Crypto Assets Under Management (AUM) Soar 27% to $66B in Feb on Bitcoin Strength

Total crypto assets under management (AUM) soared by 27% to $65.66 billion in February, driven by rising Bitcoin prices and growing adoption of Spot Bitcoin ETFs in the US.

CCData’s latest monthly report, released Monday, revealed that average daily trading volumes continued to rise in the past month, jumping nearly 15% to $1.8b.

“This rise, while more modest compared to January’s surge, underscores a consistent upward trend and robust investor engagement, largely attributed to the enthusiastic market response to ETFs in the US,” the report said.

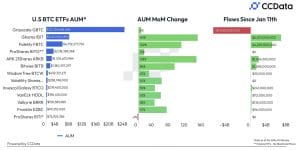

By Feb. 26, inflows into Spot Bitcoin ETFs amounted to $6.03b, while Grayscale experienced record-low outflows of $22.4b on the same day, the report showed.

Among the top 10 ETFs, BlackRock’s iShares and Fidelity’s FBTC attracted inflows of $6.02b and $4.23b, respectively, indicating robust investor confidence and market momentum.

BlackRock’s iShares Skyrockets with 569% Volume Surge

Trading volumes surged significantly, particularly for BlackRock’s iShares, which recorded an impressive volume of $7.89b, marking a 569% increase from January.

Fidelity’s FBTC and Ark & 21Shares’ ARKB also saw substantial month-on-month jumps, with increases of 509% and 575% respectively.

VanEck’s HODL ETF experienced remarkable growth, with trading volumes surging by 2000% to reach $584m.

However, products like Grayscale’s GBTC, ProShares’ BITO, and Grayscale’s ETHE, which had shown significant volumes in January, saw declines in investor interest, with volume drops of 59%, 62%, and 30% respectively.

Purpose Invest’s BTCC, Canada’s most well-known Bitcoin ETF, saw stagnation in trading volume, with a decline of 40%.

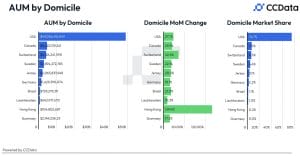

US Crypto AUM Dominates Market with 75% Share

The US reclaimed its leading role in the digital asset market, with its AUM surging by almost 30% to $49.1b, comprising roughly 75% of the market share.

Meanwhile, Canada and Switzerland saw their AUMs rise to $4.6b and $4.1b, marking increases of 23.9% and 42.6%, respectively. Despite being a smaller player, Hong Kong experienced an explosive growth of 139%, indicating a rapidly growing interest in the sector.

Bitcoin Reigns Supreme, Solana Faces Setback

Bitcoin continued to lead the digital asset management sector, with its AUM reaching around $49b, commanding a hefty market share of 74.5%. This marks a solid 29.2% increase from January.

Ethereum held onto its position as the second-largest asset, enjoying 26% growth to hit $12.3b in AUM, securing an 18.8% market share.

However, Solana (SOL) saw a slight dip of 1.51% in AUM, indicating a possible dip in interest or a shift in investor focus.