Japanese Parliamentarian Wants Tokyo to Cut Crypto Tax

A Japanese parliamentarian wants to bring about cryptocurrency tax reform – and tabled a petition on the matter with both houses of parliament.

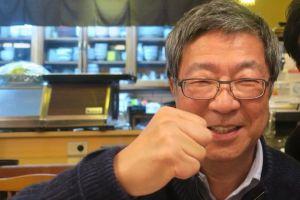

Takesi Fujimaki, a former advisor to George Soros and an ex-JPMorgan Chase employee, is currently a Japan Innovation Party member of the House of Councilors, the National Diet of Japan’s upper house. If accepted by parliament, Fujimaki’s motion would spark a debate on the measure in the diet.

Fujimaki is one of the Japanese blockchain and cryptocurrency community’s fiercest allies, and has repeatedly put pressure on the upper house to develop business-friendly fintech legislation.

Per his website, Fujimaki states that existing cryptocurrency tax laws allow Japanese traders to be taxed at up to 55%, and wants to propose a 20% cap on tax. The change would put cryptocurrency taxation on the same level as tax on foreign exchange trading, stocks and mutual funds.

The proposal would also allow traders to carry forward losses into the following financial year – deducting from profits, and meaning traders may end up paying less in terms of year-on-year taxation.

He also proposes the following:

- No tax on crypto-to-crypto trades

- No tax on small payments (Fujimaki gives the example of waiving tax on restaurant bills of USD 28 if settled in cryptocurrency)

The politician has held a series of lectures and meetings for supporters of his tax reform campaign, which he launched in December last year. Speakers at the meetings have included the likes of Oki Matsumoto, the CEO of the Monex Group (the operator of the Coincheck cryptocurrency exchange).

Fujimaki posted news of his petition bid on Twitter, where it gained scores of retweets and messages of support from Japan’s crypto-community.

________________________________

________________________________

The National Diet has now closed ahead of elections on July 4, but Fujimaki is likely to pursue the matter further when it reopens for its next session – and is believed to have directly approached Finance Minister Taro Aso in an attempt to secure crypto tax reform.