Crypto KYC Solutions Advance to Ensure Adoption and Better User Experience

Know-your-customer (KYC) measures are becoming more important as the cryptocurrency sector grows. These models have proven to help digital asset service providers prevent against crimes such as money laundering, terrorist financing and more.

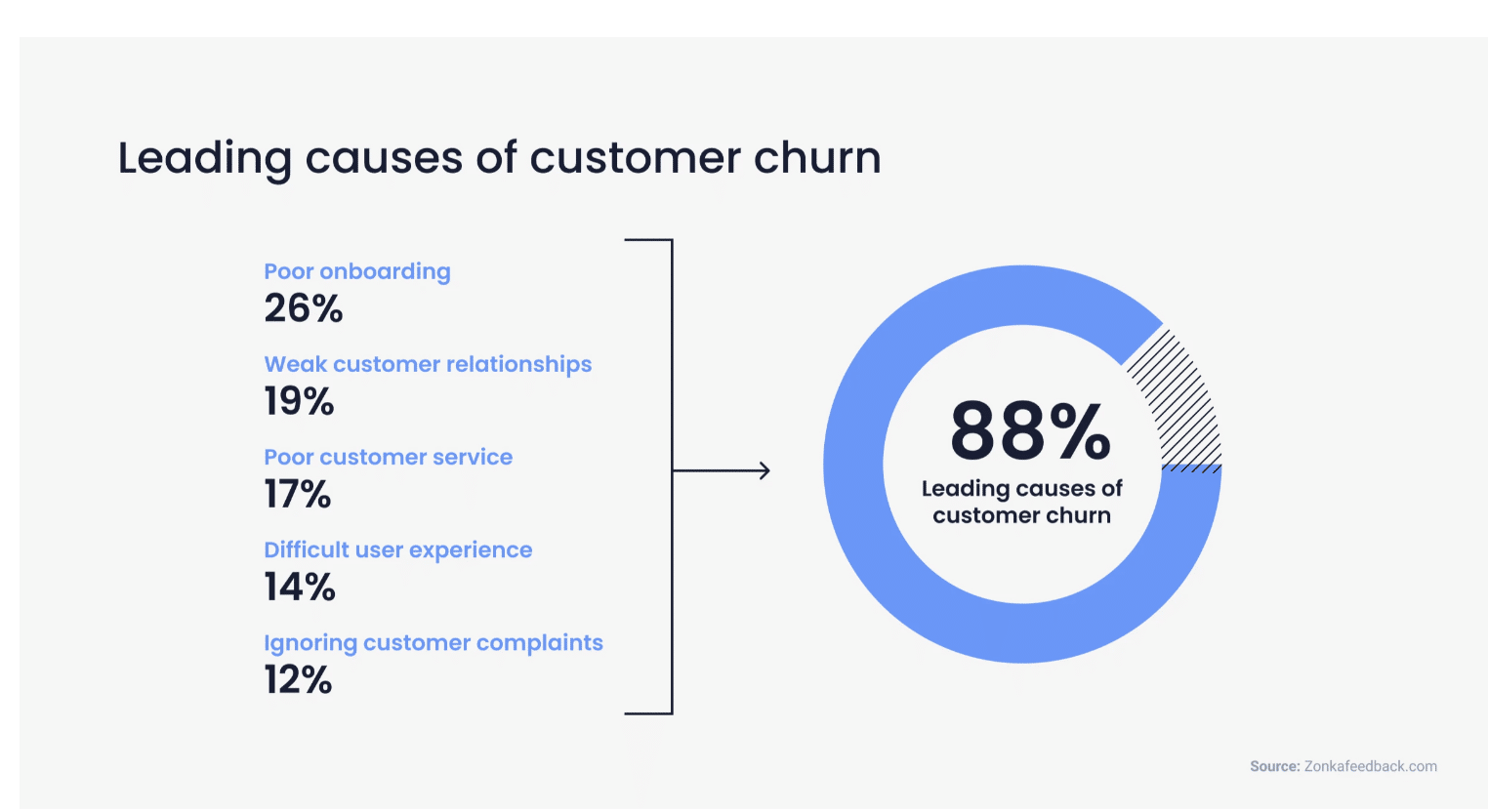

Yet while KYC processes can help financial firms better understand who their customers are, many KYC models remain time-consuming and challenging. A recent blog post from UXCam – a mobile app analytics platform – found that users often abandon sign up processes associated with fintech apps due to the complexity, time and documentation required to get started.

The same may also apply to the cryptocurrency sector. Caitlin Barnett, director of regulation and compliance at Chainalysis – a blockchain data analytics firm – told Cryptonews that crypto businesses are facing many similar challenges that traditional financial institutions face when conducting KYC. “It can be a very manual process and oftentimes customers are reluctant to provide information being requested,” she said.

Barnett added that the majority of crypto companies conducting KYC today are regulated entities and therefore the KYC process can somewhat resemble traditional financial institutions. “More and more regulators are requiring that these regulated entities collect the same personal identification information – such as name, address, date of birth, government issued ID – as traditional financial institutions,” said Barnett.

It's generally handled by Plaid.

If for whatever reason you've been flagged by OFAC or FinCen as high risk, you'll be denied services.

10+ years in OTC, 3 years as a registered fincen broker dealer.

— Mark Rizzn Hopkins (🇺🇦,🇺🇦) (@rizzn) December 13, 2023

New crypto KYC solutions are underway

In order to ensure better KYC experiences within the crypto industry, various solutions are being implemented to advance traditional processes and requirements.

Ramon Recuero, chief executive officer of Kinto – a blockchain platform focused on financial use cases – told Cryptonews that Ethereum users currently have to go through a KYC process each time they want to invest in an application or Real World Asset (RWA) protocols like Centrifuge, TrueFi or Goldfinch. Recuero believes that this creates friction for users and reduces the conversion rate for these applications.

In order to solve these challenges, Recuero explained that Kinto has developed an on-chain, permissionless KYC and anti-money laundering framework using native account abstraction. “Kinto has constructed its own concept of ‘user owned KYC.’ While users must have undergone a KYC process to be onboarded to the Kinto network, they are able to select their own KYC provider from options provided by the network’s governance. Kinto’s governance curates a list of KYC providers in the network, also allowing users to onboard new providers,” Recuero explained.

Once users have joined Kinto, Recuero noted that the network issues a ‘soulbound’ token – known as KintoID – that effectively becomes a user’s passport across the network. He said:

“In Kinto, users only need to KYC once and then they can reuse their verification for all the applications that are inside our chain. Similar to how the Apple store only needs to add your credit card once so you can pay with a tap, Kinto allows users to KYC once and reuse their credentials easily.”

The concept of “reusable KYC” as described by Recuero seems to be gaining traction. Tim Brückmann, co-founder and chief marketing officer of IAMX – a digital identity platform – told Cryptonews that IAMX facilitates a reusable KYC process, allowing customers to undergo identity verification once and then securely share the verified status with other businesses. “This approach significantly reduces the redundant efforts typically associated with inefficient KYC processes in different organizations,” said Brückmann.

Brückmann explained that IAMX leverages a combination of distributed ledger technology (DLT), zero-knowledge proofs (ZKPs), and decentralized identifiers (DIDs). Brückmann further shared that a number of crypto companies, along with financial institutions, are already using IAMX’s KYC model. He said:

“These technologies ensure a secure and immutable record of identity verifications and transactions, enhancing trust and security in the compliance process. Once a user’s identity is verified, they can reuse this verified status across different platforms that accept IAMX’s KYC, without having to undergo the verification process repeatedly.”

Marcus Bengtsson, chief marketing officer at Checkin.com – a technology provider specializing in comprehensive KYC solutions – told Cryptonews that technologies such as artificial intelligence (AI) and machine learning can also reduce customer onboarding time for crypto platforms. He said:

“We cut down the onboarding time by leveraging technologies like biometry and computer vision in conjunction with machine learning to improve the speed and accuracy of the KYC process. This enables our system to verify the data faster and reduce the steps required for the end-user to complete the process.”

Moreover, Bengtsson noted that the overall user experience during KYC can impact the amount of time the process takes. “If users are struggling with understanding what actions they need to take and how to correct mistakes, they will inevitably spend more time figuring it out and many times drop off completely,” he said.

In order to combat this, Bengtsson explained that Checkin.com uses AI with access to a huge library of user experience modules to localize and adapt experiences to each end-user. “This means that users will get a native experience regardless of their device or location.The sum of all these improvements is usually a drastic reduction in onboarding time as well as increased conversion rates,” said Bengtsson.

Bengtsson shared that Checkin.com’s KYC model is well suited for crypto companies in particular. For instance, Admirals – an online trading application that supports crypto-related instruments – currently uses Checkin.com’s solution. “I would say that most crypto-realted products are more open to try innovative products like ours,” he said.

While new technologies clearly play a large role in advancing KYC solutions, Barnett pointed out that Chainalysis has noticed that cryptocurrency companies are starting to use blockchain analytics to enhance their KYC and EDD (enhanced due diligence) processes. She said:

“Crypto companies have the ability to look at blockchain analytics to analyze source of funds as well as to understand the overall risk appetite associated with other crypto businesses. That means they can use blockchain analysis to identify other crypto services they may not want to transact with based on their own risk-based approach.”

Challenges with emerging crypto KYC solutions

Although it’s notable that crypto KYC solutions are advancing, a number of challenges remain that may result in a lack of adoption. For instance, data privacy is a primary user concern when it comes to KYC processes.

Interestingly, blockchain technology could help solve privacy concerns. For instance, Brückmann explained that IAMX leverages ZKPs to allow users to engage in transactions without exposing their entire identity, aligning with the ethos of blockchain and cryptocurrencies.

Recuero further noted that Kinto does not own or store any personal data. “The KintoID only contains flags indicating KYC status, accreditation, and AML violations. Personal data is stored with the user’s chosen KYC provider, which never includes wallet address information,” he said. Recuero added that personal data can only be accessed with a user’s permission.

It’s also important to point out that crypto KYC solutions must meet global compliance in different jurisdictions. “Adapting the KYC process for each jurisdiction on a granular level is very challenging since there is a jungle of rules, conditions and solutions in each jurisdiction,” said Bengtsson. Due to this, Bengtsson noted that checkin.com is investing heavily in research and development to ensure that the company remains ahead of the curve. He said:

“Making our system able to access the optimal solutions, translations and UX modules for virtually every market was just the first step. Following that, one needs to create an intelligent framework to make sure that each user is served with the optimal configuration of KYC steps and UX.”

Recuero shared that Kinto partners with financial service provider Plaid to help navigate the global and local regulatory requirements. Echoing this, Brückmann noted that strategic partnerships are key. “Collaborations with legal and compliance experts, such as mme.ch and kyc.ch, provide essential insights into local regulations and help maintain compliance in different jurisdictions.”