Kraken Has a Plan for the United Arab Emirates

One of the top 50 cryptocurrency exchanges by trading volume, Kraken could be looking to strengthen their positions in the United Arab Emirates, if a job posting for a UAE-based managing director is any indication. The company also advertised a vacancy for a compliance officer in Abu Dhabi, the capital of the UAE, around three months ago.

Kraken’s current vacancy, advertised as onsite and full-time, includes responsibilities such as, “responsible for the overall success of Kraken within the UAE market,” “provide leadership and guidance to the Kraken UAE team,” and “Interact with UAE regulators as necessary to ensure appropriate regulatory standing and compliance.”

The job requirements also show that the company is looking for a candidate with ten or more years of experience in “business development, operations, or general management,” as well as experience in “Crypto/Blockchain, FinTech, Brokerage/Exchange, Financial Services, Technology” and knowledge of financial regulatory compliance.

The exchange declined to comment.

A previous job posting for a compliance officer shows that Kraken has been working with its undisclosed UAE plan for a while now, and trying to do it in a manner compliant with any regulations. According to the listing, the job would require the employee to be the “primary point of contact for regulators and banking partners in UAE and regionally (Middle East and North Africa – MENA) including, but not limited to, the ADGM (Abu Dhabi Global Market) and FSRA (Financial Services Regulatory Authority)” as well as coordinate with Corporate Compliance to ensure compliance policies are in alignment with both UAE and corporate expectations, identify potential areas of compliance vulnerability and risk, and assess general compliance risks for all new products and services offered to the MENA market, and recommend appropriate risk mitigation strategies.

The exchange, that was founded in San Francisco in 2011, and is ranked 46th (10:43 UTC) by trading volume (USD 95 million in the past 24 hours) claims it has more than 4 million clients “all over the world.” It’s not available in seven countries (Afghanistan, Cuba, Iran, Iraq, Japan, North Korea, Tajikistan) and Washington State and New York.

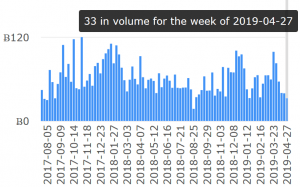

Trading volume on Kraken:

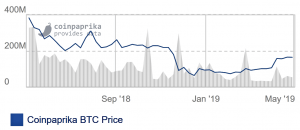

In February, the company reportedly was “on the cusp of completing a USD 100 million funding round financed by its larger customers.”

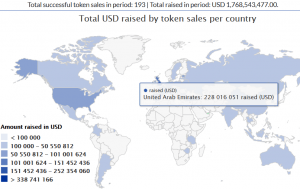

Meanwhile, the Emirates seem to be entering the crypto game as a force to be reckoned with. For example, in the last six months, the UAE was second in the world by amount raised during token sales (USD 228 million, or 12.9% of the total amount,) according to token sale data provider CoinSchedule. However, by the number of token sales, the UAE was outside the top 10 countries.

Token sales in the past six months:

_____

Weekly LocalBitcoins, a peer-to-peer bitcoin marketplace, volume (in bitcoin) in the UAE: