Nexus platform is a peer-to-peer platform which aims to deliver faster, scalable and more secure blockchain with the help of unique technologies such as satellites, three-dimensional chains and its NXS token.

What is Nexus?

Launched in 2014 under the name of Coinshield, the Nexus project is not exactly new when measured by the years of its existence in the crypto world. Yet, its developers claim that their brainchild will attempt to bring something new to the blockchain, specifically when it comes to the major problems tit wants to tackle:

- Modern blockchain architecture can hardly achieve scalability if each computer on its network is required to process all transactions. The Nexus platform was built on the blockchain architecture which implements the system of parallel processing. It lies at the core of the Nexus’ architecture designated as “Multi-Dimensional Chaining”. Its goal is to offer scaling in line with the expansion of the platform’s user base, without endangering its features dedicated to security or immutability.

- The blockchain is susceptible to the pressure from centralized mining pools which want to grab more power. Instead of centralization, Nexus goes for promoting a distributed system model in which the available resources are still allowed to maintain sufficient levels of integrity. Nexus’s three-dimensional chain features three consensus mechanisms which are supposed to reduce mining centralization. Finally, Nexus’ operation will be ensured via three distinct telecommunication systems which are supposed to further strengthen its promise of fuller decentralization.

- Blockchain may come under various security threats, including that posed by the quantum computers. The Nexus network aims to tackle existing security risks for blockchain while providing its users with the future-proof technologies. For starters, the platform features a time-based security mechanism called Trust which requires continual time-based contributions which are required for transaction validation. The nexus ledger uses 1024-bit Skein and Keccak quantum-resistant hashing algorithms as well as 571-bit private keys. Its signature chains are supposed to protect the users’ accounts by updating key pairs following each transaction.

- Blockchain should be made available to a wider pool of users with the help of other technologies. Nexus developers plan to ensure access to its platform and NXS cryptocurrency with the help of a satellite network in low-Earth orbit. The aim is to have each satellite operate as a node on the Nexus chain and serve as a building block of its smart contract platform. In addition to this, this combination of technologies is supposed to deliver affordable access to distributed services to the millions of users who are not able to connect to the web.

What is the Nexus’ 3D Chain?

To make the attainment of these goals closer to reality, Nexus has implemented the architecture going under the name of Three Dimensional Chain (3DC).

Starting with the Nexus chain, the “3” in its 3DC blockchain actually refers to three consensus channels described as:

- Prime Channel. The Prime Channel on the Nexus network is based around the Proof-of-Work mechanism. This involves the use of 308-digit dense clusters described as “prime” ones. The system is supposed to make the mining done on this channel more resistant to ASIC compared to the standard hash mining. Those who want to try their miners’ luck on this channel may welcome the opportunity to engage in mining which does not require anything but a CPU. In addition to this, the data which is generated by mining done here is to be used in quantum physics research of prime numbers.

- Hashing Channel. The Hashing Channel resembles the Prime Channel in the sense that it also uses Proof-of-Work mechanism. The difference here lies in the use of Hashcash function which substitutes dense clusters of the Prime Channel. While superficially resembling the PoW mining algorithm used by Bitcoin), the miners on the Hashing Channel actually look for SHA-3 with Skein. It is for this reason that mining on this channel should be done with GPU. Finally, block hashes on the Nexus network are four times larger compared to those found on the Bitcoin platform.

- Proof-of-Holdings mechanism.

The proclaimed goal of using three channel architecture is threefold:

- They should make it easier for the platform to adapt to an increasing number of transactions.

- Addition of new nodes to the network is supposed to allow it to scale in an “organic” manner by raising its computational capacity

- Decentralization of power in relation to mining.

What is Proof-of-Holdings?

The final layer in the channel sequence on the Nexus platform is the Proof-of-Holdings consensus mechanism. This model resembles the Proof-of-Stake system such as that used by Dash, NEO, QTUM and similar cryptocurrencies.

This means that the holders of the NXS coins can obtain newly minted ones just by holding onto what hey already own. Staking the coins is supposed to bring dividends to the token holders based on four principles which govern the rate of returns:

- Interest rate: This value is proportionate to the rate at which the token holders receive newly minted coins. It is expressed as the annual percentage of one’s balance, with the starting rate amounting to 0.5%, followed by 3.0% maximum annual rate after a 12-month period.

- Trust weight: This is a valued expression of the trust level associated with a particular node. The starting value is 5% as a percentage which can get to its 100% maximum value after a single month has passed.

- Block weight: This value is regulated based on the timing of staking transactions. Each time one transaction is made, this attribute goes back to 0%. This is followed by the slow increase in its value within a 24-hour time. Once it hits 100%, the user’s trust key is treated as expired and the attribute value resets once again. The reset system is supposed to prompt the users to keep on working on the platform maintenance around the clock.

- Stake weight: This weight’s value is approximately based on the appraisal of the average value of the user’s trust and block weights. In short, its higher values make it more likely for the user to get a transaction.

What Are the Advanced Contracts on Nexus?

End of January 2019 is supposed to bring a much-awaited Tritium update release for the Nexus network, which the developers promise as a further upgrade on the path of improving the platform’s scalability and security. This will feature introduction of the Nexus’ own variation on the smart contract technology, called advanced contracts. According to the developers, these contracts should be considered as distinct from the Turing-complete platforms in use, such as the Ethereum Virtual Machine (EVM).

The difference between them lies in the fact that the Nexus contract engine runs on seven layers (instead of two processing layers of the EVM), with each of them in charge of managing specialized tasks. In turn, rach advanced contract will be made accessible via an API.

The Nexus team hopes that such system will deliver more advanced features related to management of digital and ownership rights, escrow and other financial operations, handling of signatures and documentation and tokenization of various assets. This is supposed to bring an even stronger focus on the implementation of the Nexus contract system in the business world.

Layers of the Nexus Network

With the Tritium update, the Nexus platform will organize its operation based on individual layers. The ensuing system should take the following shape:

- Interface will be the layer in which the users interact with the Nexus platform via a wallet. This layer will feature a modular design for the easy development of apps. This approach is supposed to deliver the core of a future marketplace in which the developers would trade and share their customized modules created specifically for the Nexus interface.

- Logical layer will host advanced contract applications. Together with the API layer, it will allow for the interaction with the network, register updates and authorization of signature chains.

- API layer will allow for the interaction between applications and advanced contracts. With it, the developers will be able to retrieve or forward data to the ledger and, by doing so, execute transactions and create new contractual terms. Unlike what is the case with Ethereum, application coding will be allowed in any preferred language.

- Operational layer, as its name suggests, will be primarily used to run basic operations on the network’s registers. This is an essential layer for developers as it provides a basic language which is used to communicate with the registers.

- Register layer will be the home to the data stored by the registers for the need of advanced contracts and other apps on the platform. As the registers will reference individual checkpoint hashes in their private databases, this is supposed to enforce their confidentiality when the system is used for storing sensitive data, such as medical records.

- Ledger layer will be used for storage and structuring of the transactional data. With the planned Tritium update, Nexus promises to introduce signature chain technology which is described as a secure and accessible solution for the key management and protection of transactions. This layer will also introduce the digital reputation tracking system which would allow nodes to verify each other based on their reputation records. Finally, Nexus plans to implement support for the twin blocks system which should minimize the occurrence of orphaned blocks and increase network capacity at the same time.

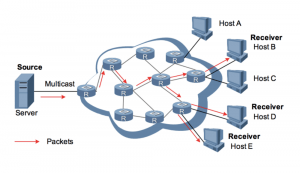

- Network layer will determine the manner in which the messages are communicated among the nodes. It is supposed to improve the system’s overall scalability by not focusing on the ledger size, but rather on the way in which the messages are distributed among the nodes. In an attempt to speed up this process, the packets will be replicated on the network layer as the “bottom” one, instead of doing so on the topmost layer.

Nexus’ Telecommunication Networks

In its bid to achieve fuller decentralization of its platform, Nexus plans to take the battle to the hardware itself – the results are the planned launches of three systems which would serve as the telecommunication platforms for the network’s operation:

- Planned for March 2019 launch after a delay, the Nexus satellite project emerged after its team entered partnership with Vector Space Systems. The goal is to have the satellite work together with the ground-based system to become orbital nodes for the hosting of the platform and any dApps developed on it.

- Nexus mesh networks are will consist of directly connected infrastructure nodes. Instead of competition, the network nodes will focus on joint work on block solving. This approach is supposed to improve the data distribution capacity of the platform.

- Finally, ground stations within the future Nexus network will act as the connection points between mesh and satellite networks.

Nexus Coin Availability

The NXS coin is the main crypto unit on the Nexus network. As of January 2019, its market cap amounted to USD 21 million, down from its historic high of more than USD 600 million in January 2018. The coin will be distributed over a planned 10-year interval, during which 78 million NXS will be supplied until September 2024. The network also plans to ditch transaction fees via inflation upon the expiry of the initial distribution period. At the moment, the default fee is 0.01 NXS and it is used for the majority of transactions on the network, with an added option to pay higher fees to ensure faster processing.

Nexus coin is readily available for trading on crypto exchanges such as Binance, Bittrex and others.

Once acquired, the coins can be stored in the project’s official wallet, with Nexus Tritium wallet being in beta as of January 2019.

Project History

Colin Cantrell, also known as Videlicet, heads the Nexus team as its founder and main developer. Cantrell is a software and hardware expert with a passion for space flights which was eventually translated into the Nexus’ ambition to extend the blockchain’s reach to the Earth’s orbit. The Nexus project started out in late 2014 under the name of Coinshield, only to be renamed to its current name a year afterward. Despite the name change, the initial vision of changing the dominant Bitcoin-based protocols and trying something new in an era of scam projects remained as the guiding principle behind the project.