On Average, an ICO Raised 29% More This Year (Excluding Telegram)

Initial Coin Offerings, the new way to raise funds for your startup, has been quickly gaining popularity, and 2018 is seeing an exponential rise in both number of startups choosing it over traditional ways of financing the project and amount of money raised.

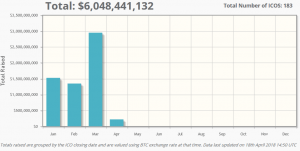

The first quarter of 2018 saw a significant increase in amount of money raised per ICO. Throughout 2017, this amount was on average around USD 18.5 million, while in the first quarter of 2018, it has climbed to USD 36.2 million, based on Coinschedule.com data.

Even excluding an ICO pre-sale of a messaging app Telegram, since it is the biggest by far, the average per ICO throughout Q1 would amount to USD 25.6 million, once again significantly higher than throughout 2017. When not final data for April is added, the number decreases to USD 23.9 million, which is 29% more than capital raised per ICO in 2017.

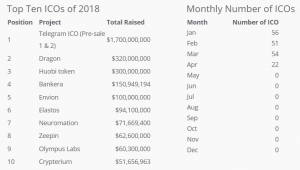

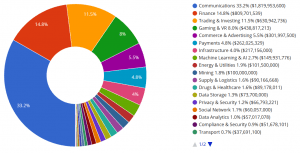

The total amount of money raised has also exceeded 2017 by far, and it has been only one quarter: 2017 saw a total of USD 3.8 billion raised by 210 ICOs, with the most popular category being Infrastructure. The first three months of 2018 already saw USD 5.8 billion with no signs of abating. This year, the “richest” category has been Communications, thanks to Telegram. Removing them again, the sum comes up to USD 4.1 billion, and Communications as a category would fall on the 8th place total, giving its throne up to Finance.

The year is on a great track to completely overshadow 2017: although presumably we cannot expect a project like Telegram to rack up such a huge amount, even going with the USD 4.1 billion raised without it, the total year would then be four times that number – USD 16.4 billion, but this is mostly speculation.

What could drive ICOs into the ground, however, is the amount of scams: investors could well become wary of investing in something still unregulated. Regulations, on the other hand, may also curb the amount of money flowing into ICOs, but could mean more safety for investors.