New Zealand Begins Plans To Introduce CBDC

The Reserve Bank of New Zealand (RBNZ) has begun its public consultation on “Digital Cash,” a proposed central bank digital currency (CBDC), as disclosed in a consultation paper released by the central bank on April 17.

The consultation is in its second stage and will last 101 days, between April 17 and July 26. After feedback and the development of a business case from Stage 2, a decision is expected to be made on advancing to Stage 3.

To understand the rationale behind the New Zealand CBDC, one must examine the motivations and objectives outlined in the consultation paper.

New Zealand CBDC Motivation & Objectives

According to the Consultation Paper, New Zealand’s Digital Cash will be a retail-focused CBDC, primarily targeting consumers and corporate users.

We’re looking at introducing a new payment option for New Zealanders – Digital Cash – an electronic version of cash, that would sit alongside but not replace physical cash. Learn more in the video and have your say here: https://t.co/FcRyY69TPI pic.twitter.com/Je4q3Q9IE6

— Reserve Bank of NZ (@ReserveBankofNZ) April 16, 2024

The Reserve Bank said its motivation for issuing a CBDC is the decline in the use of physical cash. This could adversely affect financial inclusion for those who rely on cash.

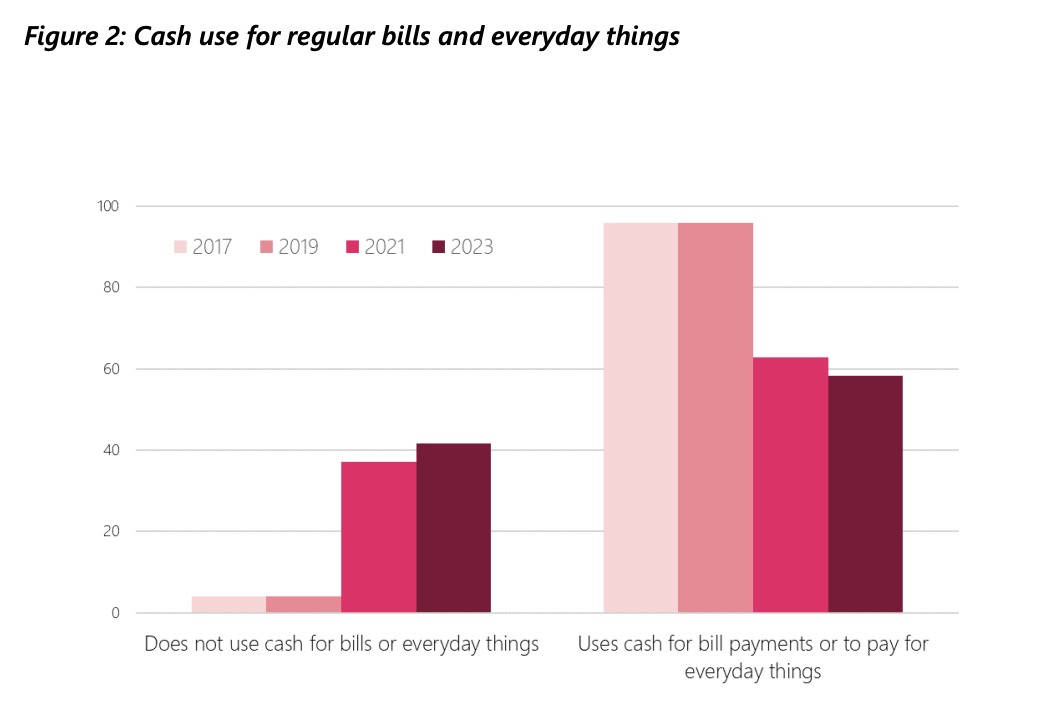

The consultation paper also included a survey showing that about 58% of consumers used physical cash as of 2023, a drop from 63% recorded in 2021, indicating a gradual reduction in fiat usage.

In addition to declining cash usage, the RBNZ wants to provide digital cash to meet needs and play a key role in financial innovation.

The consultation paper also highlighted the rapid development of innovations in crypto assets, distributed ledgers, and digital currencies issued by global technology companies.

If innovation in these sectors occurs primarily outside the New Zealand dollar, the country’s fiat currency, there is a risk that citizens may opt for alternative currencies for transactions, potentially leading to a loss of monetary sovereignty.

To address these concerns, the RBNZ sees digital cash as a way to ensure there are innovative payment services in New Zealand and protect the country’s monetary sovereignty.

“New Zealand’s payment services have become less innovative than other countries. Digital cash would help bring down barriers to entry to the payment system,” the central bank wrote in the consultation paper. “Digital cash would also be a new piece of digital public infrastructure that supports digital transformation.”

The RBNZ has outlined a comprehensive four-stage approach to develop and implement the New Zealand CBDC.

New Zealand’s Four-Stage Path Towards a Central Bank Digital Currency (CBDC)

RBNZ has adopted a four-stage approach to creating digital cash. The first stage started in 2021 and involved publishing an issues paper that assessed the need for digital cash in New Zealand (Aotearoa). The RBNZ received over 6,000 responses.

The RBNZ is currently in the second stage of its CBDC initiative, delving into design options for Digital Cash, conducting consultations, and establishing budgetary frameworks.

The @ReserveBankofNZ has just launched a consultation on a #CBDC for New Zealand called "digital cash" and lays out principles and design options for New Zealand’s digital cash in its new consultation paper – comments accepted until 26 July 🇳🇿https://t.co/xLIYQEC085 pic.twitter.com/7tyy3fryQJ

— Central Bank Payments News (@cbpaymentsnews) April 16, 2024

Once the consultation phase concludes, the RBNZ will continue developing the structure and policy requirements, with an expected completion date in June 2025. After this phase, a cost-benefit analysis will be conducted.

The RBNZ anticipates completing Stage 2 in 2026. At this point, recommendations will be made on whether to progress to Stage 3 of the New Zealand CBDC issuance process.

Stage 3 involves developing and testing prototypes to ensure the functionality of the digital cash system. The final stage, Stage 4, will mark the official launch of the New Zealand CBDC, anticipated by 2030.

🇰🇷 South Korean Central Bank to ‘Speed up’ CBDC Project

The South Korean Central Bank is set to “speed up” its CBDC project, and will pilot its digital KRW with a group of 100,000 citizens later this year.#CryptoNews #newshttps://t.co/zfzltVAjRU

— Cryptonews.com (@cryptonews) April 17, 2024

Other nations are also actively exploring CBDCs. South Korea is expediting its project, targeting to test the usability of the digital Korean Won (KRW) by the end of 2024.

Meanwhile, Hong Kong has entered the second phase of its e-HKD program, further investigating the possibilities of a digital currency.