Henry Ford’s Energy Standard: A 100-Year Old Bitcoin Prediction

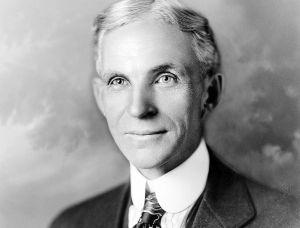

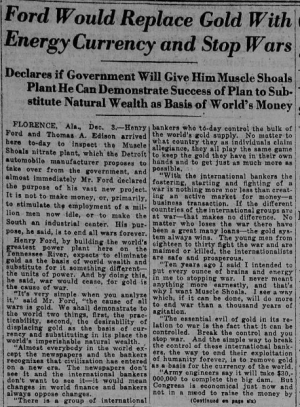

On December 4, 1921, The New York Tribune published a story detailing a plan by inventor Henry Ford, founder of the Ford Motor Company, to replace the existing gold-backed currency system into one based on an “energy currency.”

This article delves into Ford’s ambitious plan and how Bitcoin (BTC) has come to be the embodiment of a 100-year-old ideal.

A historical background

The article headlined “Ford Would Replace Gold With Energy Currency And Stop Wars” detailed Ford’s beliefs on a number of prevailing issues at the time, with a focus on international monetary policies and how they adversely affected the stability of the world.

Ford believed that gold was the basis of war, or rather played a major part in extending the length of wars. In 1921, the effects of the First World war were beginning to become painfully obvious across the globe. Dubbed ‘The War To End All Wars’, WW1 left over 9 million soldiers and 21 million civilians dead with many injured and others missing.

It was against the backdrop of a destructive global war that Ford made his remarks and introduced the world to his revolutionary idea.

Ford explained the premise of his energy currency succinctly stating:

“The essential evil of gold in its relation to war is the fact that it can be controlled. Break the control and you stop war.”

Centralized gold power

Ford believed there was a centralization of wealth and power among those who held and controlled gold, such that they would be incentivized to further hold on to that power and wealth, whether benevolently or maliciously.

The prolific businessman stated:

“There is a group of international bankers who today control the bulk of the world’s gold supply. No matter to what country they as individuals claim allegiance, they all play the same game to keep the gold they have in their own hands and to get just as much more as possible.”

Given the recently concluded WW1, Ford continued, offering the example of war. “With the international bankers, the fostering, starting and fighting of a war is nothing more nor less than creating an active market for money, a business transaction. If the different countries of the international groups are at war, that makes no difference. No matter who loses the war, there have been a great many loans – the gold system always wins. The young men from eighteen to thirty fight the war and are maimed or killed, the internationalists are safe and prosperous.”

While the gold standard was eventually abandoned, the idea of the dangers behind centralized wealth holds to this day. Traditional financial institutions with large amounts of money and power can participate in activities that adversely affect the lives of everyday people while facing next to zero consequences.

A currency backed by natural wealth?

Ford was attempting to usher in a new dispensation in global monetary policy, where countries would issue currencies backed against their natural wealth, like rivers and the like, instead of issuing currency backed by gold kept in reserves.

Ford outlined his idea at the Muscle Shoals Nitrate Plant in Tennessee. He was there to inspect it in the hope that he would be able to acquire it from the government to demonstrate the viability of his plan to the American public and the global community.

The premise behind the idea was simple, replace currency backed by gold to currency backed by natural wealth.

At the time the US government was planning to issue bonds to acquire the USD 30m needed to develop a dam. Ford, however, had an alternative idea. He proposed he would build the dam, effectively for free, if the state agreed to issue a currency backed by Muscle Shoals plant.

Muscle Shoals was built on the Wilson Dam. Ford argued that the resource would make for greater security for any currency, given its time-tested robustness. Additionally, the dam created energy, capable of furnishing a significant, if not infinite, amount of horsepower. It was this energy against which the value of the Muscle Shoals Currency would be determined.

Ford explained:

“Under the energy currency system the standard would be a certain amount of energy exerted for one hour that would be equal to USD 1. It’s simply a case of thinking and calculating in terms different from those laid down to us by the international banking group to which we have grown so accustomed that we think there is no other desirable standard.”

In other terms, Ford was suggesting a currency backed by the energy expended in kilowatt hours (kWh) which would be produced in certain amounts. More units of the currency would only be created if more energy was expended. Ford was ultimately unsuccessful in his ambitious endeavour, citing political pushback, and eventually gave up on the project in 1924.

Just over a hundred years on, however, there now exists a currency based on energy.

Enter Bitcoin

Bitcoin is supported by a group of parties called miners. Miners input energy to mine new blocks on the Bitcoin blockchain. This is what gives BTC its intrinsic value and is referred to as bitcoin energy-value equivalence. In other words, the value of bitcoin can be derived or defined by the raw joules expended to create one.

Joules are a derived unit of energy and work measurement. Work is defined as the force applied to an object over a distance. 1 kWh is equivalent to 3.6 million joules. Given that we can ascertain the energy being utilized in the Bitcoin network, it is possible to compute the value in kWh of one BTC at a certain point in time, taking into account the supply growth rate at that time and the total joules expended. This is how to calculate the value of one bitcoin under this posit.

Additionally, it would also be true to say that one bitcoin is backed by the total amount of energy ever expended by the Bitcoin network. Given the fact that the network is still minting new units, this amount will keep growing until miners stop generating new coins. However, Bitcoiners hope that because of transaction fees, miners will always be incentivized to participate in the network, even after the last bitcoin is mined around 2140.

In this way, we can see that it is possible to derive the value of a bitcoin by measuring its energy input. It is also mathematically provable that one bitcoin is backed by total expended energy across the network. Additionally, its decentralized nature means that it can avoid concentrating power in a very small section of the global populace.

It looks like this makes Bitcoin the embodiment of Henry Ford’s visionary energy standard.

___

Learn more:

Bitcoiners Ask: ‘WTF Happened In 1971?’ The Answer Might Shape The 2020s

Central Banks’ Renewed Gold Hunger Shows Need For A Hedge

As US Seized Gold in 1933, Is There a Threat to Bitcoin in the 2020s?

Attempts to Increase Bitcoin’s Supply Would End Up With Another “Bitcoin”