Will Crypto Recover? – Market Outlook (Updated May 2024)

2023 marked a rebound following late 2022’s market wide crypto crash, but the market is still well off its highs. Will crypto recover, or is crypto over? Or, could it be that the best days are yet ahead?

Recent events, such as the selloff following a flurry of Bitcoin ETF filing approvals, leave the market more jittery than ever. And deleveraging-fueled tumbles, while healthy for the long-term market, rattle investors as prices falter.

In this article, we explore the current crypto landscape to better understand what may lie ahead for the volatile cryptocurrency market. Let’s examine the puzzle pieces to see how they fit — and what the picture might look like when assembled.

How is the Crypto Market Performing Right Now?

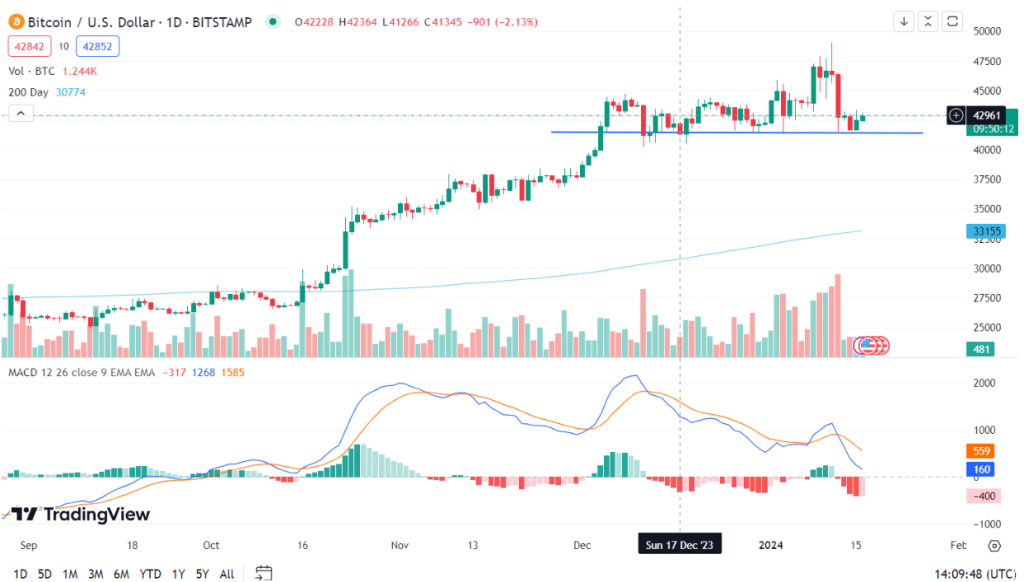

Recent days have the crypto market trading largely sideways, with Bitcoin seemingly rangebound between $41,700 and $42,900. Prior to and immediately following the ETF approvals on January 10th, Bitcoin (BTC) traded above $46,000, briefly reaching $48,000.

Likewise, Ethereum (ETH) stumbled slightly, following the same trend and timeline. The second largest cryptocurrency by market capitalization topped $2,700, later dropping to the $2,500 range in the following days.

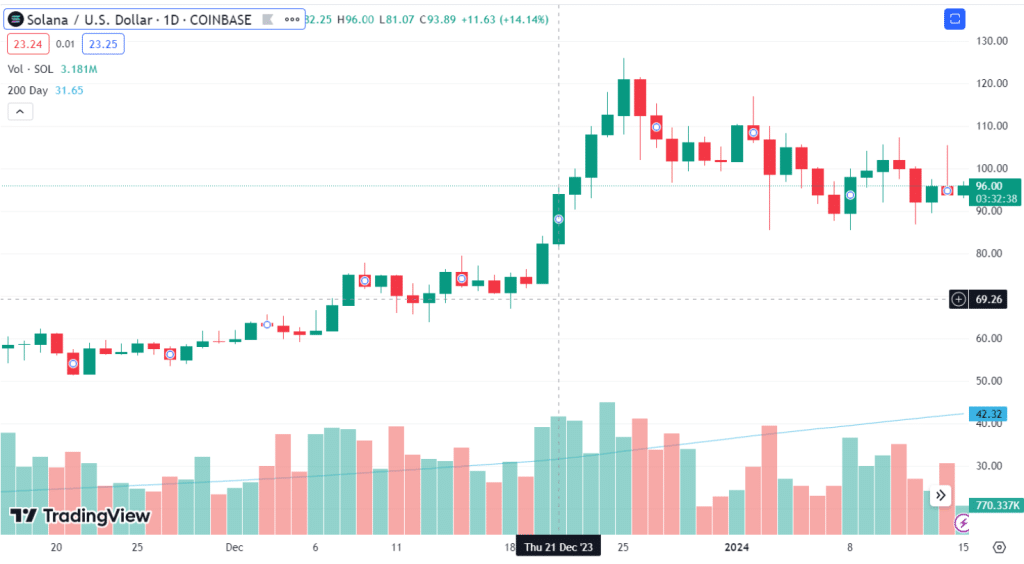

Many altcoins like Cardano and Solana peaked much earlier, both reaching short-term highs near Christmas of 2023. Since the holiday, Solana (SOL) fell from $123.76 to $96.40, a 22% decline.

Similarly, Cardano plummeted from $0.66 to $0.54 in the weeks following the Christmas holiday, an 18% drop.

So why is crypto crashing, and when will the crypto market recover? Previously, we explored possible reasons why the crypto market is down, coming away with a mix of events as root causes.

- Bitcoin ETF approvals. Following their launch, the 11 Bitcoin ETFs saw $4.6 billion in trading volume on the first full day of trading, followed by 3.1 billion on day two. Much of that volume centered on GBTC, which previously had been the troubled Grayscale Bitcoin Trust and had traded below net asset value (NAV) for months prior to its ETF conversion. Comparatively high fees for the fund likely drove outflows that may have offset potential initial gains for BTC and its ETFs.

- Stalled momentum. Immediately after the ETF approvals, BTC didn’t skyrocket, nor did it plummet. Instead, prices remained steady, rising slightly but eventually falling after it became clear that we weren’t headed to the moon just yet.

- Leverage unwinding. Margin trades allow investors to make larger bets on crypto prices, but when the market turns, leverage can steepen downturns. A small move down can create cascading effects as highly leveraged have to close positions of face liquidation. The forced selling often creates more selling.

Which Cryptos are Crashing in May 2024?

BTC typically leads the market up or down, but altcoins can move more dramatically. Changing narratives and profit-taking often play pivotal roles. Here’s what we’ve seen in the past seven days, focusing on the top 100 cryptocurrencies by market cap.

- Stacks (STX): The STX network, a layer 2 to enable smart contracts for Bitcoin, fell by more than 20% in the past seven days, more than doubling the drawdown of BTC itself, down 9% in the same period. With one-month gains of nearly 60% for STX, BTC’s downturn likely inspired profit-taking for in-the-money STX traders.

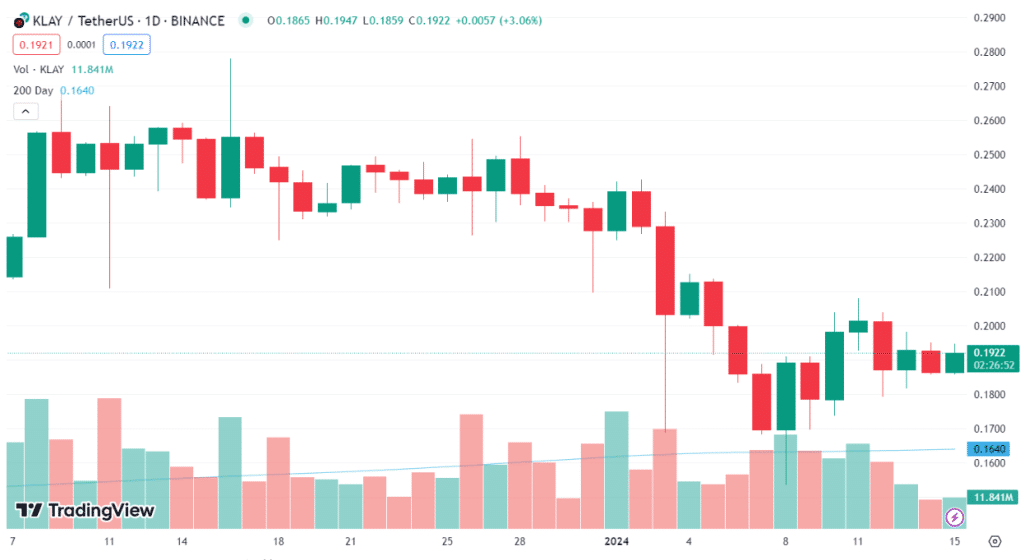

- Klaytn (KLAY): Nearly tripling in value between September 2023 and the new year — and climbing more than 38% in one day, KLAY lost its steam shortly thereafter. The crypto fell more than 20%. However, showing its volatility, KLAY jumped by 17.5% in the past 24 hours.

- Bitcoin (BTC): As the market leader, BTC’s price movements typically nudge the broad market upward or lead declines. Since the ETF launch, the largest crypto by market cap has returned 9% of its runup gains and now trades close to short-term support. Less than three months prior, BTC traded at under $30,000. A 50%+ increase in a relatively short time was bound to lead to profit-taking.

- Bitcoin SV (BSV): Bitcoin Satoshi’s Vision posits itself as the original Bitcoin blockchain, true to Satoshi’s goal for Bitcoin. Over the past 30 days, BSV far outpaced BTC in gains, but comparing the charts, also shares several of BTC’s dips. BSV lost 8% in the past seven days.

Which Cryptos are Likely to Recover First?

-

Ethereum

While it didn’t make the list above because ETH has performed well, Ethereum may still see additional gains in the coming weeks and months. The second-largest cryptocurrency by market cap enjoyed 11% gains in the past seven days, a week in which BTC fell — along with popular tokens like Solana (SOL), Injective (INJ), and Internet Computer (ICP).

Related layer 2 tokens, including Arbitrum (ARB), and Polygon (MATIC), saw gains alongside ETH, highlighting a divergence between BTC and leading EVM-compatible networks. Layer 2 activity benefits Ethereum as well as the layer 1 chain.

While still below its 2021 high of $4,878, ETH’s climb from its lows when it fell beneath $900 in 2022 to over $2,500 today illustrates its resilience.

Which crypto will recover the fastest? Cryptocurrencies likely to recover first include ETH, largely due to the continued popularity of decentralized applications, in which EVM-compatible chains lead the market.

-

Bitcoin

Will Bitcoin go back up, and is Bitcoin a good investment? Bitcoin and Ethereum couldn’t be more different, but the two leading cryptocurrencies share an important commonality: limited supply with growing demand.

The Scarcity Narrative

Bitcoin’s supply cap of 21 million Bitcoin creates competition for coins, particularly with the recent launch of 11 ETFs and the ability for retail investors to easily add BTC to portfolios. Additionally, Bitcoin’s halving will occur in April of 2024, cutting the supply of new bitcoins by 50%. Historically, Bitcoin halvings have led to double or triple-digit gains in the months following the halving.

Ethereum does not limit its supply in the same way. Instead, ether, the cryptocurrency of the Ethereum blockchain, creates new tokens for staking rewards while burning some of the ETH collected as transaction fees. The result, thus far, has been slightly deflationary. Leading layer 2 networks like Arbitrum and the newly launched Base network use ETH natively as gas to execute smart contracts. At the same time, the percentage of staked ETH continues to increase.

Scarcity amid growing demand gives reason to expect BTC and ETH to be amongst the most resilient cryptocurrencies.

Is it Safe to Invest In Cryptocurrency Right Now?

Moreso than most traditional assets, crypto brings price risk. But that same volatility fuels the spectacular gains for which crypto is known.

Outside of short-term trades, crypto follows a similar investment ethos as traditional investments: research projects carefully and consider long-term potential. However, it’s also important to weigh the network effect.

Arguably, Bitcoin and Ethereum don’t lead the market because they offer the best solutions. Hindsight allows newer projects to learn from shortcomings and improve upon established blockchain tech. They were, however, first — and still enjoy the best combination of usage and acceptance.

Crypto still faces challenges, particularly on the regulatory front, but the long-term potential remains appealing to investors. Newer crypto traders can consider a diversified portfolio that uses BTC and ETH as a solid base while allocating a percentage of their investment to promising new cryptocurrency projects. These might include Chainlink (LINK), Internet Computer (ICP), and other top-20 cryptocurrencies.

Dollar-cost averaging also helps combat day-to-day price volatility. By buying a fixed dollar amount on a regular schedule, you automatically buy more when prices dip, optimizing your average cost without needing to monitor charts and trading indicators. This strategy reduces risk but can’t remove price perils entirely.

How Do We Know if Crypto Will Recover?

The emerging theme is as old as markets themselves: supply and demand. Collectively, BTC and ETH make up 70% of the crypto market. And both cryptocurrencies have limited supplies, although managing supply by differing mechanisms.

With supply as a backdrop, here are some reasons why demand may continue to increase, not just for ETH and BTC but for innovative projects throughout the crypto world.

- Increased adoption: Bitcoin ETFs play a significant role in making crypto a mainstream investment. As a bonus, the increased awareness will bring many new investors into the crypto ecosystem directly. Investors may hold a share of BTC or ETH through ETFs while also taking self-custody of additional crypto holdings.

- Technological advancements: Although 15 years in, we’re just at the beginning of this new revolution in finance. We’ve already seen impressive leaps in tech. Newer projects like Kaspa offer the security of Bitcoin while processing ten blocks per second on Testnet compared to one block every ten minutes for Bitcoin. Examples like this exist throughout the crypto landscape. We’re still early.

- Regulatory clarity: Countless lawsuits by the SEC and regulatory actions in other jurisdictions have made investors leery of participating in a crypto market that could disappear. The approval of 11 BTC spot ETFs in the US should lead to additional clarity in other cryptocurrencies as well. However, the process will take time.

- People-friendly improvements: Several products, including the Tangem wallet, aim to make crypto easier to use while still offering offline security. Crypto’s adoption hinges on ease of use combined with secure storage. Expect continued innovation on this front.

- Crossover utility: Projects like Chainlnk, Avalanche, and Cosmos promise to connect the traditional finance world with the blockchain world. When we can use tokens to access the value of real-world assets, crypto becomes a disruptive technology that can replace many areas of traditional finance.

How is Crypto Different From Other Investments?

- Volatility: Crypto’s roller-coaster volatility can be both a blessing and a curse. While BTC towers over the S&P 500’s performance over the past five years, shown below, it’s also easy to see where many investors lost incredible amounts of money when the crypto market crashed. Digital asset investors benefit from a thick skin.

- Valuation metrics: Unlike traditional investments like stocks, cryptocurrencies can be more difficult to value. In many cases, there are no earnings, making measurements like price to earnings or revenue per share moot. Instead, investors need to consider adoption rates, supply and demand, and transaction volume. In some ways, crypto parallels the dot-com bubble in that there were few reliable metrics on which to base an investment. However, many of those once-struggling companies are thriving today.

- Regulation: Crypto remains largely unregulated. This makes it essential for investors to study investments carefully to the reduce risk of investing in scams. Contrarily, crypto’s outside-the-box approach is also its biggest draw. A blockchain-based future has the potential to change nearly every industry.

- Transferability: Traditional investments like stocks and bonds, or even real estate, are difficult to trade without an intermediary. By contrast, crypto can move across the planet in seconds. This comes with security concerns, however, requiring users to educate themselves on safe storage and best practices.

Tips for Avoiding Crypto Crash Panic

The entire crypto market is smaller than Apple’s market cap. Crypto’s relatively small size makes it susceptible to flash crashes, panic selling, and even manipulation. Long-term investors must be able to filter out the noise, but there’s a more important adage to follow.

Never invest more than you can afford to lose.

If you choose to invest and find yourself on the wrong side of a trade, there may not be reason to panic. Here are some steps you can take to reduce your risk.

- Avoid impulsive moves. Drops of 5%, 10% or more remain common in crypto. Revisit your reasons for making an investment in the first place. If those reasons are still valid, it’s often wiser to ignore short-term price movements.

- Diversify your investment portfolio. Concentrated investments can enhance your returns but also increase risk. Consider investing in several industries and financial instruments, including stocks, bonds, real estate, commodities, and crypto. Selloffs in one sector often benefit other sectors. Also, consider a core investment in blue-chip cryptos like ETH and BTC. If you want to take a chance on the fastest-growing cryptocurrency or a new project as well, invest prudently.

- DYOR: Do your own research. Social media has become a hotbed of activity for crypto pump-and-dump scams and influencers hawking projects of dubious value. If a project interests you, look for a whitepaper and study the token supply, project leadership, and other key factors before investing. Research it yourself.

- Dollar-cost averaging: When you find a project that matches your investment goals, build a position slowly. Dollar-cost averaging helps to smooth out your buying cost, automatically buying more when prices are lower. By optimizing your buying costs, you’re building a buffer that insulates against losses if (when) prices crash temporarily.

Will Crypto Recover? Our Final Thoughts

Individual crypto assets could go to zero, much like traditional stocks sometimes lose their value. However, the crypto market as a whole has 15 years of history to prove the industry is still innovating and that adoption is growing. The future of cryptocurrency still looks promising and, in many ways, poses more opportunities with fewer risks than when crypto was a fringe asset.

When will crypto recover to its previous highs? A return to 2021’s market peak may take years, but it can also happen much faster than many expect. It’s likely that market-leading cryptocurrencies like BTC and ETH will continue to dominate the market. However, the crypto market offers boundless opportunities for additional success stories, some of which may not yet exist.

References

- Reuters.com: US bitcoin ETFs see $4.6 billion in volume in first day of trading

- Coindesk.com: Shares in Grayscale’s Bitcoin Trust Trade at 36% Discount to Fund’s NAV

- Coingecko.com: Ethereum Price

- CNBC.com: Bitcoin is one year away from a major technical event

- Cointelegraph.com: Bitcoin Halving: How it works and Why it matters

- Coingecko.com: Ethereum Staking Statistics 2023

Will Crypto Recover in 2024 and Other FAQs

Will Crypto Recover in 2024?

2024 will likely see continued recovery toward all-time highs of 2021. Watch for adoption and inflows into Bitcoin ETFs as well as perhaps a launch of one or more Ethereum ETFs. The added demand for bitcoins and ether with limited supply could be the rising tide that lifts all boats.

Which Crypto Will Recover the Fastest?

Ethereum (ETH) has shown the greatest strength in recent weeks, proving resilient when other assets like Bitcoin swooned. Smaller projects may see more dynamic returns but with the possible expense of added risk. A portfolio using a core investment of BTC and ETH provides relative safety but also benefits from retail demand both in ETFs and spot markets.

How Long Will it Take Crypto to Recover?

Many expect 2024 to be a pivotal year, although recovery has already begun. BTC has tripled since its lows, while ETH’s price quadrupled since its lows in 2022. A return to all-time highs – and beyond – could still take years, although crypto markets move quickly, potentially recovering much faster.

How do We Know if Crypto Will Recover?

As with any industry, there are no guarantees. However, there are some metrics to watch that give reason for optimism. Look to adoption rates and inflows, both in ETFs and on smart-contract networks like Ethereum where total value locked (TVL) provides a measure of real usage.

Is Crypto Over?

Crypto’s meteoric rise and subsequent crash point to high volatility. However, a crash is not the end, and the crypto market has already recovered much of its losses. BTC and ETH, which make up 70% of the market, both have limited supplies. As demand continues to rise, prices for both should increase as well.

Sergio Zammit

Sergio Zammit

Kane Pepi

Kane Pepi