Bitcoin NFTs: How Ordinals Proved Bitcoin Can Evolve With the Times

While the true identity of Satoshi Nakamoto, the pseudonymously named creator of Bitcoin remains unknown, his primary purpose of creating the flagship cryptocurrency has never been a mystery. He created Bitcoin as a peer-to-peer version of electronic cash to take back financial control from institutions serving as trusted third parties to process electronic payments.

The goal was crystal clear: create a trustless system of electronic transactions. The study of the Bitcoin whitepaper further shows that Bitcoin was designed to focus purely on financial transactions.

In fact, Nakamoto had previously opposed the addition of other use cases to the leading cryptocurrency. In 2011, the pseudonymous creator of Bitcoin rejected the idea of integrating a domain name system (DNS) into Bitcoin called BitDNS, saying that combining all proof-of-work consensus systems into one dataset would not be scalable.

“The primary goal behind the creation of Bitcoin was to serve as a medium of value transfer,” Sebastian Jan Menge, co-founder of FitBurn, said in a comment. However, this goal has evolved many times over the past decade.

The first Crypto enthusiasts mostly bought in on the idea that Bitcoin’s canonical hard cap of 21 million coins would make it a hedge against inflation. This led to the cryptocurrency gaining some reputation as “digital gold,” or a sound store of value.

Even Goldman Sachs put forward the “store of value” thesis for Bitcoin. However, that narrative failed just recently when Bitcoin plunged 75% despite inflation soaring to record high levels.

Crypto believers then shifted to the narrative that the leading cryptocurrency is a way to protect against “currency debasement.” This basically means that when central banks create more money, Bitcoin’s value will rise because the new money reduces the value of the money that’s already in circulation.

This narrative has already failed, too. Central banks around the world continue to raise interest rates and shrink their balance sheet, which reduces the supply of money. If Bitcoin was a hedge against monetary debasement, it shouldn’t be up 40% year-to-date despite the decrease in the money supply.

Come in, NFTs. The recent arrival of the Ordinals protocol has unleashed a new narrative of NFTs and smart contracts on the Bitcoin blockchain, creating some much-needed buzz in the usually tranquil world of Bitcoin.

Bitcoin NFTs: What Are Ordinals?

Bitcoin Ordinals is a new protocol designed and deployed by former Bitcoin Core contributor Casey Rodarmor that enables users to explore, transfer, and receive individual satoshis, the atomic unit of Bitcoin, which can include unique data.

The protocol uses “inscriptions,” which are arbitrary content like text or images that can be added to sequentially numbered satoshis to create unique “digital artifacts.” These artifacts, which are NFTs in effect, can be held and transferred across the Bitcoin network like any other sats.

“Ordinals are a numbering scheme for satoshis that allows tracking and transferring individual sats. These numbers are called ordinal numbers. Satoshis are numbered in the order in which they’re mined, and transferred from transaction inputs to transaction outputs first-in-first-out,” according to the Ordinals documentation.

Both the numbering and transfer schemes depend on order. The numbering scheme is based on the order in which satoshis (Bitcoin units) are mined, while the transfer scheme is based on the order of transaction inputs and outputs. That’s why they are called “Ordinals.”

Ordinals Won Hearts of Many Despite Initial Backlash

Initially, the Ordinals project sparked some controversy among Bitcoinists. So-called Bitcoin purists hit out at the project, arguing that Bitcoin was designed to focus solely on financial transactions and that other features could come at the cost of scalability and higher costs.

“Bitcoin is designed to be censor-resistant. This doesn’t stop us from mildly commenting on the sheer waste and stupidity of an encoding. At least do something efficient,” Blockstream CEO and long-time Bitcoiner Adam Back said.

we can recognize we can't really stop them and it's a free world with anonymous miners. but we can also educate and encourage developers who care about bitcoin's use-case to either not do that, or do it in a prunable space-efficient eg time-stamp way.

— Adam Back (@adam3us) January 29, 2023

On the other hand, supporters noted that it can attract more people and extend the Bitcoin network’s use cases. For one, Dan Held has described it as a net benefit for Bitcoin, saying, “It brings more financial use cases to Bitcoin and drives more demand for block space (aka fees).”

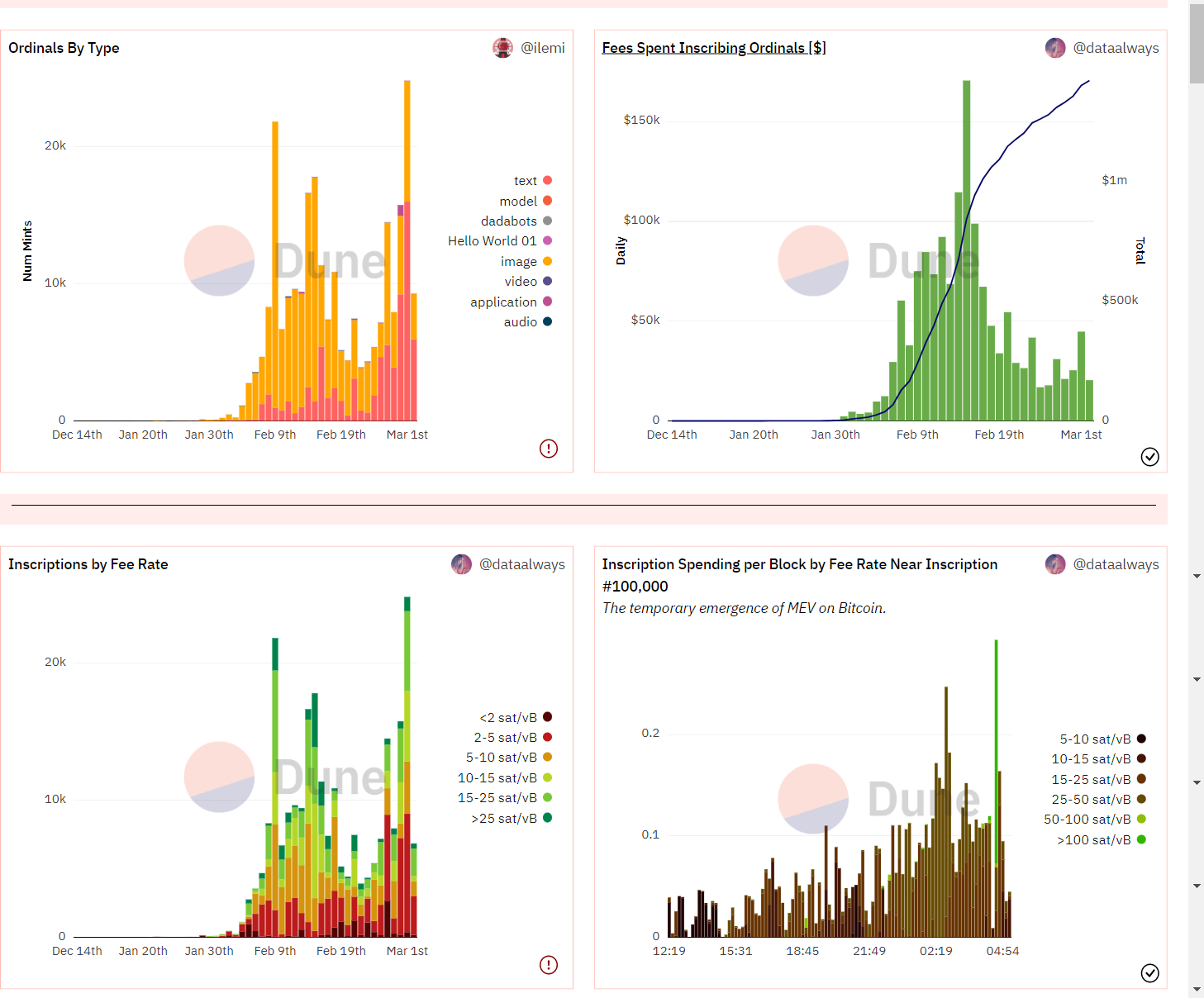

Nevertheless, Ordinals proved to be a hit, taking the Bitcoin blockchain by storm. Since January, more than 252,000 Ordinals have been inscribed to the Bitcoin network, bringing more than $1.42 million in fees for miners, as per a Dune Analytics dashboard.

Robert Quartly-Janeiro, Chief Strategy Officer of crypto exchange Bitrue, said the Bitcoin community’s predilection for Bitcoin Ordinals “remains a matter of conjecture,” as it hinges on the needs and desires of the wider user base. He added:

“Whilst it is innovative, there is a risk that it waters down the belief in Bitcoin by using the smallest denomination of it and looking to cash in on the value therein by trading off a name – it’s also not an uncomplicated process to achieve it.”

Quartly-Janeiro mentioned that if the success of the Ordinals project is community-led, it indicates that Bitcoin is “inherently adaptive and can evolve over time to accommodate new use cases. The acceptance of Ordinals on the network is a testament to this adaptability and serves as a good indicator for the network’s future growth.”

However, there is a long way to go before Ordinals become what NFTs are on the Ethereum blockchain, that’s according to Simon Davis, CEO and co-founder of Mighty Bear Games. “The wallets are not there yet and they can’t properly transact through a marketplace. Ordinals must be traded over the counter, which is very risky right now,” he said in a comment.

Davis noted that he doesn’t see a rivalry between Ethereum and Bitcoin based on the introduction of NFTs. “More utility for BTC can only be a good thing for the ecosystem as it has the deepest liquidity of all crypto asset classes. Getting the BTC audience interested in applications for the tech and on-chain assets should help the space overall,” he added.

Did Ordinals Impact the Bitcoin Price?

The arrival of the Ordinals Protocol coincided with a big jump in the price of Bitcoin. Since January 20, when Rodarmor officially launched the program on Bitcoin’s mainnet, the OG cryptocurrency is up by around 12% even despite a flurry of aggressive regulatory actions from U.S. authorities.

Although it’s uncertain if the recent rally is connected to Ordinals, the project is considered a favorable development from an investor’s perspective, according to Bryan Courchesne, founder and CEO of DAIM, a crypto asset management firm.

Courchesne noted Bitcoin has long been touted as digital gold, a digitally scarce store of value. Critics have argued that, like gold, it has no utility and therefore the value proposition is weak. “Ordinals help change that,” he stated, adding:

“Adding to Bitcoin’s element of programmability shows that the digital asset can be more than a digital store of value. You can argue the merits of Ordinals but the crypto space has responded favorably in the past to artistic expressions stored on a blockchain.”

“Just like NFTs generated billions of dollars of on-chain economic activity, Ordinals could do the same. And this is just one sign of things to come. Who knows what future upgrades could bring?” Courchesne said.

“We do know that through all of this Bitcoin will maintain its status as a digitally scarce hard asset with a proven track record. We think that Ordinals only improve the investment case.”

Ordinals Revive Interest in Bitcoin Development: Is DeFi Next?

Following the arrival of Ordinals, building products on Bitcoin saw a major uptick. This led to an increase in the average Bitcoin block size as more users started to join the network, research firm FSInsight said in a report earlier this month.

The report noted that Ordinals, which have caused higher fees per block, could eventually create a sustainable demand for block space. This could address one reasonable criticism of Bitcoin’s security model, which is the lack of miner revenue attributable to fees.

Furthermore, the excitement surrounding NFTs on Bitcoin has brought new experimentation to the network, including more efforts to bring DeFi to the OG cryptocurrency. Specifically, Ordinals’ success has renewed interest in the Stacks ecosystem.

I cannot keep up with everything happening in the Stacks layer ecosystem. This thing has a life of its own, growing & changing rapidly.

— muneeb.btc (@muneeb) February 24, 2023

Decentralized ecosystems, FTW!

Stacks is a project that seeks to unlock the full potential of the Bitcoin blockchain by bringing smart contracts and decentralized applications. Originally known as Blockstack but rebranded to Stacks in 2020, the project was designed as a layer-1 solution that uses Bitcoin as its base layer.

The platform is powered by the Stacks (STX) token, which fuels the execution of smart contracts, the processing of transactions, and the registration of new digital assets. The token has gained more than 162% over the past month, data by CoinGecko shows.

Nikolay Denisenko, co-founder and CTO at Brighty, a neodigital banking app, said the Bitcoin community has been anticipating the arrival of decentralized applications, claiming that these would benefit the entire ecosystem. He said in a comment:

“They are expected to add more utility and encourage the development of commercial projects, and – potentially – draw in new developers and expand the range of use cases. As the most secure blockchain, Ordinals and smart contract capabilities would complement what Bitcoin has to offer.”

It’s unclear how significant the new narrative of NFTs and smart contracts on the Bitcoin blockchain will be. Nonetheless, the fact that Bitcoin advocates can shift from one narrative to another shows that the leading cryptocurrency can adapt to changing times.