South Korean Crypto Consultancy Firm ‘Duped Elderly Investors out of $7.5m’

South Korean crypto controversy continues as police announced the investigation of a firm linked to a gaming coin.

Officers think company officials tricked a group of people in their late 50s and 60s by tricking them into paying for “insider crypto tips.”

Per Chosun Ilbo, police in Seoul’s Jongno District said on March 4 that they were investigating three employees of a company identified only by the letter “S.”

South Korean Crypto Firm Execs Under Investigation

Police officers think the officials told investors they could buy an altcoin named Ludena Protocol (LDN) for discount prices.

They allegedly did this at a time when the coin was listed on the Coinone exchange.

The project behind the coin says it envisions a “creative metaverse with Play-to-Earn games, an NFT marketplace, and a staking platform.”

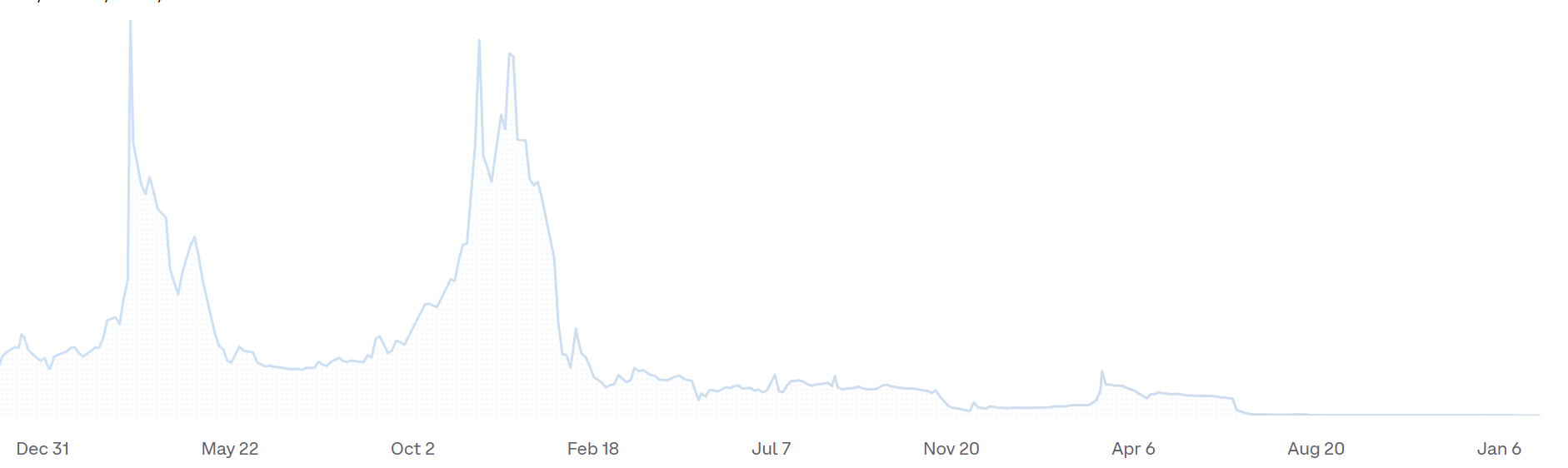

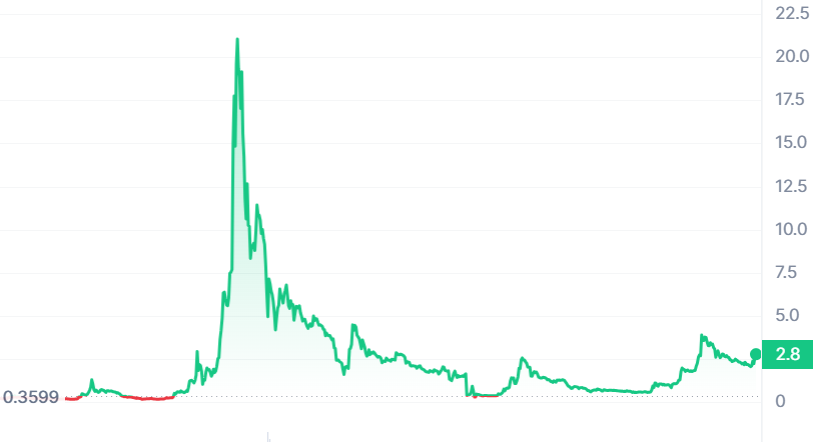

LDN coin prices spiked at the end of 2022, shortly after the token’s launch. In early 2023, the token’s price tumbled, bottoming out at fractions of a dollar mid-last year.

CoinMarketCap noted on its Ludena Protocol that its team has “not verified the project’s circulating supply,” adding:

“According to the project, its self-reported CS is 442,925,000 LDN, with a self-reported market cap of $0.00.”

The Ludena Protocol website, has not been updated since March 2023, while an associated X (Twitter) account was last updated in mid-2023.

"Exciting news! We are thrilled to announce our partnership with Trust, a leading blockchain web3 Search engine platform that can bring users and platforms together that can help users interact and gives honest reviews ! @trutsxyz 💘💖 @LudenaProtocol

👇https://t.co/JLrtYVKuol pic.twitter.com/Ja1uquUhyF

— Ludena Protocol (@ludenaprotocol) June 9, 2023

The LDN token was delisted from Coinone last year for unrelated reasons. The media outlet said that Vinetree, the firm behind the token, was not thought to be connected to the S Company case.

S Company marketed itself as an “investment consultancy agency,” police officers explained. It appears to have had no relationship with the Ludena Protocol.

How Firm Allegedly Duped Victims

The media outlet gave the example of a retiree surnamed Kim who had fallen on hard times after a series of failed stock investments.

Officers think a Company S official told Kim that he was privy to “CEO-level financial secrets.”

The alleged fraudster told Kim that he could access these secrets by paying a $7,500 “joining fee.”

The official then reportedly told Kim about a pre-sale event on an LDN-associated play-to-earn (P2E) gaming platform.

Kim then proceeded to pay Company S to “invest over $75,000 on the platform” – but was never able to retrieve the money.

Officers think the trio employed a team of about 47 people, targetting people who had either retired recently or were about to retire.

Police think that the group may have contacted some 200 people, with at least 50 duped into sending money.

Officers said that the group may have amassed a total of $7.5 million from their alleged victims.

‘The Next WEMIX’ – How ‘Fraudsters’ Duped Pensioners

Company S employees reportedly told would-be victims that the LDN coin was “the next WEMIX.”

WEMIX is the brainchild of the South Korean crypto and gaming giant WeMade. This coin has been listed on multiple domestic and overseas trading platforms.

Company S employees allegedly told potential investors they could earn “300-500%” profits in the space of “just three months.”

Employees also told investors that their coins would be “locked” for up to 120 days after the pre-sale event had ended.

Bitcoin surge renews calls for eased regulationshttps://t.co/45zXOVrhy9

— The Korea Times (@koreatimescokr) February 29, 2024

However, the media outlet explained:

“When the coin’s value fell rapidly, the suspects reportedly extended the ‘lock’ period for another 30 days and then went into hiding.”