It’s Not a Joke: eBay Listed ICO Project Claims it Got an Offer

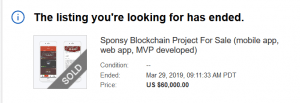

Around a week ago, the founder of blockchain platform Sponsy made the whole cryptoverse interested after revealing that they had listed their project for sale on popular online marketplace eBay for a price of USD 60,000. And now, they may well be setting a new trend in the space, as they confirmed that they have actually received an offer for their project.

“We indeed received an offer, but we are still in the middle of negotiations as we need to examine all the software and understand as to whether there is a match between their needs and our capabilities,” Ivan Komar, one of the founders of Sponsy, told Cryptonews.com, assuring that it’s not an April Fool’s Day joke.

The undisclosed interested party is not even currently part of the blockchain space, he added: “[It] is a person who has nothing to do with crypto [as far as I know] and sees to enter in that space [sic].” Komar also said that they expect to close the deal within the next week or two, and this may well be his last foray into crypto, at least for now.

As reported, the package for sale included a “mobile app, web app, MVP developed” and a “full set of investment documents” that are “designed and approved by investment bankers.” However, Komar previously admitted that “‘Approved’ might be a huge word for it.”

Sponsy is a platform developed to facilitate sponsorship transactions and make them transparent with the help of blockchain. However, its core aspect is still centralized and “it doesn’t require any crypto or blockchain component to work.”

The project missed the initial coin offering (ICO) craze of 2017 reportedly due to advice from their lawyer, who told them not to sell tokens until they had a working product. “And I asked him why, because I saw so many ICOs out there who did not have any idea for any product, yet they managed to raise tens of millions of dollars,” Komar previously told Financial Times.