How to Buy XRP (Ripple) – Easy Guide 2024

Launched in 2012, Ripple (XRP) is a large-cap cryptocurrency. Its technology enables financial institutions to make cross-border payments considerably faster and cheaper than SWIFT. Since its inception, XRP has increased by over 9,000%.

In this guide, we explain how to buy XRP from a trusted exchange. Read on to discover the safest and most cost-effective way to invest in Ripple in 2024.

Key Considerations Before Buying XRP

Before you buy XRP, there are some important considerations to make. For a start, XRP is a volatile cryptocurrency; its value can move in wild pricing swings. As such, never invest more than you can realistically afford to lose. XRP’s pricing is based on many factors, including market demand, regulatory developments, and broader adoption. For a more detailed forecast of what XRP’s price could do in the coming years check out our Ripple price prediction.

For example, when a major financial institution begins using the Ripple network, this can have a positive impact on XRP’s value. In contrast, a negative news story can result in XRP’s value dropping.

Until recently, many US-based exchanges refused to list XRP. This is because of an ongoing court battle with the SEC. Put simply, the SEC accused Ripple of selling unregistered securities. Fortunately for investors, the courts partially ruled in Ripple’s favor in 2023. This resulted in XRP’s value increasing by over 70% in just 24 hours.

What’s more, in light of the news, a wave of US exchanges announced that they would once again list XRP. Nonetheless, you should also remember that the IRS views cryptocurrencies as property. This includes XRP, so any profits you make could be liable for capital gains taxes. We explain how to avoid crypto taxes legally in our comprehensive guide.

How to Buy XRP

Now that we’ve considered the basics, we’ll explain how to buy XRP in 2024.

Step 1: Selecting a Trading Service or Venue

The first step is to choose where to buy XRP. Most investors opt for a reputable cryptocurrency exchange that supports their preferred payment method. For example, buying XRP with a debit/credit card or PayPal means a simple and fast investment process. Some exchanges also support bank transfers via ACH, SEPA, and Faster Payments.

Consider how long the XRP exchange has been active and whether it’s adequately licensed. It’s also worth exploring whether the exchange supports other popular cryptocurrencies. In addition to XRP, some of the best cryptocurrencies to buy include Bitcoin, Ethereum, Dogecoin, Solana, and BNB.

We’d also suggest exploring fees. For example, how much does the XRP exchange charge on fiat deposits? And what trading commissions will you need to pay when buying and selling XRP? It’s also worth checking whether the XRP exchange is user-friendly, and what tools it offers to help you make smart investment choices.

Step 2: Register With an XRP Exchange

The next step is to register an account with an XRP exchange. Unless you’re depositing another cryptocurrency to pay for your XRP investment, you’ll need to complete a KYC (Know Your Customer) process.

This is a legal requirement when cryptocurrency exchanges handle fiat money, such as US dollars or euros. So, you’ll need to complete a registration form by typing in your full name, nationality, and residential address.

Next, you’ll need to provide a government-issued ID. This often needs to be held against your face. The exchange will also need a document verifying your country of residence.

A utility bill or bank statement will suffice, but make sure it was issued within the prior three months. The best cryptocurrency exchanges will verify your documents within a few minutes.

Step 3: Connect to a Payment Option

The next step is to connect a payment method to your account. Most exchanges enable you to deposit funds with a debit/credit card, issued by either Visa or MasterCard.

There’s often support for popular e-wallets too, like PayPal and Neteller. Bank transfers are another option, although this can delay the process.

Step 4: Understanding Fees and Costs

Before proceeding, it’s important to know what fees you’ll be required to pay when buying XRP. For example, you’ll likely need to pay a deposit fee when using fiat money. Debit/credit cards and e-wallets are usually the most expensive, often costing up to 5%.

We found that bank transfers are often fee-free, depending on the payment network. While ACH is usually free, international bank wires can be costly.

- You might find that some exchanges enable you to buy XRP instantly.

- However, fees are sometimes built into the exchange rate. This makes it difficult to know what fees you’re actually paying.

- You should also consider the market spread. For example, suppose the XRP spot price is $0.55 but you’re paying $0.57. This means you’re overpaying by $0.o2 for every XRP you buy.

XRP exchanges also charge trading commissions. This is usually a variable percentage based on how much you buy. For instance, if the exchange charges 0.5% and you buy $1,000 worth of XRP, you’re paying a commission of $5.

Step 5: Placing an XRP Order

Now it’s time to buy XRP. Most exchanges list hundreds of cryptocurrency markets, so it’s best to use the search box. Look for a trading pair that aligns with your account currency. For example, if you deposited US dollars, you’ll want to trade XRP/USD.

Once you’re on the correct trading page, you’ll need to set up an order. We’d suggest placing a market order, as the exchange will process the purchase immediately.

Some investors opt for a limit order, which enables them to set their entry price. However, the limit order will only be executed once the target XRP price is achieved.

Either way, you’ll need to specify how much XRP you want to buy. You can state this in your account currency. For example, if you type in $1,000, you might get around 1,800 XRP.

After checking everything has been entered correctly, you can place the XRP order.

Step 6: Safe Storage

There’s a common saying in the cryptocurrency world; “not your keys, not your coins”. Put simply, this means that while your XRP coins are held on an exchange, you don’t own them. This is why most investors will withdraw their XRP to a private wallet.

This will give you full ownership of the coins. It also means you can transfer funds without needing authorization from an exchange. We discuss the best XRP wallets later in this guide.

Once you’ve selected a wallet, you can make a withdrawal request from the exchange. Simply provide your wallet address and the XRP withdrawal amount. The XRP coins will usually be released within 24 hours, almost this is often much faster.

Where to Buy XRP

Most cryptocurrency investors use online exchanges to buy and sell XRP. After all, you won’t be able to purchase XRP directly from Ripple, as this would constitute selling unregistered securities.

In addition to cryptocurrency exchanges, there are other ways to purchase XRP. This includes decentralized finance (DeFi) platforms, peer-to-peer exchanges, and cryptocurrency ATMs.

We discuss the best ways to invest in XRP in the following sections.

Cryptocurrency Exchanges

Let’s start with the most common option; cryptocurrency exchanges. According to CoinMarketCap data, hundreds of exchanges list XRP pairs in 2024. This gives you ample choice.

Still not sure which XRP exchange is best? We review two leading options below.

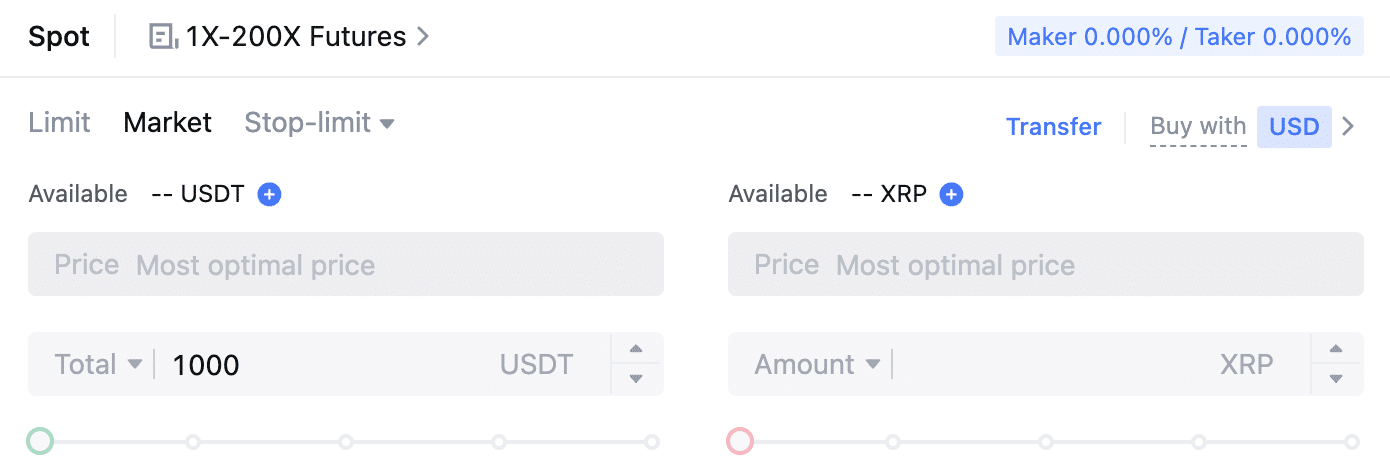

1. MEXC – Trusted Exchange With XRP Trading Fees of 0.1%

We like MEXC when buying and selling XRP – especially for beginners. MEXC supports a wide range of payment methods, making it easy to deposit and withdraw funds. Depending on the country of residence, investors can directly purchase XRP with a debit/credit card. Google/Apple Pay and bank transfers are also available in some regions.

Deposit fees vary depending on the payment provider. In terms of trading commissions, MEXC charges just 0.1% per slide. This amounts to $1 for every $1,000 traded. MEXC offers XRP trading against many cryptocurrencies, including USDT, BTC, and ETH. It supports market and limit orders, not to mention live XRP pricing charts.

MEXC is also considered a trusted exchange; its verifiable proof of reserves exceeds $1.5 billion. Most of this figure is held in liquid digital assets like Bitcoin and USDT. MEXC also offers XRP futures markets. Not only does this support long and short orders but you can apply leverage of up to 200x.

Pros

- Instantly buy Ripple with fiat money

- Accepts debit/credit cards, bank transfers, and selected e-wallets

- Trading commissions of just 0.1% per slide

- Supports dozens of XRP trading pairs

- Offers XRP futures with 200x leverage

Cons

- Some nationalities need to use third-party payment providers

- Doesn’t accept US investors

| Exchange | Deposit Fee | Commission to Buy XRP |

| MEXC | Stated when making the debit/credit card deposit. Varies depending on the payment method currency, and country of residence | 0.10% |

2. Binance – Popular XRP Exchange With Advanced Trading Tools

Binance is also worth considering when exploring where to buy Ripple. Americans have access to a dedicated US platform that supports debit/credit cards and bank transfers. Payment fees are shown when completing the payment. Binance.US charges just 0.1% per slide when trading XRP. Lower commissions are offered on larger monthly volumes.

What’s more, if you decide to buy Bitcoin, you’ll secure commissions of 0%. If you’re based outside of the US, you’ll have access to the main Binance exchange. This also offers trading commissions of 0.1%. Both Binance platforms are ideal for advanced traders, considering the analysis tools available.

For example, Binance offers live order books, custom order types, technical indicators, and chart drawing tools. It also offers OTC (Over-the-Counter) services when buying large quantities of XRP. Binance also offers a native mobile app for iOS and Android. The app enables you to buy, sell, store, send, and receive XRP with ease.

Pros

- Largest cryptocurrency exchange by trading volume

- Low commissions of just 0.1%

- Debit/credit card payments are processed instantly

- Huge liquidity ensures competitive exchange rates

- Bitcoin withdrawals are usually approved in minutes

Cons

- Some features are aimed at advanced traders

- 2% deposit fees when using Visa or MasterCard

| Exchange | Deposit Fee | Commission to Buy XRP |

| Binance | Depends on the exchange (US or global), payment method, and currency. Some banking methods are fee-free. Debit/credit cards average 2% | 0.10% |

DeFi Platforms

Another option when learning how to buy XRP is DeFi platforms. These are decentralized exchanges (DEXs), enabling you to trade XRP without a centralized intermediary. This often means you can buy XRP anonymously.

We rate Trust Wallet as the best DeFi platform and here’s why:

Best Wallet – Trade Anonymously With a Decentralized Exchange

Best Wallet is a non-custodial wallet that doubles as a DEX. The Best Wallet DEX offers a fast and hassle-free way to trade cryptocurrencies. Unlike traditional exchanges, there’s no requirement to open an account. Simply connect a private wallet to the DEX to get started. This means you can trade without revealing your identity.

What’s more, Best Wallet leverages liquidity pools rather than order books. In simple terms, this means you can trade cryptocurrencies without needing another market participant. For example, suppose you have USDT and want to swap the coins for XRP. The exchange will be processed immediately via an XRP/USDT pool.

Cryptocurrency swaps are sourced from external liquidity pools, ensuring that traders get the best market prices. Moreover, Best Wallet doesn’t charge commissions. A drawback with Best Wallet – like other DEXs, is that it doesn’t accept fiat money. Although third-party fiat gateways are supported, this will trigger a KYC process.

Pros

- No account required – trade anonymously

- Uses external liquidity pools to secure the best market prices

- Trade safely via autonomous smart contracts

- Doubles up as one of the best decentralized crypto wallets

Cons

- Fiat gateways will trigger KYC requirements

- Some features are still being developed

| Exchange | Deposit Fee | Commission to Buy XRP |

| Best Wallet | No fees for cryptocurrency deposits. Fiat gateway fees are determined by the payment provider | None – exchange rates are determined by the liquidity pool. Network fees apply |

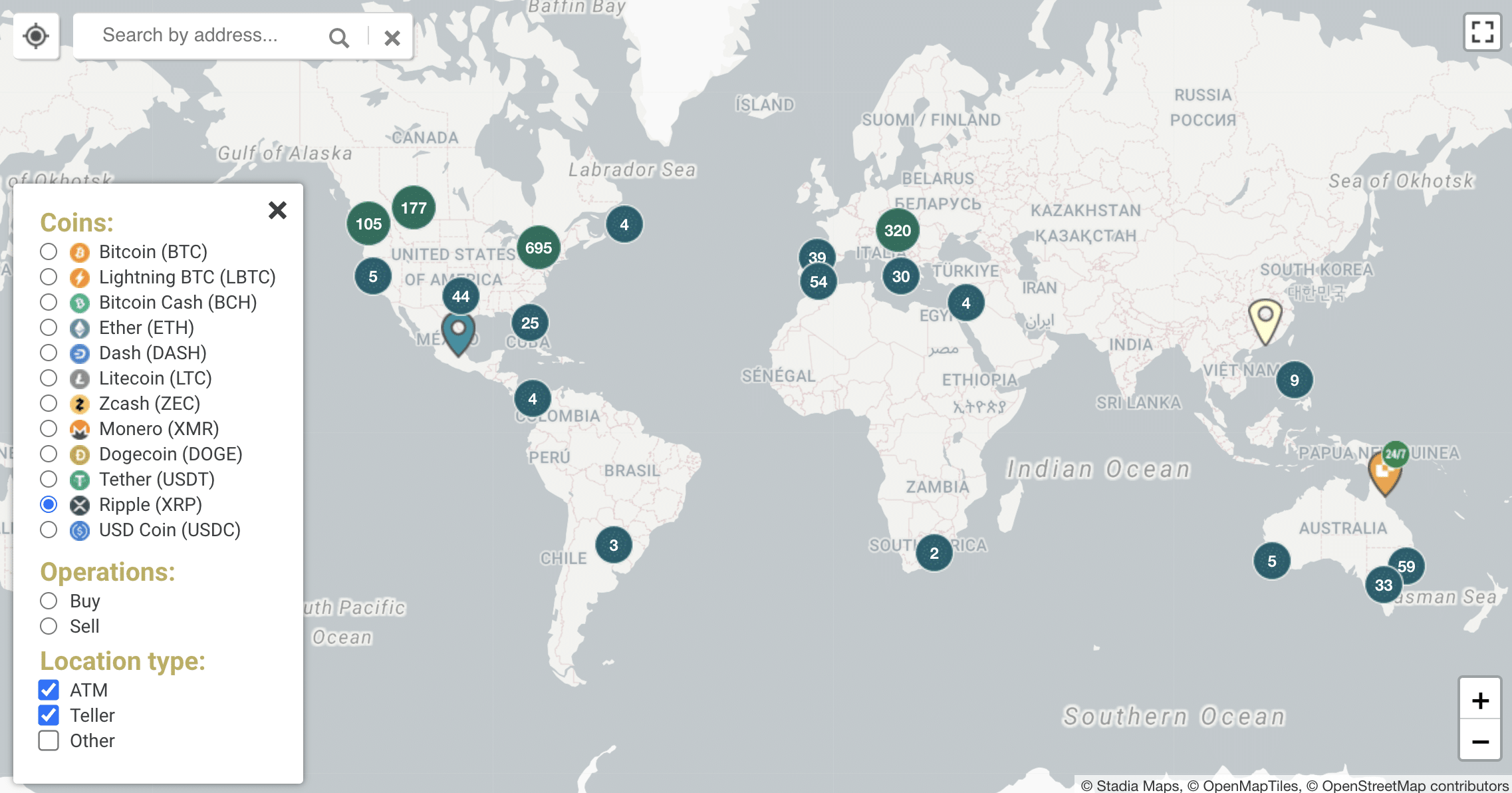

Crypto ATMs

According to CoinATMRadar, there are more than 1,000 cryptocurrency ATMs supporting XRP. This includes locations throughout the US, Canada, Europe, and Australia.

Cryptocurrency ATMs appeal to investors who want to use cash to buy XRP. Once you’ve found a location, you’ll need to state how much you want to invest. The ATM will then break down the fees. If you want to proceed, you’ll need to insert the exact amount of cash into the ATM.

Some cryptocurrency ATMs ask for a wallet QR code. This means the ATM will transfer the XRP to your chosen wallet remotely. We also found ATMs that provide a printed receipt. This will contain the wallet details to claim the XRP coins yourself.

Although cryptocurrency ATMs can be a convenient way to buy XRP, fees are usually sizable. For example, Localcoin ATMs charge 14.8% when buying XRP. In contrast, online exchanges like MEXC and Binance charge just 0.1%.

Peer-to-Peer (P2P) Platforms

Another option is to buy XRP from a peer-to-peer (P2P) platform. This cuts out the middleman, as you’ll be trading directly with sellers.

Here’s how it works:

- On your chosen P2P platform, you’ll enter the amount of XRP you want to buy and your preferred payment method. A list of suitable sellers will then be displayed, based on the exchange rate offered.

- After choosing a seller, they’ll provide you with their payment details. You’ll notify the seller once the transfer has been made.

- The seller will then release the XRP coins, which are deposited into your P2P wallet.

- You can then withdraw the XRP to your private wallet.

The benefit of buying XRP from a P2P exchange is that you can use local payment methods. The drawbacks include above-average fees and an increased risk of being scammed.

Payment Processors

Some cryptocurrency exchanges and wallets use third-party payment processors. This enables users to conveniently buy XRP with their chosen payment method. The payment processor will conduct KYC requirements on behalf of the exchange/wallet.

After completing the purchase, the payment processor will transfer the coins to the respective account. We found that this option can be costly. For example, Simplex – which is partnered with many exchanges and wallets, charges between 3.5% and 5% on debit/credit cards.

Cryptocurrency Apps

Cryptocurrency apps offer another way to buy XRP. These are usually iOS and Android apps offered by exchanges. This option will appeal to investors who prefer trading on a smartphone device.

Fees, payment methods, and user-friendliness will depend on which provider offers the app.

Storing Your XRP Safely

Now that we’ve covered where and how to buy XRP, let’s talk about storage. Put simply, XRP is a digital asset that must be stored in a suitable wallet. This section explains the different ways to store XRP in 2024.

XRP Reserves

- Unlike other cryptocurrencies, the Ripple network requires XRP to hold a minimum ‘reverse’.

- The reserve was previously 20 XRP but has since been reduced to 10 XRP.

- This means that 10 XRP of your wallet balance cannot be withdrawn. This is to prevent the network from spam attacks.

- For example, suppose you transfer 1,000 XRP to your wallet. After the 10 XRP reserve, you can only use 990 XRP.

Crypto Exchanges

The most convenient way to store XRP is with the exchange you used to make the purchase. The XRP coins will be kept in your web wallet, which can be accessed by logging into your account. This makes it simple to trade XRP at any time. Moreover, the account should come with various protections, such as device whitelisting and two-factor authentication.

However, storing XRP with a cryptocurrency exchange is also one of the riskiest options. If the exchange is hacked, your XRP coins could be at risk. And, if the exchange doesn’t have enough reserves to cover the hack, you might not have anywhere to turn. Consider that in 2022, more than $3.8 billion worth of cryptocurrencies were stolen from exchanges and other platforms.

Therefore, investors should only keep small amounts of XRP on an exchange. The result should be transferred to a private wallet.

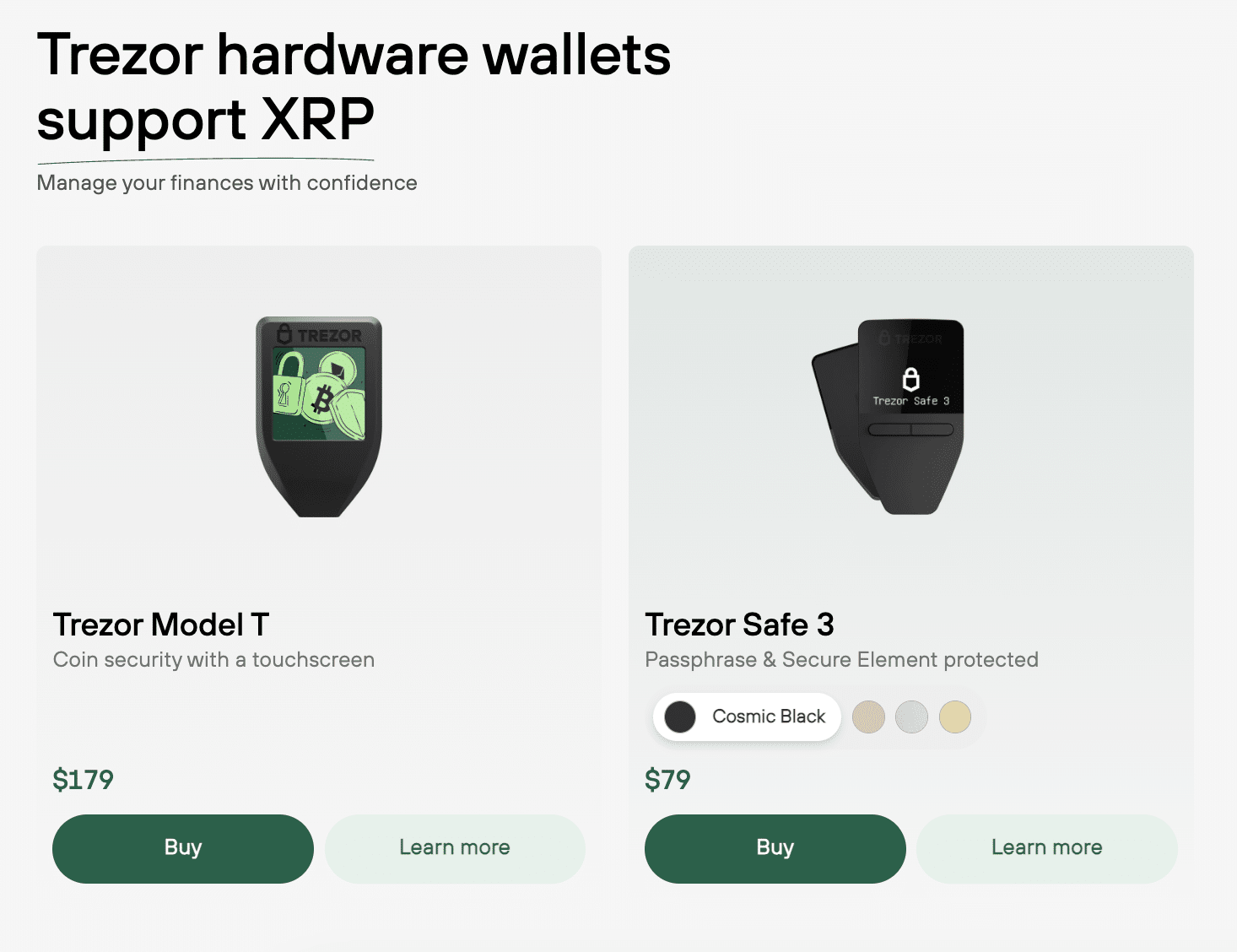

Cold Wallets

Cold wallets come with two crucial safeguards.

First, cold wallets offer non-custodial storage. In contrast to cryptocurrency exchanges, this means only you have access to your private keys. This prevents anyone else from accessing the wallet. It also means you can freely transfer XRP coins without needing permission from a third-party custodian.

Second, the majority of cold wallets come as a hardware device. This means that the private keys are always offline. To make an XRP transfer, you’d need to enter a PIN on the device. Transfers cannot be made without the PIN. Cold wallets are the best option if you’re planning to invest a lot of money into XRP. Popular options include Trezor and Ledger.

Paper Wallets

Paper wallets are another way to keep XRP coins in cold storage. The key difference is that you won’t need a hardware device. Instead, the private keys are kept on a sheet of paper – meaning they’re still offline at all times.

This makes it impossible for the wallet to be hacked. That said, if the paper wallet is lost, damaged, or stolen – you won’t be able to recover the funds. What’s more, paper wallets are only suitable for long-term XRP investors.

This is because transferring funds is cumbersome, considering you need to import the private keys into another wallet. You’d then need to transfer the XRP from the new wallet into an exchange.

Hot Wallet

Hot wallets are the complete opposite of cold wallets. This is because hot wallets are always connected to online devices. This is ideal for active cryptocurrency traders, as transactions can be executed at the click of a button.

Hot wallets come in many forms, including mobile apps, desktop software, and browser extensions. XRP coins held in a cryptocurrency exchange would also be considered as hot storage.

The risks of being hacked are a lot higher when using a hot wallet. This is because hot wallets can be hacked remotely. Common methods used by hackers include phishing emails, keyloggers, malware, and blackmail.

To keep your hot wallet safe, ensure your private keys and backup passphrases are kept offline. You should also avoid clicking on links sent from unknown people.

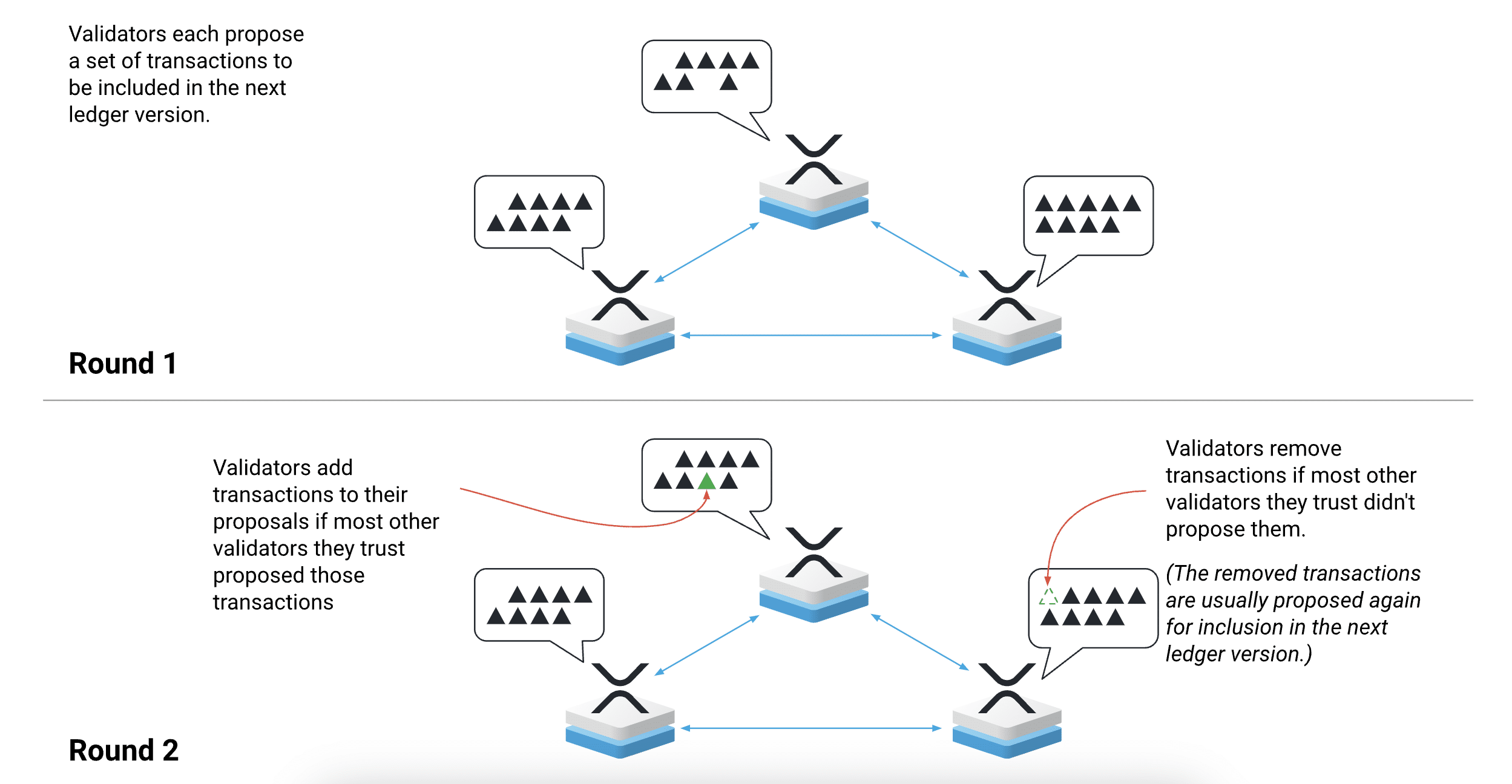

Earning Money By Owning XRP

Unlike Bitcoin and Ethereum, which use proof-of-work and proof-of-stake respectively, Ripple has its own consensus mechanism. Known as the Ripple Consensus Protocol (RCP), this enables the network to process transactions without relying on mining or staking.

The RCP method is not only secure but cost-effective and lightning-fast. The drawback is that the Ripple network doesn’t allow XRP holders to generate income. That being said, it’s still possible to earn yields on a Ripple investment. It’s just that you’ll need to use a third-party platform.

For example, MEXC supports XRP savings accounts. This currently offers APRs of 6% on the first 500 XRP. 1.8% is paid on the next 500 XRP. You’ll earn 0.45% on anything above this threshold. XRP savings accounts on MEXC are flexible, meaning you can withdraw your coins at any time. However, the XRP is lent to borrowers, so you’ll need to consider the risks.

Another option is yield farming. This income method is usually offered by decentralized exchanges. You’ll be providing the exchange with XRP and one other cryptocurrency. This forms a trading pair, which allows the exchange to offer decentralized services. Whenever the trading pair is used by traders, you’ll earn a share of the fees.

Don’t forget that market volatility can directly impact your XRP earnings. This is especially the case if the rewards are paid in XRP. Moreover, you should consider the risks of keeping your XRP coins on another platform. If the platform is hacked or it turns out to be a scam, you could lose everything.

Can you Stake XRP?

- It’s not possible to stake XRP in the traditional sense.

- This is because the Ripple network doesn’t use the proof-of-stake framework.

- That said, you can still put your Ripple investment to work through savings accounts, yield farming, and other income methods.

- Just make sure you consider the risks before proceeding.

How is XRP Different from Ripple and XRP Ledger

The terms XRP and Ripple are used interchangeably. However, Ripple refers to the network while XRP is the underlying cryptocurrency. This is similar to Bitcoin and BTC or Cardano and ADA.

For example, financial institutions use the Ripple network for cross-border payments. In doing so, transactions are processed in seconds. However, XRP isn’t transferred; fiat currencies are.

Fees are subsequently paid in XRP. Transaction fees are charged at a fixed rate of 0.00001 XRP. That said, XRP has another important use case; it provides financial institutions with a bridge of liquidity. This is useful when less liquid fiat currencies are being transferred, such as the Brazilian real or the Moroccan dirham.

Another term to know is the XRP Ledger. This is the blockchain network that backs the Ripple ecosystem. Similar to other blockchains, the XRP Ledger is transparent and immutable.

How to Sell XRP

You can sell your Ripple investment at any time. You’ve got two options when cashing out. First, some investors will look to sell Ripple for another cryptocurrency. For example, Bitcoin, Ethereum, or Tether. The second option is to sell Ripple for fiat money. In this instance, you’ll need to use an exchange that supports fiat withdrawals.

- Both options require you to deposit XRP coins into an exchange. You’d then need to search for the required trading pair.

- For example, suppose you want to sell XRP for US dollars. The required pair is XRP/USD.

- After creating a sell order, the exchange will sell Ripple at the current market price. Your exchange account will then be credited with the equivalent amount in US dollars.

Assuming you have already completed the KYC process, you can then request a bank account withdrawal.

Selling Ripple for a Profit

Hopefully, you’ve sold Ripple for a profit. However, before you re-invest your gains, don’t forget about cryptocurrency taxes. Most countries – including the US, taxes Ripple the same as stocks, ETFs, and other traditional assets. This is known as ‘capital gains tax’, meaning only the profit element is taxable.

For example, suppose you bought 10,000 XRP coins at $0.20. This means you’ve invested $2,000. A few years later you cash out the entire investment at $0.60. This means you’ve returned $6,000. Your capital gains are $4,000, which could be taxed.

Our guide on cryptocurrency tax statistics offers some useful strategies for legally reducing your tax liabilities. That said, you should also consider speaking with a qualified tax advisor who specializes in digital assets.

What Can You Buy with XRP

XRP wasn’t designed as a medium exchange for consumers. On the contrary, it’s used by financial institutions when covering Ripple network fees. What’s more, XRP also provides liquidity when making cross-currency transfers.

Even so, Ripple can still be used to make online purchases. This is because Ripple is supported by BitPay, which enables merchants to accept cryptocurrency payments.

Some of the online merchants accepting Ripple via BitPay include:

- AirBaltic

- Takeaway.com

- Scan Computers

- Ledger

- Namecheap

- AMPEX

- Newegg

Some offline merchants also accept Ripple payments, such as AMC Theatres in the US.

What Future Holds for XRP

When exploring how to buy Ripple, it’s important to consider what the future holds. From an investment perspective, you’ll need the price of XRP to increase. If it does and you decide to sell, you’ll make a profit. Currently, Ripple has a market capitalization of just under $30 billion. This is based on a circulating supply of approximately 55 billion XRP.

However, this only represents 55% of the total supply. The balance is controlled by Ripple, which should be considered a risk. After all, every time Ripple sells XRP on the open market this can have an impact on its price. CNBC explains that while Ripple’s holdings are secured in an escrow account, it can sell up to 1 billion XRP per month.

Based on current prices of about $0.55, this amounts to $550 million worth of potential monthly sales. Ripple investors should also keep an eye on the ongoing battle with the SEC. Although Ripple won a partial victory in 2023, the case is still being reviewed by the courts. The SEC – which has until April 24, 2024, to make its final response, is seeking $770 million worth of fines.

If successful, Ripple would likely cover the fines by selling XRP holdings. All that being said, the Ripple network continues to attract financial institutions. This is crucial, as more institutions using Ripple means increased demand for XRP. It also provides Ripple with a seal of approval, considering it’s already secured the Bank of America, Santander, and Standard Chartered.

The key question is whether Ripple will eventually return to its previous all-time highs of $3.84. This was achieved in January 2018. So, even though we’ve since had a prolonged bull market, Ripple peaked at about $1.60 in mid-2021. Based on current prices, Ripple trades 85% below its all-time high.

Conclusion

In summary, we’ve explained how to buy XRP safely and cost-effectively in 2024. Overall, we found that MEXC is the best option. You can invest in XRP at commissions of just 0.1%.

MEXC accepts convenient payment methods like debit/credit cards and Google/Apple Pay. Most importantly, MEXC has over $1.5 billion worth of reserves, ensuring a trusted investment process.

References

- https://www.cnbc.com/2023/10/19/sec-drops-claims-against-two-ripple-labs-executives-.html

- https://www.irs.gov/businesses/small-businesses-self-employed/digital-assets

- https://xrpl.org/blog/2021/reserves-lowered.html

- https://edition.cnn.com/2023/02/01/tech/crypto-hacks-2022/index.html

- https://xrpl.org/transaction-cost.html

- https://www.blockchain-council.org/blockchain/xrp-ledger-xrpl/

- https://bitpay.com/blog/spend-xrp-businesses-accept-xrp/

- https://www.cnbc.com/2018/01/16/why-ripple-is-not-cashing-out-its-xrp-holdings.html

Frequently Asked Questions (FAQs) About Buying XRP

Where can I buy XRP?

The best way to buy XRP is with a trusted cryptocurrency exchange like MEXC. It takes minutes to register a verified account. You can then invest in XRP instantly with a debit/credit card or e-wallet.

How much does it cost to buy one XRP?

XRP currently trades at about $0.55. This makes it one of the most affordable cryptocurrencies to buy.

Is XRP a good investment?

XRP could be a solid long-term investment, considering that over 100 financial institutions already use the Ripple network. Ripple is also celebrating a partial victory against the SEC. However, there’s no guarantee an XRP investment will make you money – so ensure the risks are considered.

Is it safe to invest in Ripple?

Investing in Ripple is safe when using a reputable cryptocurrency exchange. It’s also safe when storing Ripple in a secure wallet. However, the value of Ripple can decline, meaning there’s a chance you could lose money.

How to buy XRP in USA?

Since Ripple’s partial court victory in 2023, XRP can now be purchased on many US-approved exchanges. This includes Binance.US, Coinbase, and Kraken.

Elliott Lee

Elliott Lee

Michael Graw

Michael Graw

Eric Huffman

Eric Huffman