First Foreign Crypto Exchange About to Enter Thailand Market

Japanese companies are making bold overseas moves on the international cryptocurrency scene, with one company expanding into the Southeast Asian market, and another investing in an Israeli startup.

BitPoint, a Financial Services Agency-licensed cryptocurrency exchange, says it has struck a partnership with a Bangkok-based blockchain company named BiTherb. Per a press release, the companies say they will launch an exchange in the Thai capital.

BitPoint says it has successfully received four trading licenses from the Securities and Exchange Commission (SEC) of Thailand, the regulatory body that polices the country’s cryptocurrency markets. This would make BitPoint the first overseas exchange to win trading permits since the SEC began regulating Thai exchanges.

Readers will recall that the SEC has looked to clamp down on perceived overseas offenders after being handedsweeping new regulatory powers last year.

And according to media outlet Nikkei, the new exchange – which is slated to open in April – will trade in some five currency pairings “including Ripple and Bitcoin.”

BitPoint is owned by Remixpoint, a large business group with interests in the energy management, services and auto trading industries. BitPoint already has a number of exchanges in North Asia, including South Korea and Taiwan.

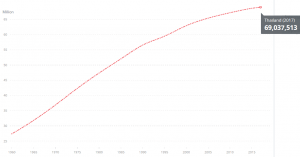

Thailand population:

_____

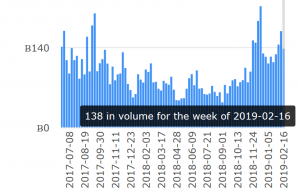

Weekly LocalBitcoins, a peer-to-peer bitcoin marketplace, volume (in bitcoin) in Thailand:

Meanwhile, earlier this week, Recruit – the Japanese employment platform that owns companies such as Indeed and Glassdoor – has announced that it has made its first significant investment in the cryptocurrency market. The company made an undisclosed investment in Israeli crypto startup Beam, developer of a confidentiality-centric token that makes use of the Mimblewimble protocol.

Recruit made its investment through the USD 25 million RSP Blockchain Fund, a subsidy that it established in Singapore in November last year.