Ethereum Whales Accumulating, Bitcoin Futures Send a Sign

Both bitcoin (BTC) and ethereum (ETH), the first and second most valuable cryptoassets by market capitalization, may be about to see a surge in interest from investors, new data suggests.

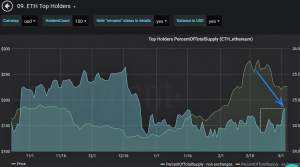

According to research from Santiment, a behavior analytics platform for cryptocurrencies, the 100 largest ethereum holders in the world are once again accumulating more ETH tokens relative to the total ETH supply, a potentially bullish sign for the asset.

According to the firm, the current accumulation is particularly noteworthy because it has happened during a period of lower prices for most cryptoassets. This suggests that the largest stakeholders are considering the asset to be “undervalued and believe it’s a great mid to long-term hold play,” the firm wrote in a Twitter thread while adding: “Sometimes these price rises take a bit of time after this accumulation rises, but it is generally a good sign for ethereum bulls.”

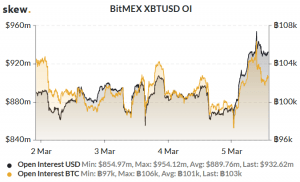

Meanwhile, a potentially bullish sign for bitcoin is coming from BitMEX, one of the most popular derivatives exchanges in the crypto space, where open interest in bitcoin futures has surged today compared to the levels seen over the past few days. Although it is still an open question what this may mean for the price, it might suggest that market participants are positioning themselves for a large move.

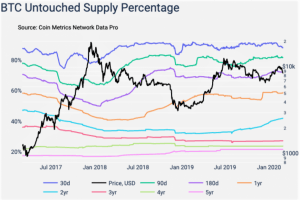

Further, as reported, data from crypto analytics provider Coin Metrics shows that the percentage of bitcoin that has remained “untouched” in digital wallets for at least two years is now at the highest level since mid-2017, suggesting that an increasing number of long-term buy-and-hold investors are remaining bullish on the asset.

“As of March 1st, about 42% of all BTC has not been moved on-chain (i.e. transacted) for at least two years. The amount of BTC untouched in more than two years has not eclipsed 42% since July, 2017,” Coin Metrics wrote in its latest State of the Network report.