US Taxes Got More Confusing with Crypto Losses

Taxes in the United States always seemed confusing – especially to outsiders – but cryptocurrencies have brought another dimension to this. Americans have lost billions trading cryptocurrencies last year, but they don’t seem to intend to report that, according to a survey, even though they could claim a deduction.

According to American personal finance company Credit Karma, Americans lost USD 1.7 billion in 2018 at an average of USD 718 per person, with unrealized losses of more than USD 5 billion, but most aren’t planning to claim a tax deduction they’re entitled to on the realized losses. According to the online survey of 1,009 American bitcoin investors last November, more than half said they thought their gains or losses were too small to claim deduction, more than a third said they didn’t believe they had a requirement to file, and a fifth said they didn’t know how to.

Investors who learned they could deduct capital losses were more likely to say they would report, even if they made money, the survey further found. Of survey respondents, 58% with realized losses and 53% with realized gains said they’re more likely to report their investment activity now that they know the rules.

When investing in crypto in the US, a cost basis is established for tax purposes. Selling an asset also triggers a taxable event. In the case of crypto, the state of the market determines what the individual that holds the coins is responsible for with their taxes. If their asset is never sold the gains or losses are only paper gains or losses, therefore they cannot be claimed on taxes. Due to the data supplied, those living in the U.S. do not realize that their crypto assets must be sold in order for it to be a taxable event.

“At the end of the day, the majority of Bitcoin investors (53%) do plan to report their gains or losses. So it may not be fair to conclude those who don’t are intentionally trying to avoid paying taxes. Some education may be all that’s needed to remedy the situation,” according to Credit Karma. It noted that “Additionally, helping investors who lost money understand that they may be able to deduct their losses could be welcome news to many.”

However, this data is still a change from last year, when only 0.04% of the first tax filings in February reported cryptocurrency gains, according to Credit Karma. The confusing laws surrounding the process did not help much, as even the Internal Revenue Service (IRS) seemed as lost as everyone else.

Meanwhile, as reported last week, major cryptocurrency market player and member of a U.S. based crypto industry lobbying group, Circle is working with regulators in order to change the current painful tax treatment for crypto-to-crypto transactions.

______

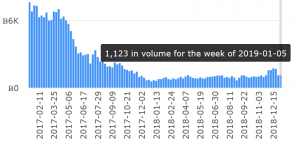

Weekly LocalBitcoins, a peer-to-peer bitcoin marketplace, volume (in bitcoin) in the US: