Polygon Price Prediction as Launch of New zkEVM Mainnet Beta Approaches – Can MATIC Reach $100?

After finding support earlier in the week at around $1.15, partially as a result of buying around the 21-Day Moving Average (DMA) at $1.2050, Polygon (MATIC) has rebounded into the upper $1.20s. The cryptocurrency, which powers layer-2 Ethereum scaling solution Polygon, is eyeing a break back to the north of the $1.30 level, potentially opening the door to a retest of multi-month highs hit earlier this month in the $1.35 area. Price predictions are thus becoming more bullish.

Some analysts have been surprised by crypto’s resilience in the face of hotter-than-expected US inflation numbers on Tuesday and stronger-than-expected US Retail Sales data out on Wednesday, the combined impact of which has been to push up the US dollar and US yields as traders revise higher their Fed tightening bets. MATIC/USD was last trading around 7.5% higher in the last 24 hours, according to CoinMarketCap.

Roses are red 🌹

— Polygon (Labs) (@0xPolygonLabs) February 14, 2023

Violets are blue

Poems are hard 😩

Mainnet Beta is here

ON MARCH 27, Polygon #zkEVM launches the future of Ethereum scaling

🚢💜🚢💜https://t.co/OqSOYTn8Uv pic.twitter.com/kpXavea3ff

An announcement from Polygon’s developers Polygon Labs on Tuesday that the scaling protocol will be implementing a much-anticipated upgrade before the end of next month is likely bolstering sentiment. On the 27th of March, Polygon will launch a beta version of is zkEVM (zero knowledge Ethereum Virtual Machine) Mainnet, kicking off “the journey to the future”.

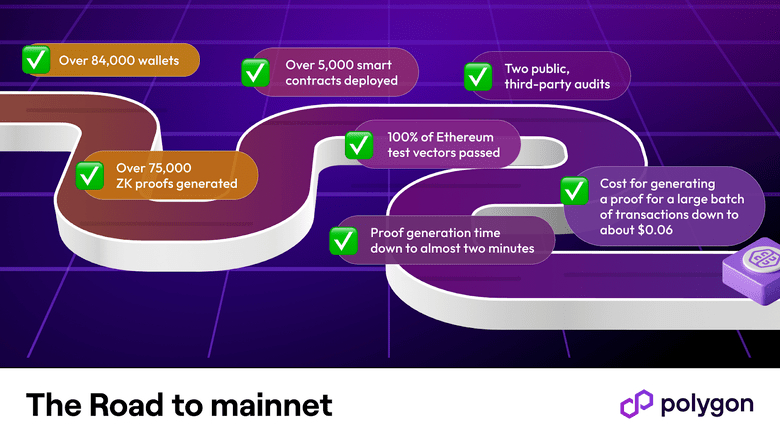

Polygon Labs released a zkEVM testnet last year, which Polygon Labs says “gave the world the first glimpse of seamless scaling for Ethereum” and “has been groundbreaking from the beginning”. Indeed, the testnet achieved a series of impressive milestones, as detailed in the graphic above. With the launch of the zkEVM Mainnet beta in March, Polygon Labs say that “it’s time to truly start the revolution to unlock mass adoption and the full potential of Web3”.

Price Prediction – Where Next for Polygon (MATIC)?

Positive upcoming fundamental developments relating to the Polygon protocol as well as the broader cryptocurrency market’s ongoing resilience suggest an increasing likelihood that MATIC will be able to muster a lasting break to the north of the key long-term $1.30 resistance area. If MATIC can manage a strong daily candle close above this level, that would mark a key medium-term technical breakout.

Bets for a return to record highs just under $3.0 per token would likely start rising. Speculators with a shorter time horizon would likely target a near-term test of resistance in the $1.75 area.

Can MATIC Reach $100?

A rally in MATIC to $100 per token would mark a near 78x gain. Whilst such gains aren’t out of the question in cryptocurrency markets, it would also require a surge in Polygon’s market capitalization (currently around $11 billion) to around $800 billion. This probably isn’t likely to happen in the short term.

But if we are moving towards a world where Bitcoin’s future market cap rivals that of gold at around $11 trillion (Bitcoin’s market cap is currently around $440 billion), then Polygon hitting $800 billion in the next 10-20 years probably isn’t out of the question. Investors just need to be patient and remember the remind themselves of their long-term crypto adoption thesis.

MATIC Alternatives to Consider

As discussed above, MATIC’s outlook is looking pretty good. But traders should nonetheless always be looking to diversify and might want to consider other high-potential tokens, such as those being sold in pre-sale by promising up-and-coming crypto projects. We’ve reviewed some of the best candidates in this list of the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.