Changes in Crypto Lending, Investors Bet on Crypto Tax Services, NASA vs. NFTs + More News

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

__________

Investments news

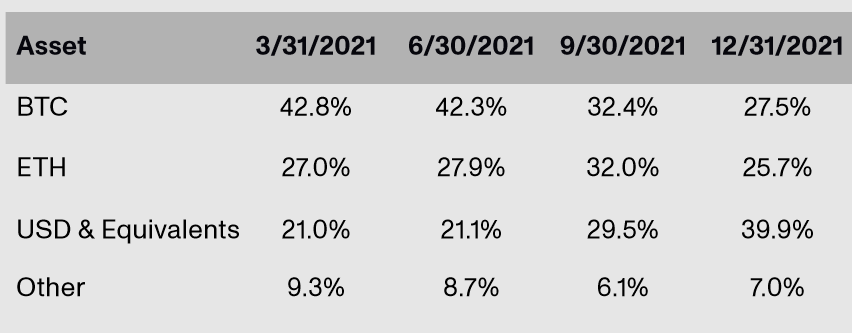

- Genesis, a digital currency prime brokerage, said that its loan originations reached USD 50bn in the last quarter of 2021, up 40% over Q3 2021. Loan originations for 2021 totaled USD 131bn, nearly 7x higher than 2020, the company said, adding that they also noticed organic growth in USD originations relative to previous quarters with clients seeking more flexibility going into year end.

- CoinTracker, a crypto tax and portfolio tracker, said it has secured USD 100m in Series A financing, bringing CoinTracker’s total valuation to USD 1.3bn. The round was led by Accel, with participation from new and previous investors. The platform plans to hire “high caliber talent,” expand its services for tax professionals, and scale customer support, among other goals.

- Cross-exchange digital asset trading network Apifiny announced its merger with special purpose acquisition company Abri SPAC I, which will result in Apifiny becoming a publicly-traded company on Nasdaq. The merger will enable Apifiny to accelerate growth, continue developing advanced blockchain and crypto technology solutions, and enhance regulatory transparency as a public company, they added.

- The US Securities and Exchange Commission (SEC) extended its window to approve the ARK 21Shares bitcoin exchange-traded fund (ETF), originally proposed in July 2021, to April 3, 2022.

- Elon Musk’s electric car company, Tesla, did not sell any bitcoin in the fourth quarter, according to the company’s latest financial statement. Tesla is holding bitcoin worth around USD 1.26bn, per the company.

- Crypto custodian Fireblocks said it raised USD 550m in Series E funding, which brought their valuation to USD 8bn. The new capital infusion – co-led by D1 Capital Partners and Spark Capital, among others – will help the company “continue removing the complexity of working with digital assets,” the team said.

- The HBAR Foundation, an organization fueling development in the Hedera Hashgraph (HBAR) ecosystem, and crypto VC Outlier Ventures announced the upcoming launch of the Hedera Base Camp, an accelerator program for early-stage projects building on this distributed ledger network.

NFTs news

- US space agency NASA stated that it does not want any of its contents to be tokenized into non-fungible tokens (NFTs). NASA’s logo has often been used for commercial purposes such as branding on fashion items; however, the agency stated that it is unable to approve of any such uses in the NFT sphere.

- Real estate blockchain project Propy announced the launch of real-estate-backed NFTs in the United States. The technology will be available to interested owners and brokers, and the company will auction two residential properties located in Florida on February 8 as part of a real estate NFTing service.

Adoption news

- Elevate Brands, which holds a portfolio of Amazon-focused consumer products companies, announced today its ‘Cash or Coin’ acquisition program and integration with Coinbase Prime, a prime brokerage service by major crypto exchange Coinbase. “Through this integration we are allowing acquisition payouts to Amazon Marketplace Sellers to be offered in bitcoin and other cryptocurrencies,” said the press release. Nick Eary, who sold his company to Elevate in 2021, will receive his earnout payment from Elevate in BTC next month.

- Brussels member of parliament Christophe De Beukelaer announced that he will take his full 2022 salary in BTC in an effort to raise awareness about the digital currency in Europe.

DAOs news

- The Gansong Art Museum, South Korea’s oldest private art museum, will be auctioning two sculptures designated as “national treasures” by the South Korean government, while two decentralized autonomous organizations (DAOs), National Treasure DAO and HeritageDAO, will be among the bidders, per the Korea Herald.

- Treasury protocol BitDAO announced that a proposal to fund decentralized autonomous organization zkDAO was passed. zkDAO is “approved and will receive USD 200m in funding from the BitDAO treasury,” they said, adding that this “marks a watershed moment for the growth of [zkSync] and the collective effort to scale Ethereum and beyond.”

- Crypto trading platform ByBit said it has contributed USD 134m to DAO-directed treasury BitDAO between November 1 and December 31. They have also pledged recurring contributions.

- The Superdao project, which aims to help other projects launch their own DAOs, said it has raised USD 10.5m in a funding round led by VC firm SignalFire.

Economics news

- US GDP during the October-through-December period increased at a 6.9% annualized pace, the Commerce Department reported Thursday. Economists surveyed by Dow Jones had been looking for a gain of 5.5%, per CNBC.

Regulation news

- The US House of Representatives will examine the outlook for stablecoin regulation on February 8, in a virtual hearing called “Digital Assets and the Future of Finance: The President’s Working Group on Financial Markets’ Report on Stablecoins.” No witness list is yet available.

- The SEC is scrutinizing crypto firms Celsius Network (CEL), Voyager Digital Ltd., and Gemini Trust Co. as part of a broad inquiry into companies that pay interest on virtual token deposits, Bloomberg reported, citing undisclosed sources. The SEC enforcement review focuses on whether the companies’ offerings should be registered as securities with the watchdog, the sources said.

Metaverse news

- Decentralized gaming metaverse The Sandbox (SAND) partnered with Warner Music Group (WMG) to create a music-themed world in The Sandbox gaming metaverse. A combination of musical theme park and concert venue, the Warner Music Group LAND in The Sandbox will host concerts and musical experiences featuring WMG’s roster of artists.

- Also, The Sandbox said it has committed USD 50m to global venture accelerator Brinc for The Sandbox Metaverse Accelerator Program, which will target 100 startups to enhance the open metaverse. The program will invest in, mentor, educate, and support the development of promising startups and projects while also providing access to potential partnerships and business development opportunities.