureaucrats.” Despite the decision, however, it is believed that the FSA will retain all of its existing regulatory powers, and will be able to step in with governance measures should it feel the JVCEA is not doing enough to police its members.