The Conglomerate Capital is Building the Investment Platform for The Future, Presale Already Causing Waves

Disclaimer: The text below is a press release that is not part of Cryptonews.com editorial content.

The Conglomerate Capital project, which we explain here, has the potential to change how investors look at investing in businesses, offering clear and direct opportunities while still being governed by a DAO. The presale of its token CONG ,started on January 16, with a goal of USD 2.5 million and has already been heavily fulfilled.

The cryptocurrency market was a revolution in terms of finance. This has been well and truly established, even if the market has had some growing pains in terms of being seen as legitimate in the eyes of the wider world. Still, despite being operational for over ten years, there are still some pitfalls when it comes to actually raising capital.

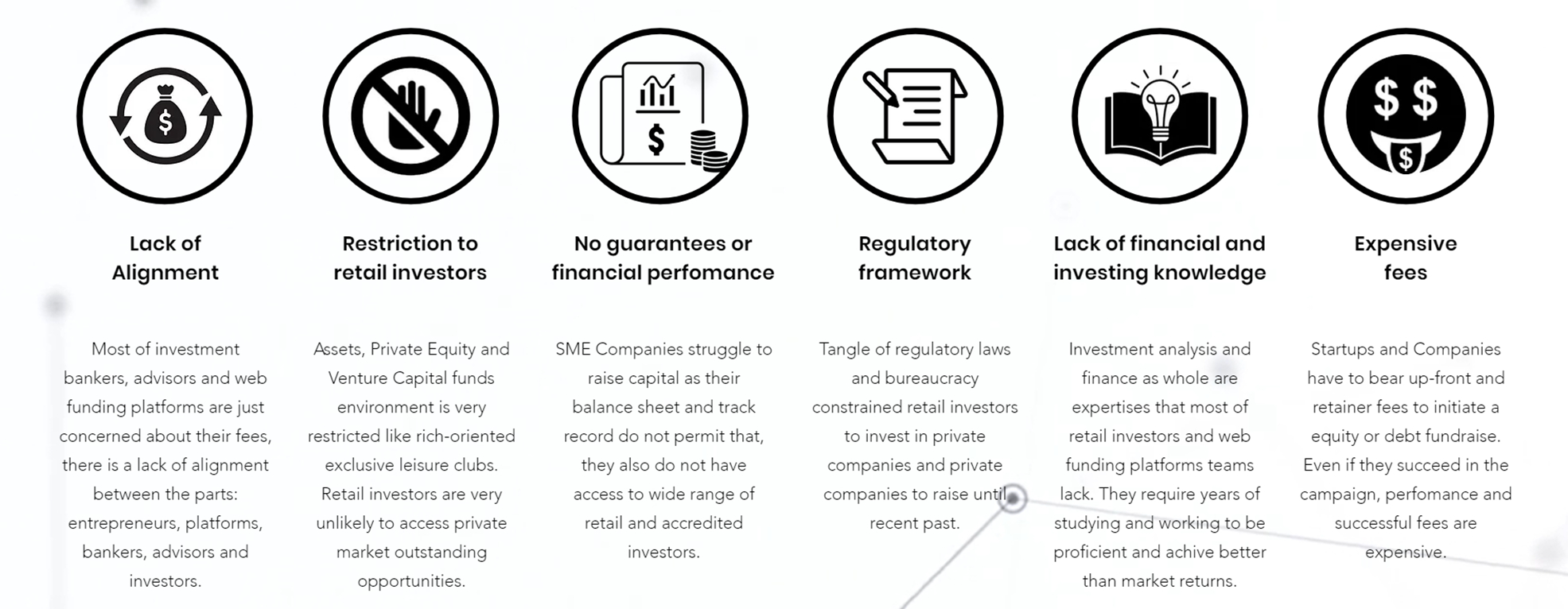

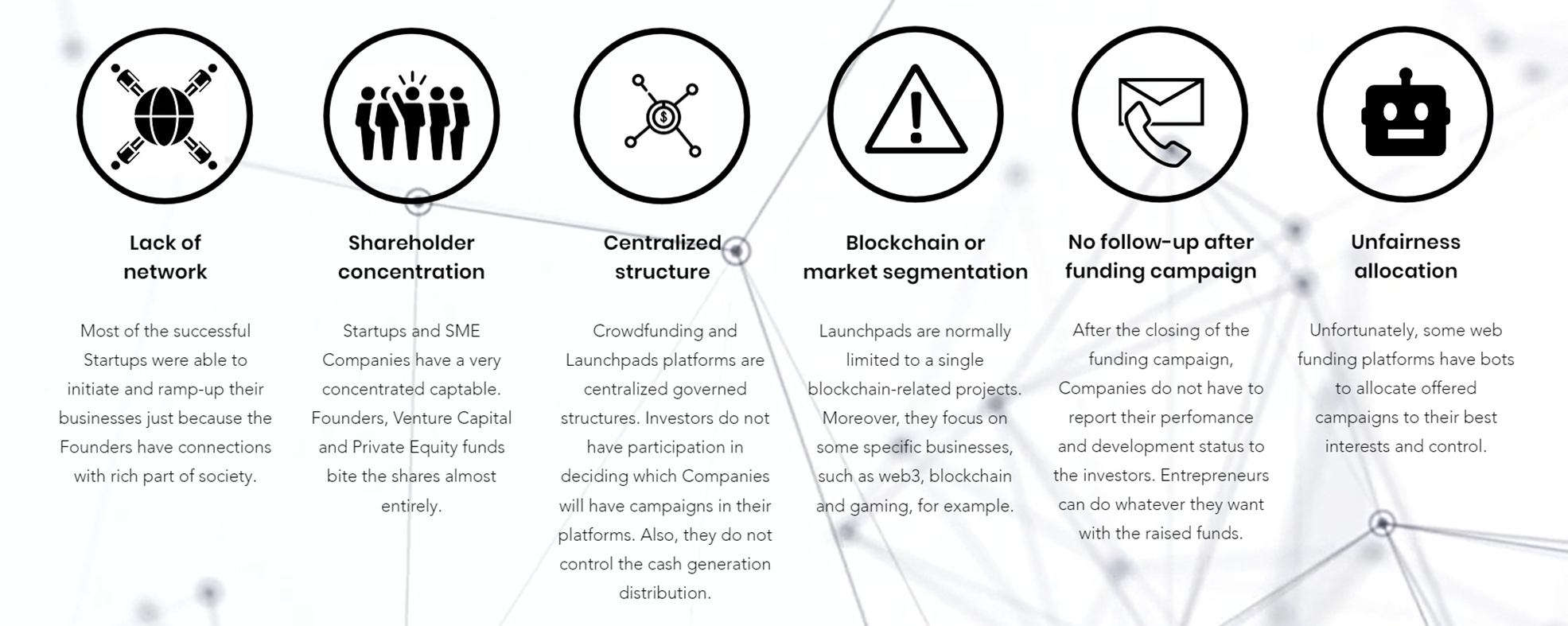

From a clear lack of alignment to regulatory issues and no lack of financial performance, the crypto market has some more obstacles to overcome before it becomes the de facto means of raising capital. That’s what The Conglomerate Capital is trying to do – offer a pioneering investment platform that addresses all issues and becomes a gold standard for investing in SMEs (Small and Medium Enterprises) and startups.

The Conglomerate Capital Benefits Both Investors and Companies

There are some obstacles for average investors to get into private equity and venture capital. Namely, there is a huge financial barrier, as well as some unnecessary red tape that prevents them from accessing investment into some lucrative up-and-coming businesses. Similarly, SMEs and startups can find it difficult to raise capital from eager investors, leading to limited growth opportunities for them.

Decentralized platforms can change all of that, and The Conglomerate Capital is proving to be the pioneering platform to lead this change. The company’s co-founder, Yves Civolani, puts it best when talking about the project plans to benefit all stakeholders.

“Before beginning to work on the project’s development, a thorough examination of VC/PE, crowdfunding and crypto launchpads sectors was necessary. We wanted to comprehend concerns and issues from the viewpoints of all participants: investors, business owners/companies, and platforms.”

Civolani is not the only one on the team that has the insight and experience to bring sizable change to the investment market. Collectively, the team has several years of experience in the venture capital, private equity, and mergers and acquisition markets. Civolani and fellow cofounder Diego Queirantes have together raised more than $200 million for the companies they have advised or worked for.

Of course, this is a decentralized platform, so it will be governed by a DAO. This includes deciding the issuance of the CONG token, which will act as the fuel of the large ecosystem that is The Conglomerate Capital.

Speaking of the ecosystem, the platform will bring together the best of crypto, DeFi and blockchain technology – all while keeping the focus on private equity and venture capital investments. The general structure of The Conglomerate Capital and the Conglomerate Subsidiary Companies will follow the structure-type of venture capital and private equity industry.

None of The Conglomerate Capital’s operations would work without the CONG token, which has just started its presale on January 16. The token has a maximum supply of 10 billion tokens.

The first presale stage sees the CONG token priced at 0.0025 USDT. The second stage will see the price go up by 20% to 0.0030 USDT. As such, it makes sense to get into this project in the first round, as it offers the biggest bargain on the price. The presale is taking place on the official website.

Investors can benefit from a referral link of 5%, which will be paid in USDT, USDC, or BUSD. This will be refunded in the form of a cashback that will go back directly into the investor’s wallet.

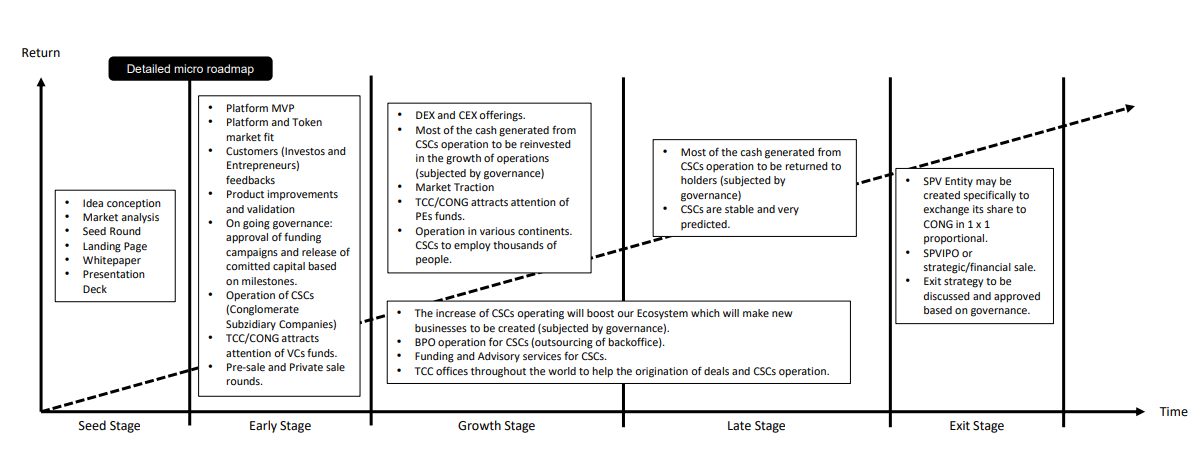

There will be CEX and DEX listings after the presale, which will undoubtedly have a strong impact on the price. For further information on both the short-term and long-term future of the project, it is worth taking a look at the two roadmaps that the team has put together.

The long-term macro roadmap shows the plans through the early stage, growth stage, and late stage of the project. This includes increasing the number of Conglomerate Subsidiary Companies (portfolio companies) and strategies for operational growth. The short-term roadmap includes such priorities as the development of smart contracts for vesting, governance and farming, and general platform development and testing.

The team is extremely committed to keeping the platform as secure as possible, with various security measures put into place. The CONG token launch smart contract has already seen one round of auditing by blockchain auditing firm SecureBlock.

Making VC and PE Investment Accessible and Seamless

The crypto market has provided a lot of solutions for finance, but it is still lacking in terms of how it can help people invest in companies that are aligned with the needs of all stakeholders. If it can solve this problem and others, then it allows for much more open and transparent dealings, benefiting all.

The Conglomerate Capital’s platform is proving to be just the antidote for this problem, and it can supercharge funding inflow for all sorts of companies. The presale is already catching the attention of investors and whales, and very soon it could become the disruptive platform that draws small businesses, and startups need to navigate the new era in finance.

Visit The Conglomerate Capital

Disclaimer: The text above is an advertorial article that is not part of Cryptonews.com editorial content.